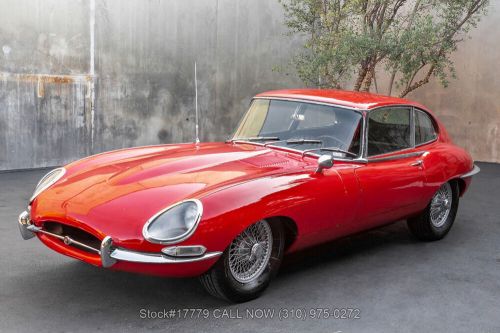

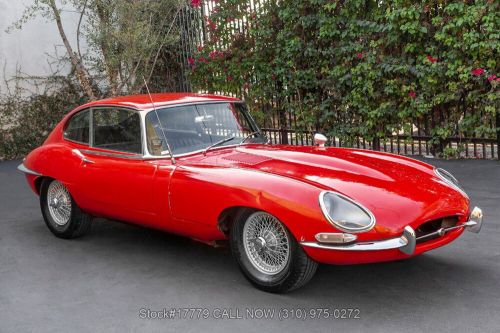

1966 Jaguar Xk Series I 2+2 on 2040-cars

Vehicle Title:Clean

VIN (Vehicle Identification Number): 17779

Mileage: 0

Exterior Color: Red

Interior Color: Other Color

Make: Jaguar

Manufacturer Exterior Color: Carmen Red

Model: XK

Trim: Series I 2+2

Jaguar XK for Sale

2015 jaguar xk(US $21,800.00)

2015 jaguar xk(US $21,800.00) 2012 jaguar xk(US $305.00)

2012 jaguar xk(US $305.00) 2007 jaguar xk(US $21,990.00)

2007 jaguar xk(US $21,990.00) 2005 jaguar xk(US $500.00)

2005 jaguar xk(US $500.00) 2007 jaguar xk coupe luxury premium(US $17,995.00)

2007 jaguar xk coupe luxury premium(US $17,995.00) 2009 jaguar xk xkr coupe(US $27,890.00)

2009 jaguar xk xkr coupe(US $27,890.00)

Auto blog

Can a Jaguar XKR-S be drifted while blindfolded?

Thu, 27 Dec 2012Bring together a 550-horsepower Jaguar XKR-S and a rain-soaked skidpad, and it's almost impossible to not end up in a sideways drift... accidental or on purpose. With that in mind, the gang over at Autocar got a hold of the monstrous XKR-S for the latest installment of "Will it Drift?," only they raised the stakes a little by attempting the feat with a blindfolded driver

We've driven the XKR-S a number of times here at Autoblog (including a First Drive, Review and Quick Spin), so we weren't at all surprised to learn that blind drifting in the car is possible. But what is remarkable is the ease at which it happened. This, of course, can be credited as much to the car as to the driver, Steve Sutcliffe. Check out the impressive video for yourself, which is posted after the jump.

Road & Track names its 2013 Performance Car of the Year

Thu, 14 Nov 2013Road & Track recently staged its first annual Performance Car of the Year test, pitting 13 new and updated performance cars against each other on track, then graduating the top six to a road test before picking a winner. Additionally, the magazine staff picked the best automobiles of the year in eight categories.

But first, let's cover the PCotY segment. Here's the list of cars brought to the comparison test: Audi R8 V10 Plus; BMW 435i; BMW M6 Competition Package; Chevrolet Corvette Stingray Z51; Ferrari F12 Berlinetta; Ford Fiesta ST; Jaguar F-Type V8 S; Jaguar XFR-S; Mercedes-Benz E63 AMG S-Model Wagon; Mercedes-Benz SLS AMG Black Series; Mini John Cooper Works GP; Nissan GT-R Track Edition; and Porsche Cayman S.

To find out the results of the comparison, head over to Road & Track's website or check the press release below, where you'll also find the magazine's top-rated vehicles in eight categories. Want more? Head over to the 2013 PCotY hub. But before you do that, take a stab at guessing the winner of PCotY (we'll give you one hint: it isn't a Porsche).

Jaguar crossover won't be based on Evoque or have off-road chops

Wed, 21 Aug 2013Jaguar's long-rumored crossover won't be built on the same platform as the Land Rover Range Rover Evoque, says the Australian site Car Advice. The future of the new CUV remains uncertain, but if Jaguar does dip its toes into the SUV/crossover pool, though, the new vehicle will likely be a car-based soft roader, lacking (or perhaps more appropriately, not needing) the off-road-engineered chops inherent in Land Rover's small CUV platform.

Jaguar product planner Steven De Ploey explained to Car Advice, "There's many groups around the world [platform sharing] - obviously Volkswagen Group is doing it all the time - but I think we have to be careful. He added, "Jaguar is something quite different... It's about capability, but very much on-road focused capability." That seems to gel with our suspicions that the XQ, as it's expected to be called, will share its platform with an upcoming small Jaguar sedan, the oft-rumored X-Type successor.

Still, we'd recommend taking any mention of a Jaguar crossover with a grain of salt. Based on many of the (quite compelling) statements made by De Ploey against a Jag crossover and previous statements made by Jag's design boss, Ian Callum, the case against a leaper-bearing crossover seems strong. If a high-rider were to arrive from Jaguar, though, the article insinuates that it'd be more in line with the BMW X6 or upcoming X4 - sort of a coupe-based crossover. Like we said, grain of salt. If a Jag crossover is going to arrive soon, the upcoming Frankfurt Motor Show is the most likely locale for its debut. We'll find out in a few weeks.