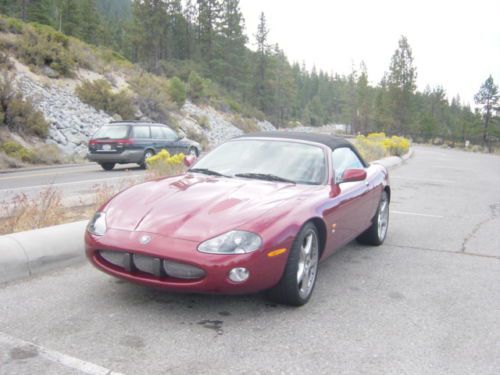

2004 Jaguar Xkr Stirling Moss Edition. on 2040-cars

Monterey, California, United States

Jaguar XKR for Sale

Red 2004 limited edition xkr(US $40,000.00)

Red 2004 limited edition xkr(US $40,000.00) 2010 jaguar xkr base coupe 2-door 5.0l(US $51,500.00)

2010 jaguar xkr base coupe 2-door 5.0l(US $51,500.00) 2008 jaguar xkr portfolio edition(US $40,000.00)

2008 jaguar xkr portfolio edition(US $40,000.00) Beautiful jaguar convertible for the summer !!! **mechanic's special**(US $4,995.00)

Beautiful jaguar convertible for the summer !!! **mechanic's special**(US $4,995.00) 2007 jaguar xkr base convertible 2-door 4.2l(US $35,900.00)

2007 jaguar xkr base convertible 2-door 4.2l(US $35,900.00) 2002 jaguar xkr base convertible 2-door 4.0l supercharged 370 horsepower(US $14,750.00)

2002 jaguar xkr base convertible 2-door 4.0l supercharged 370 horsepower(US $14,750.00)

Auto Services in California

Z Best Auto Sales ★★★★★

Woodland Hills Imports ★★★★★

Woodcrest Auto Service ★★★★★

Western Tire Co ★★★★★

Western Muffler ★★★★★

Western Motors ★★★★★

Auto blog

2017 North American Car, Truck, and Utility of the Year entries announced

Wed, Jul 6 2016Over 40 vehicles will compete for the 2017 North American Car, Truck, and Utility of the Year awards. If that name looks a little strange, it's because the competition added a third category. In years past, pickup trucks, crossovers, SUVs, commercial vans, and minivans competed for the same award. That's why there were occasionally weird comparisons, like last year's competition between the Volvo XC90 and Nissan Titan XD. The new format separates pickups and commercial vans into the truck contest and CUVs, SUVs, and minivans into the utility competition. A complete list of eligible vehicles is below, but here are a few highlights. For one, the entire list of entries has a luxurious lean. Of the 43 vehicles, nearly half of them are from premium brands. There are two eligible Bentleys – the Bentayga and Mulsanne – the Rolls-Royce Dawn, Jaguar F-Pace, Audi Q7, and the Mercedes-Benz GLS-, E-, and S-Class Maybach. The performance ranks are lofty, too, with the Audi R8, Acura NSX, Alfa Romeo Giulia, Mercedes SL- and SLC-Class, Porsche 718, and F-150 Raptor. The mainstream entries are just as comprehensive. From the Chrysler Pacifica to the Chevrolet Cruze to the Fiat 124 Spider to the Mitsubishi Mirage, NACTOY has covered an enormous price range with this year's contestants. Of course, these are only the eligible vehicles. They'll need to run through three rounds of judging, starting in September at NACTOY's traditional Hell, MI, test drive. The Canadian and American journalists involved in the judging will announce this year's nine finalists – three in each category – on December 6. Cars Acura NSX Alfa Romeo Giulia Audi A4 Audi R8 Bentley Mulsanne Buick Cascada Buick LaCrosse Cadillac CT6 Chevrolet Bolt Chevrolet Cruze Fiat 124 Genesis G90 Hyundai Elantra Infiniti Q60 Jaguar XE Kia Cadenza Lincoln Continental Mercedes-Benz E-Class sedan Mercedes-Benz S550 Maybach Mercedes-Benz SL-Class Mercedes-Benz SLC-Class Mini Clubman Mitsubishi Mirage/G4 Porsche 718 Boxster and Cayman Rolls-Royce Dawn Toyota Prius Prime Volvo S90 SUVs Audi Q7 Bentley Bentayga Buick Envision Cadillac XT5 Chrysler Pacifica GMC Acadia Infiniti QX30 Kia Sportage Mercedes-Benz GLS-Class Jaguar F-Pace Mazda CX-9 Nissan Armada Trucks Ford F-Series Super Duty pickups Ford F-150 Raptor Honda Ridgeline Nissan Titan half-ton Related Video: Featured Gallery Bentley Bentayga View 23 Photos News Source: Automotive News - sub.

Jaguar's electric speedboat smashes decade-old record

Mon, Jun 18 2018We knew Jaguars prowl on dry land, but apparently they dabble with water, too. Jaguar teamed up with powerboat racing specialist Vector and Williams Advanced Engineering to beat the existing British and world records for fastest battery-powered boat with some expertise from Jaguar's Formula E team. The team had to top 76.8 mph, a record set in 2008 by Helen Loney in her Firefly electric hydroplane with Agni motors. The attempt was made in the same location, Coniston Water in the English Lake District, where speedboat record runs have been made since the days of Sir Malcolm Campbell as early as the 1930s, and son Sir Donald Campbell into the 1950s and 1960s – including the fateful record attempt that cost the younger Campbell his life in 1967. The company's documented the attempt in the video shown above. It reveals that the 2008 record wasn't easy to beat. At first, pilot and Jaguar Vector co-founder Peter Dredge managed to get the boat to 76.6 mph – annoyingly close to, and just under, the record. But a later run rewarded the team's efforts, with a clear improvement of nearly 12 mph, making the new record 88.61 miles per hour. This achievement is also impressive considering that Jaguar and Vector only announced their partnership in October 2017, so progress has been swift. The tech in the boat is reportedly derived from Formula E technology, though Jaguar Vector and Williams Advanced Engineering have not disclosed the boat's exact specifications nor what parts are based on Jaguar Formula E car parts. Related Video: Green Jaguar Electric Racing Vehicles Videos williams advanced engineering

2017 Jaguar F-Type SVR First Drive

Fri, Sep 2 2016Jaguar's F-Type SVR has a special new exhaust. I drove the car in Monterey, California, where there's this tunnel right in the middle of town. You see where I'm going with this. The pipes attached to the "normal" F-Type R's supercharged 5.0-liter V8 is a flatulent riot, one of the most flamboyant wind sections in modern exhaust-dom. And then Jaguar's Special Vehicle Operations, the group of madmen responsible for the Project 7, comes along and rips it all out for the SVR. The room is needed for a rear diffuser, see. So a new system is fabbed using two fancy lightweight alloys, Inconel and titanium. A pair of mufflers sprout where one used to be. More. Better. Louder. Yes, all of that. Geez it's loud. And there's this tunnel, remember. Enter it and lift from the throttle, and it sounds as though there are some kids stowed away in the trunk tossing handfuls of M-80s out the back. "Big report" is what it'd say on the box if the F-Type SVR were a firework. It's dramatic, perhaps excessive. Scratch that – it's definitely excessive. This F-Type is only the second full-production effort from Jaguar Land Rover's SVO, the first being the Range Rover Sport SVR, and so it's also the first Jaguar SVR ever. Whereas that Range Rover combines quickness with surprising cross-country abilities, the F-Type SVR has a singular mission: Go faster. And so, with a tweak of the electronic limiter and some other fiddling, voila!, suddenly the coupe can reach a top speed of 200 mph. The convertible is not far behind at 195. Although there aren't many places in the world where you'll actually want to probe those max velocities, the engine's 575 horsepower and 516 pound-feet of torque are plenty to risk your license. The SVR adopts many of the engine improvements that hoisted the Project 7 to the same power level but bests that very special car's torque figure thanks mostly to new intercoolers. Remember, the regular F-Type R is only good for 550 hp. Only. What a world we live in. Aside from the added power, this is much more of a range-topping special trim than it is a significantly different model. Like the R, the SVR comes only with all-wheel drive and an eight-speed automatic transmission. Operating it in manual mode is more pleasant, in part because the paddle shifters behind the wheel are made out of aluminum instead of plastic like on other automatic F-Types.