2014 Hyundai Elantra Gt Base on 2040-cars

2308 S Woodland Blvd, DeLand, Florida, United States

Engine:2.0L I4 16V GDI DOHC

Transmission:Automatic

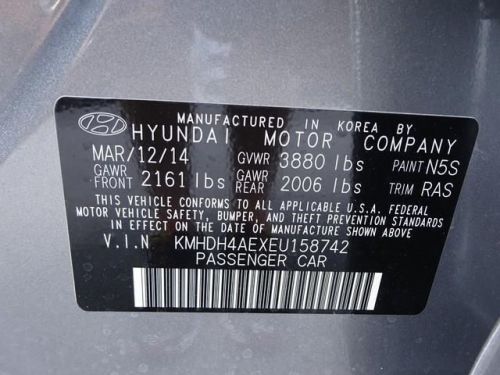

VIN (Vehicle Identification Number): KMHD35LH1EU197621

Stock Num: EU197621

Make: Hyundai

Model: Elantra GT Base

Year: 2014

Exterior Color: Black Noir Pearl

Interior Color: Beige

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 8

Price excludes tax, tag, dealer installed options, $98 private tag agency fee and $699.00 predelivery service fee.

Hyundai Elantra for Sale

2014 hyundai elantra se(US $20,110.00)

2014 hyundai elantra se(US $20,110.00) 2014 hyundai elantra se(US $20,175.00)

2014 hyundai elantra se(US $20,175.00) 2014 hyundai elantra se(US $20,195.00)

2014 hyundai elantra se(US $20,195.00) 2014 hyundai elantra se(US $20,370.00)

2014 hyundai elantra se(US $20,370.00) 2014 hyundai elantra limited(US $25,320.00)

2014 hyundai elantra limited(US $25,320.00) 2014 hyundai elantra gt base(US $26,610.00)

2014 hyundai elantra gt base(US $26,610.00)

Auto Services in Florida

Wildwood Tire Co. ★★★★★

Wholesale Performance Transmission Inc ★★★★★

Wally`s Garage ★★★★★

Universal Body Co ★★★★★

Tony On Wheels Inc ★★★★★

Tom`s Upholstery ★★★★★

Auto blog

Senator calling for answers from Hyundai and Kia over MPG debacle

Fri, 30 Nov 2012Hyundai and Kia have already gone public with plans to make good on the inflated fuel economy claims scandal that has rocked both companies in recent weeks. But one US senator, Jay Rockefeller (D-WV), is skeptical that the general public will see much good from the proposal, and he's looking for answers.

To recap: Hyundai/Kia have agreed to compensate owners of 900,000 affected vehicles for real versus previously claimed fuel mileage (as well as adding in a one- fifteen-percent premium), by way of pre-loaded debit cards. It has been speculated that this payout could crest $100 million by the time the Korean automakers are done writing checks.

Said Rockefeller to The Detroit News, "While I believe this is a positive step, I am concerned that many affected customers may not learn about the program or may find it burdensome to participate in the program." Rockefeller would reportedly like to see a monitoring system for the paybacks more clearly defined, with the goal being as many wronged car buyers as possible getting the recompense that they're due.

Hyundai planning pure electric Genesis model

Sun, Jun 5 2016The market for luxury EVs is set to grow bigger by at least one model. The latest is set to come from Genesis, the new luxury brand launched by Hyundai. The news, according to Reuters, was revealed by the brand's chief executive Manfred Fitzgerald at the Busan Motor Show in South Korea. "We will definitely go as Genesis brand down the road of alternative propulsions and it is very, very obvious that EV is definitely on the map," said Fitzgerald "I think full electric cars will be the future in the auto industry." The executive stopped short of providing further details or a timeline for the EV's eventual launch, however it's not the first alternative powertrain the brand will offer. The G80 (pictured) is set to gain a diesel version to join the existing gasoline model, aimed principally at the vital European market that Genesis' key rivals call home. The electric Genesis would join a growing field of luxury EVs. Faraday Future is taking aim at Tesla, German automakers like Audi, BMW, Mercedes, and Porsche are expected to launch upscale electric vehicles – and others are likely to follow. Fitzgerald recently signed on as Senior Vice President at the Hyundai group to oversee the Genesis brand, having previously served as branding chief at Lamborghini. He is one of a number of Westerners recruited by Hyundai's vice chairman and heir apparent Chung Eui-sun, the impetus for the upscale brand's launch, alongside the likes of designer Luc Donckerwolke and performance engineer Albert Biermann. Related Video:

Hyundai N 2025 Vision Gran Turismo concept coming to Frankfurt

Wed, Aug 26 2015Hyundai will be using the Frankfurt Motor Show to tout its N Performance sub-brand and the future possibilities it could create. A purely conceptual extrapolation comes via the N 2025 Vision Gran Turismo, which joins the expanding list of carmaker-created superfast racers for Sony's Playstation game. The company's 2016 World Rally Championship entrant will grace the stand, previewing the car Hyundai will use to try to dethrone Volkswagen. It is a completely new racecar based on the next-generation five-door i20, still undergoing testing now but planned for competition at the 2016 Monte Carlo Rally. The RM15 concept shown at the Seoul Motor Show will be the third demonstration of Hyundai's enthusiast intentions. The carmaker says the mid-engined, Veloster-based coupe is about "suggesting how N driver-focused technologies could come into production," but we imagine that won't mean installing a 296-horsepower, 2.0-liter turbo-four where the rear seats are. All three cars are intended to rework perceptions of the South Korean company, which is working to "create striking and pioneering high performance cars" and make "real and emotional connections with customers." There's a press release below with more details, and a gallery of the N 2025 concept above that will be arriving in GT6 soon. Hyundai Motor's New High Performance Sub-brand 'N' Takes Center Stage at Frankfurt Motor Show - The sub-brand N will build new momentum for an exciting driving performance and provide emotional driving experience for customers - The latest motorsport challenger and two dynamic concepts will also be introduced at the Motor Show August 26, 2015 – Hyundai Motor will showcase its high performance sub-brand N at the Frankfurt International Motor Show 2015. The result of intensive testing and product development, the sub-brand N builds on Hyundai Motor's successful motorsport experiences and technology capability to drive future performance-oriented and race-track-capable models forward and bring 'the most thrilling winding road' fun to customers who truly love cars. The N builds on not just Hyundai Motor's continued advancement as a primary competitor in World Rally Championship (WRC) but also on the company's dedication and investment to create striking and pioneering high performance cars.