Luxury Suv 6.0l on 2040-cars

Red Springs, North Carolina, United States

Vehicle Title:Clear

Engine:6.0L 5967CC 364Cu. In. V8 GAS OHV Naturally Aspirated

For Sale By:Dealer

Body Type:Sport Utility

Fuel Type:GAS

Interior Color: Other

Make: Hummer

Model: H2

Warranty: Unspecified

Trim: Base Sport Utility 4-Door

Drive Type: 4WD

Mileage: 74,676

Number of Cylinders: 8

Sub Model: LUXURY

Exterior Color: Black

Hummer H2 for Sale

2006 h2 sut blk/blk only 8,703 actual miles navigation tv/dvd like new rare!!!(US $45,800.00)

2006 h2 sut blk/blk only 8,703 actual miles navigation tv/dvd like new rare!!!(US $45,800.00) 2007 hummer h2 6.0l v8 awd rear camera moonroof lift kit tow package video(US $35,000.00)

2007 hummer h2 6.0l v8 awd rear camera moonroof lift kit tow package video(US $35,000.00) Hummer h2 sut 1 owner 4x4 bose leather navigation adjustable suspension

Hummer h2 sut 1 owner 4x4 bose leather navigation adjustable suspension Hummer h2 sut

Hummer h2 sut 2006 hummer h2 suburban 42k miles

2006 hummer h2 suburban 42k miles 2003 hummer h2 6.0 fabtech magna supercharged eaton lockers gears 5.13 lift 40"

2003 hummer h2 6.0 fabtech magna supercharged eaton lockers gears 5.13 lift 40"

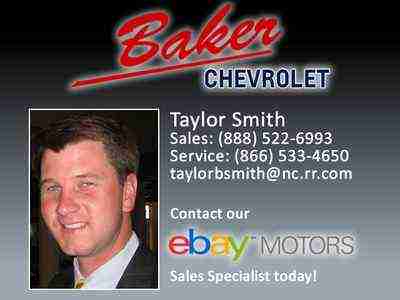

Auto Services in North Carolina

Whitey`s German Automotive ★★★★★

Transmission Center ★★★★★

Tow-N-Go LLC ★★★★★

Terry Labonte Chevrolet ★★★★★

Sun City Automotive ★★★★★

Show & Pro Paint & Body ★★★★★

Auto blog

GM renames its Detroit-Hamtramck plant Factory Zero

Sat, Oct 17 2020Maybe we'll win, saved by zero. General Motors on Friday announced that its sprawling Detroit-Hamtramck facility, which is being retooled to build electric vehicles, has been renamed Factory Zero — as in zero emissions, along with the promise of an autonomous future in which there are zero crashes and zero congestion. The company is spending $2.2 billion to retool the plant into a futuristic facility that is flexible enough to build a variety of cars and trucks across the GM portfolio of brands. GM says that's the most it has ever spent on a production facility, and when the plant's cranking out EVs at scale it will have created 2,200 manufacturing jobs. Factory Zero's first projects will be the all-electric GMC Hummer pickup and the self-driving electric Cruise Origin, both build on GM's new Ultium battery platform, with other EVs to follow. Factory Zero should start cranking out Hummer pickups by fall 2021. A Hummer SUV will come along later. Check back with Autoblog when the Hummer is revealed next Tuesday, Oct. 20. Sustainability will be another key feature. During construction, excess concrete from pours in the plant has been used to pave roads, and stormwater runoff is being recycled to charge the factory suppression system and circulate in cooling towers. The 365-acre site also has 16.5 acres of wildlife habitat — GM says monarch butterflies hang out there, along with foxes and wild turkeys. GM says it's committed to powering all its southeast Michigan plants with sustainable energy by 2023, the rest of its U.S. facilities by 2030, and overseas plants by 2040. To that end, Factory Zero has a 30-kilowatt solar carport, and a 516-kilowatt ground-mounted solar farm, from DTE. “Factory ZERO is the next battleground in the EV race and will be GMÂ’s flagship assembly plant in our journey to an all-electric future,” said Gerald Johnson, GM executive vice president of Global Manufacturing. “The electric trucks and SUVs that will be built here will help transform GM and the automotive industry.” Related Video:   Green Hirings/Firings/Layoffs Plants/Manufacturing GM Hummer hamtramck

GeigerCars Hummer H2 Bomber is ready for winter...now that it's spring

Fri, 26 Mar 2010GeigerCars Hummer H2 Bomber - Click above for high-res image gallery

GiegerCars has a love affair with American cars, and a particularly strange affection for Hummers. The German tuner has created all sorts of strange variants like a Christmas-themed H2, a 700-horsepower H2 built for a Texas sheriff or any number of racing-liveried Hummers like the "Gulf Wing" or this Martini Racing inspired H3.

GiegerCars' latest creation is the Hummer H2 Bomber. The most notable modification is the addition of four Mattracks 88M1-A1 rubber tracks that replace the twenty inch wheels. The rest of the vehicle features a military design theme as well as a roof box with lighting and a silver matte paint finish. Now all we need is a race on a snow-covered drag strip between this and Ken Block's Subaru TRAX STI. Follow the jump for the press release from GeigerCars.

GMC Hummer EV could have had the Chevrolet Avalanche's Midgate

Tue, Nov 3 2020One of the many rumors swirling around the GMC Hummer EV claimed the truck would resurrect the Midgate inaugurated by the original Chevrolet Avalanche. Although we now know there's no way to fully knock down the partition between the cab and the cargo box, the firm revealed the rumor wasn't entirely false. "There was [a Midgate] early on. We opted for the functionality of the drop glass in the back. With the package layout and things like that, it was not advantageous to pursue that one. And, the five-foot bed was kind of the industry standard in regards to price of entry in that segment," explained John Mack, the Hummer's exterior design management, during an interview with Muscle Car & Trucks. The Hummer will go on sale with a five-foot box, and it doesn't sound like a longer bed will be available, so a modern version of the Midgate would have made the model more versatile by giving users the ability to fold down the partition behind the rear seats to carry bulky items, like plywood and ATVs. It's a feature that would have inevitably made the truck more complicated to build, however, because it adds moving parts that need to be sealed. Hinges, seals, and latches in turn add weight, and complexity almost always invites high manufacturing costs. As an electric pickup built with newly-developed components, the Hummer already has enough of each. Motorists who need to carry something that's significantly longer than the cargo box aren't entirely out of luck. As Mack pointed out, the rear window drops into the partition, so owners will have the ability to haul surfboards, lumber, or anything else that's relatively long and reasonably thin by simply pushing a switch. Alternatively, the only thing limiting cargo space when the roof comes off is the sky — or, depending on where you live, bridges. Mack didn't reveal when the Midgate was dropped. GMC launched the Hummer project in April 2019, and it previously released early design sketches that show how the truck transitioned from a sketch to a prototype. As of writing, nothing suggests the Midgate will make a comeback in the near future on any member of the General Motors portfolio. It was introduced in 2001 on the first-generation Chevrolet Avalanche, which went on sale in the United States for the 2002 model year. It later spread to Cadillac's luxed-up variant of the truck, the Escalade EXT, and to the short-lived GMC Envoy XUV.