2007 Jaguar Xk Base Convertible 2-door 4.2l No Reserve on 2040-cars

United States

|

No Reserve Auction. Salvage Title Convertible. Needs work. Prior accident and/or damage unknown.

I got a local mechanic to get it to start with a jump and doing something else but not stay running and won't start by just a normal turn of a key. Exterior of car is in very decent shape. Missing some parts for front driving lights. Misc. unknown electrical / sensor issues. I don't have a mechanic here in South Texas that's good for a Jag. My loss is your gain. I paid $15,500 at auction for it but I'm willing to take a major loss as I don't have the time/expertise to make this car right. This car is being sold AS IS WHERE IS. You are buying a car with known problems and a salvage title. The car does roll/steer/etc. Parts are worth my asking price. Underhood some misc. parts seem to be missing but I honestly just don't know. Inspect prior if questions/email but I'm no mechanic. NON supercharged. Interior is in near perfect condition excepting these back panels by the small rear windows panels need recover. Tires are at 70% tread. NADA book rough is $20k. Retail is $28k. Kelly Blue Book is even higher. Someone can have a killer car if they have a Jag expert or are one themselves or make some money. Please - don't email/call with questions like "so it just needs a battery?" This doesn't need a minor repair. This needs an expert to figure things out. This is a No Reserve Auction - this vehicle WILL SELL. Email Questions: inertiachad@gmail.com or text questions/call: 956.238.3761 This is considered a legally binding agreement. |

Jaguar XK for Sale

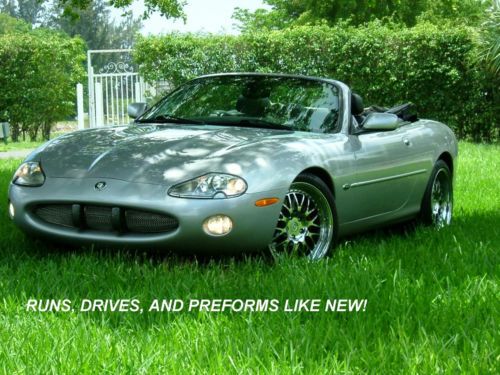

2001 jaguar xk8 convertible from florida! 55,000 miles, 1 owner, like brand new!(US $13,200.00)

2001 jaguar xk8 convertible from florida! 55,000 miles, 1 owner, like brand new!(US $13,200.00) Custom body kit and total paint.no dings every light im asked what kind of car.

Custom body kit and total paint.no dings every light im asked what kind of car. 08 xk convertible clean carfax navigation luxury pkg push button start xenon fl(US $30,000.00)

08 xk convertible clean carfax navigation luxury pkg push button start xenon fl(US $30,000.00) 2011 jaguar xk coupe 5.0l british rac. green/almond 36k miles mint we finance(US $47,500.00)

2011 jaguar xk coupe 5.0l british rac. green/almond 36k miles mint we finance(US $47,500.00) 1997 xk8 jaguar convertible beautiful car with only 74,668 miles hard to find!!!

1997 xk8 jaguar convertible beautiful car with only 74,668 miles hard to find!!! 2003 jaguar xk8 convertible(US $10,250.00)

2003 jaguar xk8 convertible(US $10,250.00)

Auto blog

2016 Jaguar XE is ready to stalk the competition

Mon, 08 Sep 2014

The XE wears some of the best styling elements from Jaguar's current litter.

Big sedans and sports cars. Jaguar has been known for those two things since the company's name was birthed in 1945. Stylish saloons like the Mark 2 and performance machines like the E-Type make up the brand's heritage, but the compact sedan market is one where the British marque has lacked great product.

Jaguar XJ facelift suggests that if it ain't broke...

Tue, Dec 16 2014Jaguar is preparing what looks to be a very modest upgrade for its long-serving XJ, now heading into its fifth year in production. The fullsize luxury sedan's changes are so limited it seems like a stretch to even refer to these changes as a proper update. New front and rear lights represent the big changes, although the XJ's front grille looks to get a tiny bit of tweaking. Beyond that, though, we can't see too much changing for Jag's flagship luxury car. That said, there could be some tweaks below the sheetmetal and within the cabin that these images don't really show. Take a look at our gallery of spy photos, at the top of the page, and let us know what you think Jag is up to with this particular XJ.

Lotus Esprit S1 gets wet and wild in 'Forza Horizon 4' James Bond trailer

Tue, Sep 18 2018It only makes sense. When the official trailer for Forza Horizon 4 ( FH4) first debuted at E3, details showed the game is set in Britain. Those who were ahead of the curve might have recognized this as a foreshadowing of sorts. Celebrating the launch of FH4's XBOX One and Windows 10 demo on Sept. 12, Playground Games announced that the next version of the beloved racing simulator will launch with an available Best of Bond pack that includes many of James Bond's storied rides. As expected, the list is heavy on the Aston Martin, but there are plenty of other goodies, too. Included in the 10-car pack are the 1964 Aston Martin DB5, a 1969 Aston Martin DBS, a 1986 Aston Martin V8, a 2008 Aston Martin DBS, a 2015 Aston Martin DB10, a 1974 AMC Hornet X Hatchback, a 1977 Lotus Esprit S1, a 1981 Citroen 2CV6, a 1999 BMW Z8, and a 2010 Jaguar C-X75. If you can name every movie that all of these vehicles are from, pat yourself on the back and grab a martini. View 15 Photos Microsoft is rewarding those who are all-in on FH4. The Best of Bond pack will come with the Ultimate Edition of the game that is allowed an early play date, starting Sept. 28. For those who haven't fully committed, the Best of Bond pack will be available as an add-on for purchase when the game launches globally on Oct. 2. The action-packed trailer shows many of the vehicles transforming or busting out tricks they're known for from the films, including the Lotus emerging from the sea. Although players will not be able to drive any vehicles under water (that we know of), several of the gadgets will make it into the game and will be viewable during Forzavista mode. The '64 DB5 has many of its features, such as the bumper rams and revolving license plate, while the Lotus will have an available body kit, fins and all. The Bond pack also comes with a few features irrelevant to the cars, including two Bond outfits and six "quick chat" phrases that can be used during multiplayer. The pack adds to an already impressive catalogue of vehicles that includes more than 450 different rides. Available now to pre-order, the FH4 Ultimate Edition is priced at $99.99, the Deluxe Edition is $79.99, while the base game is $59.99. For those who love Bond but don't own a gaming system, don't forget about the recently announced DB5 Lego kit.