|

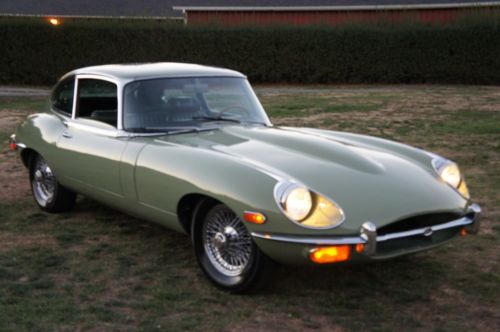

Nice daily driver. with a little love this could be a real show car. Car spent most of it life in Florida. I shipped it up about 8 years ago. I spent over $ 20,000.00 on exhaust, brakes, suspension and much more getting safety inspected and road worthy. It has air conditioning but it need a fan to get it back up and running. Tires and rims are good. all gauges and lights work. interior is nice with the normal wear and tear. I can help with shipping but not with the cost of shipping. When I shipped the car up from Florida it was really easy dealing with customs and the shipper. I can answer any questions or take pictures of any thing you would like just let me know. listed locally as well so when its gone its gone. So be aware auction may end early. |

Jaguar E-Type for Sale

1970 jaguar xke coupe lhd 4 speed 94k 4.2 original miles really solid with tools(US $29,999.00)

1970 jaguar xke coupe lhd 4 speed 94k 4.2 original miles really solid with tools(US $29,999.00) 1973 jaguar xke 2+2 v12

1973 jaguar xke 2+2 v12 Jaguar: e-type one family owner since new. factory installed removable hardtop.(US $68,700.00)

Jaguar: e-type one family owner since new. factory installed removable hardtop.(US $68,700.00) 1973 jaguar xke series iii roadster - a crown jewel e-type v12(US $76,500.00)

1973 jaguar xke series iii roadster - a crown jewel e-type v12(US $76,500.00) Beautiful 1968 xke series 1 1/2 convertible(US $67,500.00)

Beautiful 1968 xke series 1 1/2 convertible(US $67,500.00) 1969 jaguar xke roadster--last owner since 70---just pulled from hibernation---(US $48,950.00)

1969 jaguar xke roadster--last owner since 70---just pulled from hibernation---(US $48,950.00)

Auto blog

New York Auto Show, Tesla Model 3, Alpina B7 | Autoblog Podcast #535

Thu, Apr 5 2018On this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Associate Editor Reese Counts and Senior Editor of Green John Snyder. We talk about the New York Auto Show and its highlights. We also discuss some of the cars we've had in the office including the Jaguar XF S Sportbrake and BMW Alpina B7. And of course, we'll help choose a new vehicle for a listener in our "Spend My Money" segment. Autoblog Podcast #535 Your browser does not support the audio element. Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown New York Auto Show Cars in the office: Jaguar XF S Sportbrake, BMW Alpina B7 Tesla Model 3 Spend my money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video: Green Podcasts New York Auto Show BMW Jaguar Tesla Car Buying Used Car Buying Wagon Electric Luxury Performance Sedan 2018 new york auto show alpina alpina b7

Land Rover plotting high-performance Disco Sport, Evoque

Tue, Jan 20 2015Jaguar Land Rover is getting serious about performance with its new SVR line of high-output machinery. We've already seen the Range Rover Sport SVR, and we're anticipating more to follow with SVR versions of the new Jaguar XE, Range Rover LWB, outgoing Land Rover Defender and plenty more. The lineup will eventually include performance versions of most, but not all of the British automaker's products. But while the smallest Land Rovers may not get the full-on SVR treatment, JLR reportedly has something in the works. According to Australian website Motoring, Land Rover is watching the segment and considering its options. It sees Audi with its SQ5, BMW planning performance versions of the X3 and X4, and Mercedes plotting an AMG version of the GLC that's set to replace the GLK. The question is just what Land Rover will do. Both the Discovery Sport and Range Rover Evoque are based on the same D8 platform that incorporates transversely mounted inline-fours, so fitting something larger might be prohibitive, but a high-output turbo version of the new Ingenium four-cylinder engine design could do the trick. Considering what the likes of Volvo and Mercedes have managed to do with their high-strung turbo fours, Land Rover's approach could prove to be no slouch at all – even without the 5.0-liter supercharged V8 powering the flagship SVR models. In related news, Autovisie – the automotive section of Dutch newspaper De Telegraaf – projects that an SVR version of the Jaguar F-Type will be among the high-performance models coming up next. Slotting above the F-Type R with its 550 horsepower, the F-Type SVR will be even more powerful. The Project 7 speedster packaged a 575-hp version of the same supercharged V8, potentially pointing the way forward for future SVR models. Featured Gallery Land Rover Range Rover Evoque Autobiography View 17 Photos Related Gallery 2015 Land Rover Discovery Sport View 16 Photos News Source: Motoring.com.au, AutovisieImage Credit: Land Rover Jaguar Land Rover SUV Performance jaguar land rover svr

Jaguar XE SV Project 8 slices record Nuburgring lap down to 7:18.361

Wed, Jul 24 2019No production four-door vehicle has ever come close to breaking a seven-minute lap on Germany's Nuburgring (we see you WRX STI Type RA NBR), but manufacturers are slowly inching toward the achievement a few seconds at a time. Jaguar announced that it returned to the famed racetrack with its XE SV Project 8 and clocked a 7:18.361 lap, a new sedan record that's 2.9 seconds faster than the Project 8's previous record. When Jaguar debuted the Project 8 in 2017, it had the makings of a specialty car that would slither into the shadows as quickly as it blasted onto the scene. But it's been quite the opposite. Jaguar has continued development of the vehicle and offers three different versions, including a touring variant. Production has lasted into the 2019 model year, and we recently tested one to get a handle of just how monstrous the thing truly is. Much can change and be learned in two years, though, and Jaguar wanted to follow up its first trip to the Nurburgring, where it posted a record-setting time of 7:21.23. Under the guidance of Project 8 development driver Vincent Radermecker, the Jag ran the circuit in 7:18.361 on July 8, 2019. It did so in two-seat track pack spec and on Michelin Pilot Sport Cup 2 R tires. Jaguar made sure to clarify a detail about the run and the time. The 2017 time was done on the then-used 20.6-kilometer (12.8 miles) setup, and so was this time. But starting in 2019, the Nurburgring began officially recording times on the full 20.832-kilometer (12.94 miles) lap. Using the 20.832 lap, the Project 8 recorded a time of 7:23.164. With that run, the 592-horsepower supercharged Project 8 is the first vehicle to set an official whole lap record in the mid-range production car class. Watch the 7:18 run in 360-degree video below.  This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.