2001 Jaguar Xjr on 2040-cars

Franklin, Kentucky, United States

Transmission:Automatic

Vehicle Title:Clean

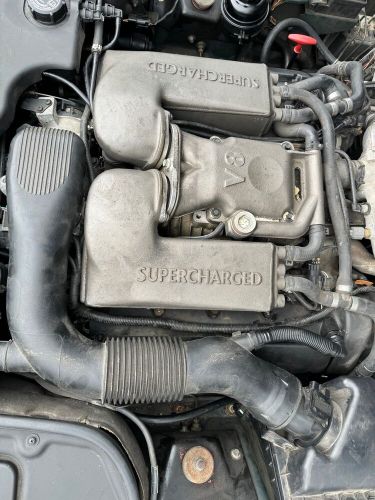

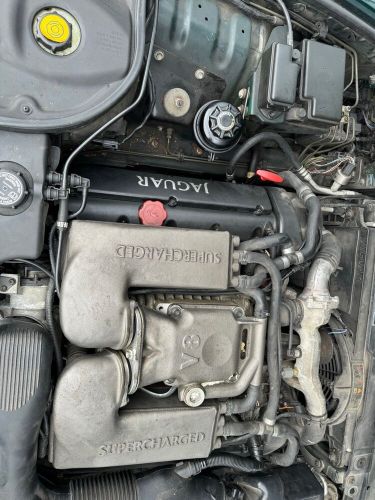

Engine:4.0L Gas V8

Fuel Type:Gasoline

Year: 2001

VIN (Vehicle Identification Number): SAJFA15B61MF31824

Mileage: 147508

Number of Cylinders: 8

Model: XJR

Exterior Color: Green

Make: Jaguar

Drive Type: RWD

Jaguar XJR for Sale

1995 jaguar xjr sedan(US $1,000.00)

1995 jaguar xjr sedan(US $1,000.00) 1998 jaguar xjr(US $17,000.00)

1998 jaguar xjr(US $17,000.00) 2007 jaguar xjr xjr - supercharged(US $11,900.00)

2007 jaguar xjr xjr - supercharged(US $11,900.00) 2005 xjr base(US $18,998.00)

2005 xjr base(US $18,998.00) 1998 jaguar xjr(US $18,000.00)

1998 jaguar xjr(US $18,000.00) 2007 jaguar xjr(US $21,995.00)

2007 jaguar xjr(US $21,995.00)

Auto Services in Kentucky

Withers Imports Reprs ★★★★★

Supreme Oil Co ★★★★★

Steven`s Transmission Repair ★★★★★

Sam Swope Cadillac ★★★★★

Robke Ford/Parts Dept ★★★★★

Performance Plus ★★★★★

Auto blog

Jaguar F-Type Coupe is here, will debut on stage in LA

Tue, 05 Nov 2013When Jaguar previewed its new sportscar two years ago with the C-X16 concept, it showed a coupe form. But when the car hit production as the F-Type, it rolled out in roadster form only. Not that we're complaining, but we all knew it wouldn't be long before Coventry revealed the production coupe, and that's just what it's doing at this month's LA Auto Show.

Jaguar hasn't given us much to go on yet - just a single shot of the vehicle from above and nothing in the way of technical details - but we all know the drill. The F-Type Coupe will essentially be the same as the existing roadster, only with a fixed roof - with a large glass panel, mind you, to let plenty of light in and keep the cabin from feeling markedly more claustrophobic than the open-top version.

That ought to make it a little lighter (though not much) and a little stiffer, but otherwise we can expect more or less the same specs as the convertible. We'll have to wait until the evening of November 19 to know for sure, though, so watch this space for more.

Jaguar F-Type squares off against Porsche 911, Aston V8 Vantage with Chris Harris

Fri, 21 Jun 2013Chris Harris is back on the job, taking on really really difficult car questions like: Which enormously sexy and good-to-drive, high-performance convertible is the top of the heap? As one of the hottest cars in the luxury space right now, the Jaguar F-Type S is, of course, in on the action. Competition comes in the form of the Aston Martin V8 Vantage Roadster and the Porsche 911 Carrera S Cabriolet. Sun-loving CEOs who despise test-driving need look no further.

Scroll on below for a fully featured (with a running time of more than 20 minutes) comparison video. Harris does his best to entertain - in a typically nitpicky and made-up-British-words fashion - and the moving pictures are lovely to look at. Kick back, pour a pint and get your weekend started off right.

2017 Jaguar XE

Thu, Apr 30 2015You've seen this movie before. Topple the BMW 3 Series has gone more rounds than The Fast and The Furious and The Transporter combined. But like any good cinematic retread, this time it's different. For starters, the latest installment is a zombie flick. Born from the ashes of Ford ownership and the failed X-Type, the 2017 Jaguar XE is coming to save us from the somnambulant, undead Bimmer. Think Army of Darkness with luxury sport sedans, and you'll understand what we're going for. Okay, the plot is only based on a true story. The reality in the automotive world isn't as dramatic as most car journalists would like you to believe. But the XE is hugely important for Jaguar's desire to increase global production. You're looking at the future best-selling model. It's built on an all-new body structure that forms the basis for all the brand's upcoming sedans. The smallest, most affordable Jaguar also launches with a new engine family, built in a new factory in England. The XE arrives stateside in early 2016 with two available engines. A 2.0-liter diesel from the new Ingenium lineup is the entry-level model. Above that is the supercharged 3.0-liter V6 familiar to the Jaguar and Land Rover lineup. A turbo 2.0-liter gas engine will come in below the diesel at a later date, with an optional manual transmission. The XE versions on launch will offer rear- or all-wheel-drive. Pricing information is yet to be revealed. Until then, just assume the XE will mimic its competitors for price and content. We spent most of our time driving the 35t with R-Sport trim, but check back for a driving impression of the diesel in a few days. As we reported in our prototype drive of the XE earlier this year, this car has incredible steering feel. It's the supernatural aid in the XE's monomyth if any film buffs are still paying attention. The electrically assisted system ranks in the hall of fame with the rack on the current Porsche 911 Carrera. Lightly weighted, the loads build up in the steering wheel like it's wired to strain gauges on the sidewall of the front tires. It's not just good programming that makes the XE steer so well, although that's a big part. The rest comes from the chassis. Jaguar engineers claim the double wishbone front suspension uses lessons learned from the F-Type. The rear part of the car's quick responses comes from a multi-link setup Jag calls integrated link. A body 20-percent stiffer than the current XF also contributes to sharp reflexes.