2003 Hyundai Elantra Gls Sedan 4-door 2.0l - It's Good On Gas! on 2040-cars

Locust Valley, New York, United States

Body Type:Sedan

Engine:2.0L 1975CC l4 GAS DOHC Naturally Aspirated

Vehicle Title:Clear

Fuel Type:GAS

For Sale By:Private Seller

Number of Cylinders: 4

Make: Hyundai

Model: Elantra

Trim: GLS Sedan 4-Door

Warranty: Vehicle does NOT have an existing warranty

Drive Type: FWD

Power Options: Air Conditioning, Power Windows

Mileage: 80,627

Sub Model: GLS

Exterior Color: Silver

Number of Doors: 4

Interior Color: Gray

Hyundai Elantra for Sale

Elantra mint only 1k miles leather we finance & love trades $249 u own it(US $18,900.00)

Elantra mint only 1k miles leather we finance & love trades $249 u own it(US $18,900.00) 2011 hyundai elantra gls sedan 4-door 1.8l

2011 hyundai elantra gls sedan 4-door 1.8l 2009(09) elantra we finance bad credit! buy here pay here low down $1699 ez loan(US $13,497.00)

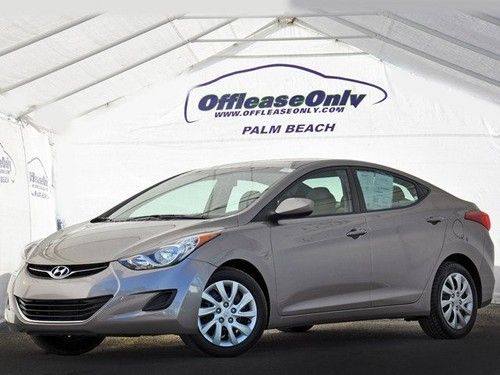

2009(09) elantra we finance bad credit! buy here pay here low down $1699 ez loan(US $13,497.00) Automatic all power power mirrors cd player cruise control off lease only(US $13,999.00)

Automatic all power power mirrors cd player cruise control off lease only(US $13,999.00) 2006(06)elantra we finance bad credit! buy here pay here low down $1199 ez loan(US $10,497.00)

2006(06)elantra we finance bad credit! buy here pay here low down $1199 ez loan(US $10,497.00) Gls 2.0l hyundai certified pre-owned we finance!!!

Gls 2.0l hyundai certified pre-owned we finance!!!

Auto Services in New York

Westchester Toyota ★★★★★

Vision Dodge Chrysler Jeep ★★★★★

Village Automotive Center ★★★★★

TNT Automotive ★★★★★

Sterling Autobody Centers ★★★★★

Sencore Enterprises ★★★★★

Auto blog

Hyundai shoots down the rumor claiming it is done developing engines

Tue, Jan 4 2022Hyundai has clarified that the recent rumor claiming it had stopped developing gasoline- and diesel-burning engines to focus on various forms of electrifications is false. It said that development work remains on-going and that the internal combustion engine still has a future. "Hyundai Motor Group can confirm that it is not halting the development of its engines following recent media speculation. The Group is dedicated to providing a strong portfolio of powertrains to its global customers, which includes a combination of highly efficient engines and zero-emissions electric motors," said senior group manager Michael Stewart in an interview with Motor1. The report that emerged in late 2021 claimed that the Hyundai Group (which includes the Hyundai brand, Kia, and Genesis, among other entities) had completely stopped designing piston-powered engines to focus on electrification. It claimed that most of the engineers had been assigned new roles related to electrification, though it also noted that some were staying behind to continue refining the technology. If this sounds familiar, it's likely because Hyundai recently shot down a separate but similar rumor that said it had put the hydrogen-electric powertrain it planned to install in many of its cars (including some upmarket Genesis models) on hiatus. The carmaker explained that it has merely reshuffled the team that's developing the technology because unspecified technical hurdles have slowed down the project. Several electric Hyundai models are in the pipeline, including the production version of the Prophecy concept unveiled in 2020 and a relatively big SUV previewed by the 2021 Seven concept. But, its comments suggest that more gasoline-powered models are on the way as well, which is great news; its range of N-tuned high-performance models includes excellent cars and there's still room for it to grow. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Hyundai recalls 24k Genesis sedans over electrical issue

Mon, Mar 9 2015An electrical problem has prompted Hyundai and the National Highway Traffic Safety Administration to issue a recall for the 2015 Genesis. The problem arises when water leaks into the taillight assembly, which – in a way that would only make sense to an electrician – could cause the incorrect gear to be displayed on the instrument panel or even a delay in switching from Park to Reverse or Drive. Needless to say, if the driver doesn't know into which position the transmission has shifted, that could increase the likelihood of a crash. The issue affects an estimated 24,400 units of the 2015 Genesis in the United States – specifically those manufactured between February 21, 2014, and January 24, 2015. Owners of those vehicles can expect to hear from their local dealer to arrange the installation of additional waterproofing pads to prevent the troublesome moisture from leaking in to the taillights. RECALL Subject : Water may Leak into Rear Combination Lamp Assembly Report Receipt Date: FEB 19, 2015 NHTSA Campaign Number: 15V097000 Component(s): ELECTRICAL SYSTEM , EXTERIOR LIGHTING , POWER TRAIN Potential Number of Units Affected: 24,400 Manufacturer: Hyundai Motor America SUMMARY: Hyundai Motor America (Hyundai) is recalling certain model year 2015 Genesis vehicles manufactured February 21, 2014, to January 24, 2015. Water may leak into the rear combination lamp assemblies and cause an incorrect gear display on the instrument panel or a delay in the engagement of the selected gear when the vehicle is shifted from Park to Reverse or Drive. CONSEQUENCE: If the incorrect gear is being displayed, the vehicle may move in an unintended direction, increasing the risk of a crash. REMEDY: Hyundai will notify owners, and dealers will apply pads to prevent water intrusion into the combination lamp housing, free of charge. The manufacturer has not yet provided a notification schedule. Owners may contact Hyundai customer service at 1-855-671-3059. Hyundai's number for this recall is 128. NOTES: Owners may also contact the National Highway Traffic Safety Administration Vehicle Safety Hotline at 1-888-327-4236 (TTY 1-800-424-9153), or go to www.safercar.gov.

Consumer Reports no longer recommends Honda Civic

Mon, Oct 24 2016Consumer Reports annual Car Reliability Survey is out, and yes, there are some big surprises. First and foremost? The venerable publication no longer recommends the Honda Civic. In fact, aside from the walking-dead CR-Z and limited-release Clarity fuel-cell car, the Civic is the only Honda to miss out on CR's prestigious nod. At the opposite end there's a surprise as well – Toyota and Lexus remain the most reliable brands on the market, but Buick cracked the top three. That's up from seventh last year, and the first time for an American brand to stand on the Consumer Reports podium. Mazda's entire lineup earned Recommended checks as well. Consumer Reports dinged the Civic for its "infuriating" touch-screen radio, lack of driver lumbar adjustability, the limited selection of cars on dealer lots fitted with Honda's popular Sensing system, and the company's decision to offer LaneWatch instead of a full-tilt blind-spot monitoring system. Its score? A lowly 58. The Civic isn't the only surprise drop from CR's Recommended ranks. The Audi A3, Ford F-150, Subaru WRX/STI, and Volkswagen Jetta, GTI, and Passat all lost the Consumer Reports' checkmark. On the flipside, a number of popular vehicles graduated to the Recommended ranks, including the BMW X5, Chevrolet Camaro, Corvette, and Cruze, Hyundai Santa Fe, Porsche Macan, and Tesla Model S. Perhaps the biggest surprise is the hilariously recall-prone Ford Escape getting a Recommended check – considering the popularity of Ford's small crossover, this is likely a coup for the brand, as it puts the Escape on a level playing field with the Recommended Toyota RAV4, Honda CR-V, and Nissan Rogue. While Ford is probably happy to see CR promote the Escape, the list wasn't as kind for every brand. For example, of the entire Fiat Chrysler Automobiles catalog, the ancient Chrysler 300 was the only car to score a check – there wasn't a single Dodge, Fiat, Jeep, Maserati, or Ram on the list. That hurts. FCA isn't alone at the low end, either. GMC, Jaguar Land Rover, Mini, and Mitsubishi don't have a vehicle on CR's list between them, while brands like Mercedes-Benz, Volvo, Nissan, Lincoln, Infiniti, and Cadillac only have a few models each. You can check out Consumer Reports entire reliability roundup, even without a subscription, here.