2021 Hyundai Sonata N Line on 2040-cars

Tomball, Texas, United States

Engine:4 Cylinder Engine

Fuel Type:Gasoline

Body Type:--

Transmission:Automatic

For Sale By:Dealer

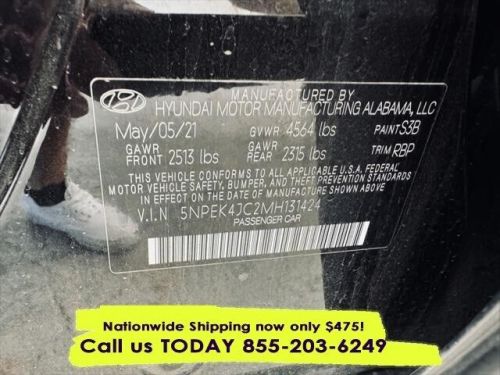

VIN (Vehicle Identification Number): 5NPEK4JC2MH131424

Mileage: 31916

Make: Hyundai

Trim: N Line

Drive Type: FWD

Features: --

Power Options: --

Exterior Color: Black

Interior Color: Black

Warranty: Unspecified

Model: Sonata

Hyundai Sonata for Sale

2023 hyundai sonata sel(US $22,473.00)

2023 hyundai sonata sel(US $22,473.00) 2020 hyundai sonata limited(US $19,667.00)

2020 hyundai sonata limited(US $19,667.00) 2021 hyundai sonata sel(US $21,581.00)

2021 hyundai sonata sel(US $21,581.00) 2012 hyundai sonata hybrid(US $4,500.00)

2012 hyundai sonata hybrid(US $4,500.00) 2023 hyundai sonata n line(US $30,000.00)

2023 hyundai sonata n line(US $30,000.00) 2015 hyundai sonata(US $2,000.00)

2015 hyundai sonata(US $2,000.00)

Auto Services in Texas

Z`s Auto & Muffler No 5 ★★★★★

Wright Touch Mobile Oil & Lube ★★★★★

Worwind Automotive Repair ★★★★★

V T Auto Repair ★★★★★

Tyler Ford ★★★★★

Triple A Autosale ★★★★★

Auto blog

Hyundai will launch 26 green models through 2020

Mon, Apr 4 2016Hyundai Motor Group, which comprises both Hyundai and Kia, believes that launching a blitz of 26 green models through 2020 could place the Korean automaker among the leaders in the segment. Only Toyota would be larger in the electrified vehicle market, if Hyundai Motor's plan works, Automotive News reports. The 26 models run the gamut of the green car field, and they include at least 12 hybrids, six PHEVs, two EVs, and two hydrogen fuel cells, according to Automotive News. If customers latch onto them, Hyundai and Kia could move as many as 300,000 electrified vehicles a year by 2020 versus about 43,000 in 2015. Kia is responsible for at least 11 of these vehicles like the upcoming Niro crossover. Meanwhile, Hyundai wants the upcoming Ioniq (above) to challenge the Toyota Prius, and the Korean company has hybrid, PHEV, and EV versions on the way. To save money on the development of so many electrified vehicles, Hyundai Motor uses shared components. "For example, all our electric motors have the same diameter," Lee Ki-Sang, Hyundai's green powertrain boss, told Automotive News. "The power output is different, but we can just adjust the width of the core winding. Or for the motor controller, we standardized to use the same printed circuit boards." Trying to go from a relatively small player to a market leader is an audacious move, but it's especially risky right now. Gas prices are the cheapest in 12 years in the US, and green car sales are down in the US and in Europe. Toyota even predicts the inexpensive fuel could cut into Prius sales, and it's far more established than Hyundai's models. The South Korean company could have an even tougher time because these efficient vehicles still lose money for now. "Our target is before 2020, we would like to make profits on these eco-friendly vehicles," Lee told Automotive News. Related Video:

Insider trading ahead of Hyundai-Kia MPG debacle suspected

Fri, 21 Dec 2012Reuters is reporting that large-scale insider trading may be at the heart of some particularly fishy stock-selling behavior, just prior to the original announcement about the Hyundai-Kia fuel economy ratings debacle.

On November 1st, Hyundai-Kia shares traded roughly 2.2 million times (the single highest-volume day of the year), and the stock price fell by about four percent. For reference, a standard daily trading volume for the stock in 2012 saw about 600k shares trading hands. On November 2nd, the company made public the bad news about the dropping fuel economy ratings for many of its models. In other words: No one outside of the company (and only a smallish group inside the company, we'd imagine) should have known anything about the impending bad news as of the first day of November. After the announcement, the stock price tanked, as you'd expect, and trading volume was way down as well.

Experts seem fully aware that the whole thing reeks of leaked information and subsequent insider trading. If chicanery on this sort of scale seems wacky to you, you'd be inline with the experts who report to Reuters that the level of trading is absolutely suspicious.

Hyundai plans to catch up with other automakers, offer EVs

Thu, Mar 30 2017YONGIN, South Korea (Reuters) - South Korea's Hyundai Motor Co is developing its first dedicated architecture for electric vehicles, seeking to catch up with the likes of Tesla in the growing segment with multiple, long-range models. While the platform will not be completed soon, Hyundai Motor and affiliate Kia plan to roll out small electric sport utility vehicles (SUVs) based on an existing underpinning next year, said Lee Ki-sang, who leads Hyundai-Kia's green cars operations. Hyundai will launch an electric SUV, followed by a sibling model by Kia Motors next year, Lee said, citing strong demand for SUVs. The subcompact or compact models would have a range of more than 300 km (186 miles) per charge, and would be "more competitive" than rival offerings, Lee said. And Hyundai said in a statement on Thursday that it plans to launch a new luxury electric vehicle under its Genesis marque in 2021, after introducing a plug-in hybrid version of an unidentified Genesis model in 2019. The separate platform represents a major push into the battery electric-car segment for a firm which has long trumpeted rival fuel-cell vehicles, reflecting strong investor pressure to compete more vigorously in a market that has been stimulated by U.S.-based Tesla's longer-range models. And tough fuel-economy and emissions regulations in the United States, Europe and China are compelling automakers to push fuel-efficient cars even though low oil prices have undercut demand. Hyundai's electric-car platform would allow the automaker to install a battery pack in vehicle floors to accommodate more battery capacity and maximize cabin space, Lee said. "The electric-vehicle platform will require high up-front investments, but we are doing this to prepare for the future," he said at Hyundai-Kia's green car research center in the city of Yongin, outside Seoul. He did not reveal the cost. Lee, a senior vice-president at Hyundai Motor, was speaking during an interview on the eve of an auto show that kicked off in Seoul on Thursday. Analysts said Hyundai had no choice but to build separate electric-vehicle platforms to be relevant in the segment. "The separate platform may incur losses initially, but Hyundai will be left behind the market if they don't offer long-distance models, like 300 km, 500 km and 600 km," said Ko Tae-bong, an analyst at Hi Investment & Securities.