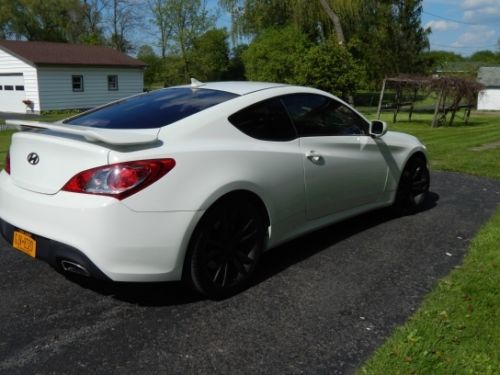

Mint!!! Low Miles!! 2010 Hyundai Genesis Coupe 2.0t R-spec Coupe 2-door 2.0l on 2040-cars

Auburn, New York, United States

|

Mint condition 2010 Hyundai Genesis Coupe R-Spec with 32,443 miles, 2.0

Turbo, 6speed manual. Still under factory warranty. Two owners. I purchased this car in 2012 from a dealership and have babied it ever sense. Looking to buy a bigger vehicle which is the only reason I am selling it. Car has no flaws, very low mileage and runs great. Everything is stock

other than 20% window tint, and after market fog lights, and HID's, all

of which can be removed if preferred. Car has been stored every winter

but 1. No accidents!!! Ipod hookup.

Please message with any questions or concerns. I have the right to end this listing early if the car is sold locally. I will accept cash and or bank checks. Will ship anywhere within U.S, but arranging shipping is the priority of the buyer, I will help but shipping fees are up to the buyer. |

Hyundai Genesis for Sale

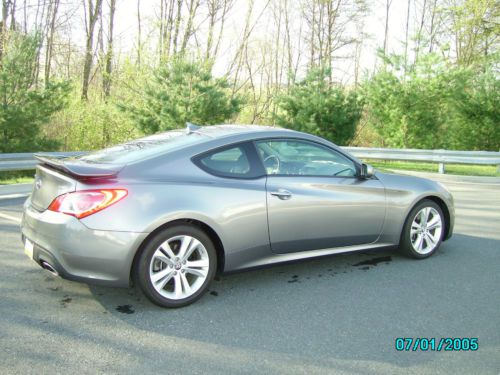

2011 hyundai genesis coupe 2.0 r spec

2011 hyundai genesis coupe 2.0 r spec 2012 hyundai genesis coupe 3.8 grand touring coupe 2-door 3.8l

2012 hyundai genesis coupe 3.8 grand touring coupe 2-door 3.8l 2010 hyundai genesis coupe 2.0t r-spec coupe 2-door 2.0l(US $13,900.00)

2010 hyundai genesis coupe 2.0t r-spec coupe 2-door 2.0l(US $13,900.00) 3.8 new 3.8l nav cd wheels: 18 x 8.0j machine finished aluminum alloy tachometer(US $41,995.00)

3.8 new 3.8l nav cd wheels: 18 x 8.0j machine finished aluminum alloy tachometer(US $41,995.00) 3.8 new 3.8l nav cd wheels: 18 x 8.0j machine finished aluminum alloy tachometer(US $38,995.00)

3.8 new 3.8l nav cd wheels: 18 x 8.0j machine finished aluminum alloy tachometer(US $38,995.00) Coupe 3.8 track edition, leather, infinity sound system, htd sts - silverstone

Coupe 3.8 track edition, leather, infinity sound system, htd sts - silverstone

Auto Services in New York

Xtreme Auto Sales ★★★★★

WaLo Automotive ★★★★★

Volkswagon of Orchard Park ★★★★★

Urban Automotive ★★★★★

Trombley Tire & Auto ★★★★★

Tony`s Boulevard Service Center ★★★★★

Auto blog

Recharge Wrap-Up: LAPD gets Zero MMX, Chevy's new inverter, Hyundai Tucson's new powertrains

Wed, Jul 16 2014Some police in Los Angeles will be riding Zero MMX electric motorcycles on duty. The LAPD is adding the fully electric police/military all-terrain bikes to its patrol fleet. According to Officer Steve Carbajal of the department's off-road unit, "It costs less than 50 cents to charge compared to using gallons of gas, maintenance is simple, and the community appreciates how quiet they are." The electric bikes, with their lack of noise and a headlight the rider can turn off, also have the benefit of stealth, giving the officers what Carbajal calls "an added tactical advantage." The MMX also has swappable batteries, is designed for quick ignition and has power reserve capabilities so the rider won't be caught with a dead battery while chasing down a perp. Read more at Ride Apart. Remember when it seemed like we'd never run out of oil, and giving your buddy five bucks for gas was actually a worthwhile gesture? Drivers of classic cars in Detroit were able to fill up their tanks at gas prices corresponding to their model year, thanks to a promotion by Hagerty Insurance for National Collector Car Appreciation Day on July 11. That meant prices from 21 to 90 cents a gallon, as the cars that showed up ranged from the years 1929 to 1989. That's about as affordable as charging your EV. Head over to Autoweek for more details and some photos from the event. The next-generation Chevrolet Volt will likely benefit from a new inverter being developed by General Motors. GM is about two-thirds of the way through the development of the new inverter, which should be ready in January 2016. The inverter, which has a peak output of 55 kilowatts a continuous output of 33 kilowatts, will be adaptable for use in other GM vehicles. Chevrolet is working to reduce the Volt's production costs by $10,000 per vehicle, which should make it more affordable, and the new inverter could help reach that goal should it make its way into the car. Read more at Green Car Reports. Hyundai is likely planning some interesting powertrain changes for the 2016 Tucson, says Green Car Reports. Plug-in hybrid? Maybe. Diesel? Probably not. "We are covering the waterfront on all alternative fuel strategies, from standard hybrid, to plug-in, battery-electric, and fuel cell," says Hyundai's US Chief Dave Zuchowski.

Here are all the EVs with 800V charging available in 2024

Fri, May 31 2024As technology advances, electric cars are improving their fast-charging times. That means less time spent waiting at a DC public charger when you’re out on the road. While Level 3 chargers used to provide a maximum of 150 kilowatts of power, 350-kW chargers are become more common, making for super-fast charging Â… if your car is capable of taking advantage of it. So how do automakers improve the charging speed of their EV batteries? Some are turning to higher voltage, specifically 800V charging. What's the difference between 800-volt charging and 400-volt charging? So how does 800V charging improve upon the more common 400V EVs? Put simply, the higher the voltage, the less amperage (current) it requires to charge. In other words, with more voltage, you get more wattage (power, aka charge rate) from the same amperage (current). 800V architecture is also more efficient, with less electrical resistance, so it can use thinner cables and smaller, lighter components while needing less cooling. The tradeoff is that it is more costly, and guess who that cost gets passed on to. While automakers don't break down their pricing to show how much more you're paying for that 800V system, you'll just have to evaluate any potential purchases as a whole, and make your decision based on overall pricing of the vehicle. Thankfully, the 800V EVs on sale now are generally ones we like. Now, 800V charging capability doesn't necessarily mean an EV has 800V vehicle architecture. For instance, the GMC Hummer EV and Chevy Silverado EV operate at 400V, but with their dual battery packs, can switch to 800V when charging by temporarily connecting those packs in series. Currently, there are only a handful of EVs available with 800V charging. But if you are going to find yourself taking longer trips in your EV and using DC fast chargers more often, you might want to consider choosing one with this faster charging capability. With that in mind, these are the EVs available with 800V charging, either on sale now or coming in 2024. 800-volt EVs available in 2024 Audi E-Tron GT Chevrolet Silverado EV Genesis GV60 Genesis Electrified G80 Genesis Electrified GV70 GMC Hummer EV Pickup GMC Hummer EV SUV GMC Sierra EV* Hyundai Ioniq 5 Hyundai Ioniq 6 Kia EV6 Kia EV9 Lotus Eletre* Lotus Emeya* Lucid Air Lucid Gravity* Porsche Macan Electric* Porsche Taycan Ram 1500 REV* Tesla Cybertruck *Coming later in 2024 Green Audi Chevrolet Genesis GMC Hyundai Kia Lotus Porsche Tesla Electric Lucid EV charging

Hyundai going with AeroVironment for dealership PHEV chargers

Sun, Nov 29 2015Hyundai will partner with AeroVironment as the supplier for charging stations at dealers for the 2016 Sonata Plug-in Hybrid. The 240-volt chargers will be able to top up the PHEV in less than three hours. Customers can also order AeroVironment's home chargers directly from the automaker's showrooms. AeroVironment is a veteran to working with automakers on charging solutions and has experience partnering with Fiat, Ford, Nissan, and BMW. The company also installed a network of locations along the I-5 corridor in Oregon. Customers can already buy the Sonata PHEV in ten states, including California, for a starting price of $35,435 (after $835 destination but before any tax incentives). The sedan has a total output of 202 horsepower from its 2.0-liter four-cylinder and electric motor. The 9.8-kWh lithium-polymer battery offers 27 miles of electric range and an EPA-estimated 99 miles per gallon equivalent. Hyundai dealers might have more green cars on the lot to use these chargers in the coming years. The company reportedly has a project codenamed AE under development, and rumor indicates that hybrid, PHEV, and EV models could be on the way. Hyundai Motor America Picks AeroVironment to Provide Dealer Charging Stations for the All-new 2016 Sonata Plug-in Hybrid Model AeroVironment to provide reliable and easy-to-use EV charging stations in Hyundai dealerships Hyundai becomes the seventh major auto manufacturer to choose AeroVironment as its preferred dealer charging station provider Hyundai drivers have the option to purchase AeroVironment's portable TurboCord charging system or its wall-mounted EVSE-RS charging station SIMI VALLEY, Calif., Nov. 24, 2015 – Hyundai Motor America has selected AeroVironment, Inc. (NASDAQ:AVAV) as the preferred provider for charging system installation at its dealerships across North America for its all-new 2016 Hyundai Sonata Plug-in Hybrid. Hyundai is the seventh plug-in electric vehicle (EV) auto manufacturer to choose AeroVironment as one of its suppliers. The 2016 Sonata Plug-in Hybrid comes with a high-capacity lithium-polymer hybrid battery system that delivers an all-electric range of 27 miles before switching to hybrid mode. The Sonata Plug-in Hybrid also comes with a lifetime hybrid battery warranty. The AeroVironment 240-volt TurboCord and the EVSE-RS charging station can charge the Sonata Plug-in Hybrid in less than three hours versus the approximate nine hours needed using a standard 120-volt charging cable.