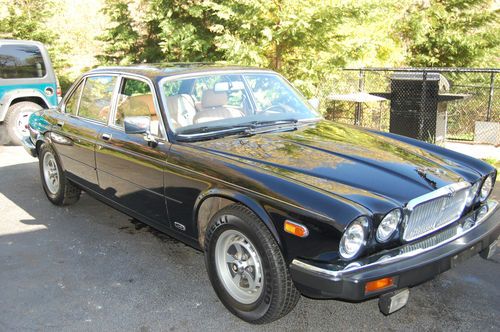

1983 Jaguar Xj6 Vanden Plas V8 Conversion on 2040-cars

So Cal , United States

Body Type:Sedan

Engine:305 Chevy V8

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Interior Color: Tan

Make: Jaguar

Number of Cylinders: 8

Model: XJ6

Trim: Vanden Plas V8 Conversion

Drive Type: V8 Conversion

Options: Sunroof

Mileage: 2,000

Power Options: Power Windows

Sub Model: Vanden Plas V8 CONVERSION

Exterior Color: Silver

Jaguar XJ6 for Sale

1983 jaguar 30k documented miles very clean(US $6,550.00)

1983 jaguar 30k documented miles very clean(US $6,550.00) 1987 jaguar xj6

1987 jaguar xj6 1987 jaguar xj6 base sedan 4-door 4.2l(US $3,000.00)

1987 jaguar xj6 base sedan 4-door 4.2l(US $3,000.00) 1983 jaguar vj6 with 95k original miles(US $3,500.00)

1983 jaguar vj6 with 95k original miles(US $3,500.00) 1987 jaguar xj6 - just 53k miles(US $9,500.00)

1987 jaguar xj6 - just 53k miles(US $9,500.00) 1997 jaguar xj6 florida rust free beautiful car paint and interior are very nice(US $4,499.00)

1997 jaguar xj6 florida rust free beautiful car paint and interior are very nice(US $4,499.00)

Auto blog

Jaguar models could rev with inline-six engines again

Tue, Apr 19 2016Rumors are swirling once again that Jaguar might return an inline-six engine to its lineup. Autocar claims Jaguar Land Rover will use the modular Ingenium engine family to create a 3.0-liter straight-six. The new motor will replace the automaker's current V6. As with the Ingenium 2.0-liter four-cylinder, JLR will likely offer the powerplant in gasoline- and diesel-fueled versions. A rumor in May 2015 also suggested JLR would create an Ingenium-based turbocharged 3.0-liter inline-six and a 1.5-liter three-cylinder unit. According to Autocar, the engine bay in the XE, XF, and F-Pace can already fit the longer engine. The automaker isn't talking, though. "We can't comment on future product one way or another," company spokesperson Nathan Hoyt told Autoblog. Jaguar built much of its performance legacy with straight-six-powered vehicles. While the C-Type and D-Type were winning races with the engine layout, practically every Jaguar production model used them as well. Today, straight-sixes are less common. BMW continues to use them, and Mercedes-Benz reportedly also plans to offer one soon. While Autocar's report is still just a rumor, the move to an inline-six could be advantageous for JLR. For example, using an Ingenium-derived design could simplify manufacturing by allowing the company to build the powerplant in one factory alongside the 2.0-liter version. Returning to a design with such an important heritage for Jaguar would also make life easy for the brand's marketing team because it could link the new engine to past racing glory. Related Video:

Stirling Moss' Jaguar C-Type could bring $7.5M in Monaco

Mon, Nov 23 2015With little over 50 examples made and a decorated racing history, the Jaguar C-Type is one of the most sought-after models ever made by the famous British marque. Bonhams has a very special one coming up for auction – one that Sir Stiling Moss drove at Le Mans in 1952. Jaguar built chassis number XKC 011 for its works racing team in 1952. It made its debut at Silverstone at the hands of pre-war racing legend Peter Walker. Then the factory outfitted with specially elongated bodywork for Le Mans, where Moss teamed up with Walker to split driving duties. Sadly it didn't make it to the finish line thanks to an engine failure, marking the second of eight DNFs that Moss would suffer in ten campaigns at the French endurance race. Moss drove this C-Type in several more races after it was converted back to its standard bodywork. It was then raced by Ecurie Francorchamps before being sold to run in British club racing. The current owner acquired it in 1963, and has held onto it until now. XKC 011 is scheduled to highlight the upcoming Bonhams event at the Fairmont Monte Carlo during the Monaco Grand Prix Historique next May. Bonhams has not published a pre-sale estimate for how much it expects this example to sell for. However in correspondence with Autoblog, the company's auction specialist James Knight revealed: "We certainly feel the car will exceed GBP5m and has the potential to achieve much more." That base estimate works out to over $7.5 million at current exchange rates. We'll be watching to see whether the final sale price comes closer to the $3.7 million for which - according to the Sports Car Market database - Gooding sold one C-Type in 2012, or to the $13.2 million which RM Sotheby's raised for another this past August. Related Video: BONHAMS RETURNS TO MONACO WITH EX-STIRLING MOSS JAGUAR C-TYPE THE MONACO SALE 'LES GRANDES MARQUES A MONACO' 13 May 2016 Monte Carlo In 2016, Bonhams will return to Monaco to present an exclusive sale of just 40 hand-picked, exceptional motor cars. Timed to coincide with the Monaco Grand Prix Historique, the sale will take place on 13 May 2016. "Already renowned in motorsport circles for its annual Monaco Grand Prix and Monte Carlo Rally, the glittering Mediterranean Principality is now to host the Bonhams Monaco Sale," said James Knight, Bonhams Group Motoring Director. "The auction will be carefully curated, tailored to offer only the most desirable models to the market.

2019 Jaguar I-Pace gets official 234-mile range rating

Tue, Oct 23 2018The 2019 Jaguar I-Pace is officially rated to travel as far as 234 miles on a single charge of its battery pack. That's down slightly from the 240 miles initially promised when the slinky electric crossover was first unveiled here in the States. And, while it's roughly equal to the base version of the Tesla Model X, that's not exactly an apples-to-apples comparison. Quoting maximum electric range without considering the capacity of a car's battery pack is the same as quoting the maximum driving range of a gasoline-fueled vehicle without considering how many gallons of gas the tank holds. The I-Pace's battery pack is rated at 90kWh. The Model X's smallest pack is 75kWh. So the Tesla can go about the same total distance as the Jaguar using significantly less energy. It's not just Tesla that boasts greater efficiency figures than the Jaguar. Chevy manages to eke 238 miles out of the Bolt EV's 60kWh battery pack, and Hyundai gets 258 miles from the Kona Electric's 64kWh pack. These vehicles certainly don't all play in the same market segments, and there are a lot of variables to consider. For instance, the Jaguar's 4.5-second 0-60 rating is quicker than the Model X's 4.9-second rating, and its advertised power output of 394 horsepower and 512 pound-feet of torque is higher than Tesla's for the 75D (though Tesla's actual power numbers aren't really advertised in traditional hp and lb-ft figures). But even if cars like the Model X, Chevy Bolt, and Hyundai Kona EV aren't directly comparable across the board, their range and battery capacity figures do help us understand the relative efficiency of each specific vehicle. The efficiency of electric vehicles rated by the EPA is expressed as a MPGe (miles per gallon equivalent) figure. The 2019 Jaguar I-Pace's figures of 80 city, 72 highway, and 76 combined MPGe don't compare favorably with the Tesla Model X's 91 MPGe city, 95 MPGe highway and 93 MPGe combined ratings. It'll be interesting to see how much EV buyers care about the Jaguar's comparatively poor MPGe ratings, but they will definitely have an impact in the real world. In practical terms, what all of this means is that the Jaguar I-Pace is going to use more electricity per mile than the Tesla Model X. And that means it's going to cost more to drive the same distance in the Jag when compared to the Tesla, or just about any other modern long-range EV that's currently on the market. Related Video: This content is hosted by a third party.