1996 Jaguar Xjs Convertible 350 V8 Conversion on 2040-cars

Montgomery, Texas, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:350 V8 LT1

Fuel Type:Gasoline

For Sale By:Owner

Make: Jaguar

Model: XJS

Options: Cassette Player, Leather Seats, Convertible

Drive Type: 2 door convertible

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Mileage: 10,000

Power Options: Air Conditioning, Power Locks, Power Windows, Power Seats

Sub Model: XJS

Exterior Color: Black

Interior Color: Tan

Warranty: NONE

Number of Cylinders: 8

Trim: Two door Convertible

Jaguar XJS Convertible. Professionally converted to a 350 Chevy V8 LT1 in 2012- includes rebuilt LT1 engine, transmission, computer,new alternator, new battery, car rewired, new custom exhaust, AC, new leather on front seats. My mechanic who completed the conversion will answer any questions- I have all receipts - the engine has approximately 400 hp - There are minor blemishes on the paint, the convertible top motor and the trunk release cable needs replacing but can use manually. The engine and rebuild has 10,000 miles on it - while the car itself has 61,000 original miles on it. I made this car my daily driver but just changed careers and can no longer use in my job as a Realtor. I have $25,000 invested in the conversion with receipts and she drives like a dream! Price - $ 24,500 Make offer!

Jaguar XJS for Sale

Auto Services in Texas

Z`s Auto & Muffler No 5 ★★★★★

Wright Touch Mobile Oil & Lube ★★★★★

Worwind Automotive Repair ★★★★★

V T Auto Repair ★★★★★

Tyler Ford ★★★★★

Triple A Autosale ★★★★★

Auto blog

2016 Jaguar XJR meets 1988 XJR9-LM at Silverstone

Mon, Nov 16 2015The current Jaguar XJR is not the first Jaguar XJR. Not by a long shot. In fact there's a long and distinguished history of Jaguar production and racing models that have worn those letters over the years. So to highlight its lineage, Jaguar brought the 2016 model together with its nearly 30-year-old racing namesake to Silverstone. And it brought Andy Wallace along for the ride. Wallace won at Le Mans in 1988 driving the XJR9-LM. Designed for the race track and adorned with iconic Silk Cut livery, the XJR9 looks entirely different from the XJR luxury sedan you can buy today. And with a 7.0-liter V12 mounted amidships instead of the modern sedan's 5.0-liter supercharged V8 placed up front, they're mechanically different beasts as well. But it's not the difference in design, powertrain, or performance that Jaguar is highlighting in this video encounter. Instead, Wallace is impressed by the advancement of the lighting technology from the Le Mans racer he drove in the late 1980s to the sedan sold today. To hear him talk about how they used to use the headlights in the nighttime hours of the famously grueling endurance race is harrowing enough all on its own. Hear his story in the video above. NEW JAGUAR XJR MEETS XJR9-LM AT SILVERSTONE WITH LE MANS WINNER ANDY WALLACE AT THE WHEEL - Andy Wallace drives new Jaguar XJR and Le Mans-winning XJ-R9 LM at Silverstone - XJR9-LM – one of one million XJs now built – back on track at night for the first time since it won the 24 Hours of Le Mans in 1988 - Track session presents benefits of new Jaguar XJ LED headlights in day and night driving conditions - Wallace discusses new XJR headlight technology, which offers drivers more confidence, safety and performance at night - New short film captures all the action https://youtu.be/IgMxSkJb058 (Whitley, Coventry - 16 November 2015): Legendary racing driver and 24 Hours of Le Mans winner Andy Wallace relived his 1988 victory by taking to the Silverstone circuit to drive the Jaguar XJR9-LM during day and night back-to-back with the new 550PS, 5.0-litre Supercharged V8 Jaguar XJR. Wallace discusses his experiences in the XJR9-LM and the new XJR in an exciting new film available to view and share at https://youtu.be/IgMxSkJb058 Driving at night on the Silverstone circuit gave Wallace the opportunity to test the new LED headlights on the new XJ, which are a first for Jaguar. "Driving at Le Mans back in 1988, it was so hard to see at night," said Wallace.

Thieves stole $3.7 million worth of Jaguar Land Rover engines

Fri, Feb 3 2017This past Tuesday was not a good one for Jaguar Land Rover. According to British news source Birmingham Mail, just over $3.7 million worth of engines were stolen from the company's factory in Solihull, England. Reportedly, the thieves drove up to the facility in a stolen semi-truck, found a trailer full of engines, hooked it up, and drove off. The thieves did this twice in one night, with the same truck, and got the first trailer in just six minutes. Perhaps more shocking is that Birmingham Mail reports this is the second time a theft of this type has occurred at the facility. The previous time happened in almost exactly the same way, but the engines taken were valued at just over $1.2 million, and five people were convicted of the crime. Currently, local police are looking for the latest suspects and the engines. The trailers were found, but were empty. We got in touch with a Jaguar representative who provided us the company's official statement: "We can confirm that we are working closely with West Midlands Police to investigate the theft of engines from the Solihull manufacturing plant. A reward is on offer to anyone who has information which leads to the successful recovery of these engines. It would be inappropriate for us to make any further comment whilst this investigation is ongoing." This was the only statement he would provide, and didn't provide answers as to what engines were stolen and if there would be any impact on manufacturing or vehicle deliveries. But if you're in the UK, and you've got a tip, let the cops know. Related Video: Related Gallery 2017 Jaguar F-Pace View 46 Photos News Source: Birmingham Mail, JaguarImage Credit: Jaguar Plants/Manufacturing Weird Car News Jaguar Land Rover Luxury jaguar land rover

Jaguar teases E-Pace crossover details - and price under $40K

Wed, Jun 21 2017So it turns out we'll be seeing the fully revealed Jaguar E-Pace much sooner than we expected. Jaguar announced the debut will occur on July 13, so we're less than a month away. The company also provided a teaser of the E-Pace's tail. It shows a fat rear fender and Jaguar's trademark taillight design. While many other companies would be content to release a teaser and nothing else, Jaguar actually provided a number of other interesting details. Among them is the powertrain. It will only be available with gasoline-powered engines and all-wheel drive. We're expecting it to use roughly the same powertrain combinations as the Land Rover Range Rover Evoque. The other big details are pricing and availability. The baby Jaguar SUV starts at $39,595, which is over $3,000 less than the entry-level F-Pace and the Range Rover Evoque. You'll also be able to bring one home from the dealer next year. Related Video: Image Credit: Jaguar Jaguar Crossover SUV Luxury jaguar e-pace

1995 jaguar xjs v12 2+2 convertible

1995 jaguar xjs v12 2+2 convertible 1990 xjs v-12 2 door coupe

1990 xjs v-12 2 door coupe Rare xj-sc cabriolet, longtime california car

Rare xj-sc cabriolet, longtime california car 1986 jaguar xjs base coupe 2-door 5.3l

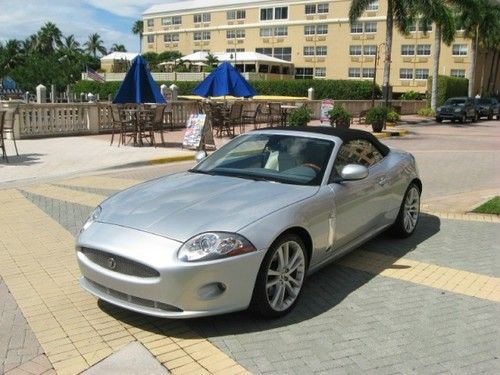

1986 jaguar xjs base coupe 2-door 5.3l 2007 jaguar xk convertible

2007 jaguar xk convertible 1994 jaguar xjs 2+ 2 4.0 convertible

1994 jaguar xjs 2+ 2 4.0 convertible