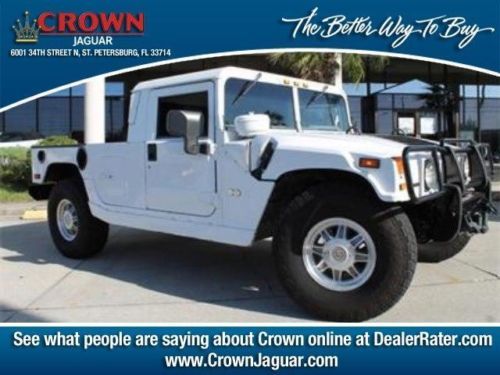

2003 Hummer H1 Open Top Excellent Service History Call Greg 727-698-5544 on 2040-cars

Saint Petersburg, Florida, United States

Engine:6.5L Turbodiesel

Transmission:Automatic

Body Type:SUV

Year: 2003

Make: Hummer

Options: 4-Wheel Drive

Model: H1

Safety Features: Anti-Lock Brakes

Warranty: Vehicle does NOT have an existing warranty

Mileage: 43,523

Number of doors: 4

Exterior Color: White

Series: Open Top

Certification: None

Drivetrain: 4WD

Hummer H1 for Sale

1995 hummer h1 automatic 4-door suv(US $39,999.00)

1995 hummer h1 automatic 4-door suv(US $39,999.00) 98 hummer h1 wagon turbo diesel 4wd monsoon sound cd changer(US $54,995.00)

98 hummer h1 wagon turbo diesel 4wd monsoon sound cd changer(US $54,995.00) Alpha open top + led light bar + 20" fuel hostage wheels + brushguard + duramax

Alpha open top + led light bar + 20" fuel hostage wheels + brushguard + duramax 93 hmmwv humvee m998 ca registered 817 miles

93 hmmwv humvee m998 ca registered 817 miles 22" fuel wheels, 21k mls, leather seats, momo, led's, billet, predator light bar

22" fuel wheels, 21k mls, leather seats, momo, led's, billet, predator light bar (US $49,500.00)

(US $49,500.00)

Auto Services in Florida

Zeigler Transmissions ★★★★★

Youngs Auto Rep Air ★★★★★

Wright Doug ★★★★★

Whitestone Auto Sales ★★★★★

Wales Garage Corp. ★★★★★

Valvoline Instant Oil Change ★★★★★

Auto blog

2023 Chicago Auto Show Mega Photo Gallery: See all the new cars from the show

Thu, Feb 16 2023The 2023 Chicago Auto Show played host to a number of reveals this year, and we were there to capture all of them. In traditional auto show fashion, that means you’re getting a mega gallery of galleries to flip through and see all the vehicles on the show floor. Our EditorsÂ’ Picks from the show are already out — spoiler alert, the 2024 Toyota Grand Highlander took home the prize. That said, there were other important reveals like the 2024 Volkswagen Atlas and Atlas Cross Sport and the 2024 Subaru Crosstrek. We also learned some interesting tidbits, such as the fact that VW is considering a pickup, and Jeep owners really are plugging in. To see the photos, scroll on down and start flipping through those galleries.  2024 Toyota Grand Highlander 2024 Toyota Grand Highlander View 7 Photos 2024 Volkswagen Atlas 2024 Volkswagen Atlas View 14 Photos 2024 Volkswagen Atlas Cross Sport 2024 Volkswagen Atlas Cross Sport View 7 Photos 2024 Ford Mustang Dark Horse with its carbon fiber wheels 2024 Ford Mustang Dark Horse with carbon fiber wheels View 7 Photos 2024 Chevrolet Corvette E-Ray 2024 Chevrolet Corvette E-Ray View 10 Photos Jeep Wrangler Anniversary Editions Jeep Wrangler Anniversary Editions View 3 Photos 2023 BMW XM 2023 BMW XM View 6 Photos Ram Revolution Concept Ram Revolution Concept View 6 Photos NASCAR Chicago Street Race Pace Car — Toyota Camry NASCAR Chicago Street Race Pace Car ? Toyota Camry View 4 Photos Everything else at the 2023 Chicago Auto Show Lamborghini Countach LPI 800-4 View 12 Photos Related video: Chicago Auto Show BMW Buick Chevrolet Ford GM GMC Hummer Jeep Lamborghini RAM Toyota Volkswagen Truck Coupe Crossover SUV Concept Cars Electric Hybrid Luxury Off-Road Vehicles Performance Supercars Sedan

2022 GMC Hummer EV shows off accessories ahead of SEMA

Thu, Oct 28 2021As is the case with nearly every new off-roader on the market, the 2022 GMC Hummer EV will have a bunch of accessories available for personalizing the big electric pickup truck. In fact, GMC says that the total number of add-ons is close to 200. But for the SEMA show, it's sharing just a few of what it says are the more interesting accessories. Quite a few of these parts will take you a long way to turning the Hummer EV into an overlander. The most obvious is the roof-top tent that utilizes mounts on the roof and the bed. It looks quite large and roomy. Naturally, auxiliary lighting is available, too, including a 50-inch roof light bar and two smaller spot lights that mount ahead of the A pillars. For storage, there's a nifty swing-out toolbox, shown in the gallery as more of a tackle box, plus a battery-powered cooler and a bed-mount for a full-size spare tire. There's also a more traditional bed extender and simple bed rail-mounted rack. And just for fun, you can get a Kicker audio sound system built into the MultiPro tailgate to listen to your music. Not all the accessories are about utility, though. There are some visual enhancements such as the red decals shown in the gallery. They match other decals and badges available, and they're offered in bronze, too. There are some branded puddle lights on offer as well. These should be available around when the Hummer EV pickup goes on sale next year. Pricing for each part will surely vary, though exact numbers haven't been announced. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Turn Out the Lights: Final Hummer H3 rolls off the line... for Avis

Tue, 25 May 20102010 Hummer H3 - Click above for high-res image gallery

Would the last one out the door please switch off the lights? The long strange trip that has been the Hummer brand is just about over for General Motors. The final ever production H3 rolled out of GM's Shreveport, Louisiana factory on Monday May 24, 2010 on its way to an Avis rental car outlet. As you may recall, GM had actually stopped assembling H3s in mid-2009 as it went through bankruptcy, but it resumed production recently in order to fill an 849 unit special order.

GM tried to sell the Hummer brand to Sichuan Tengzhong Heavy Industrial Machines Co., Ltd but the deal ultimately fell apart last February. A subsequent offer from Raser Technologies also went nowhere. Now that production has ceased, 200 of the 900 remaining employees at Shreveport will be laid off by July and the rest of the Hummer staff back at headquarters in Detroit is either leaving or being reassigned.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.198 s, 7891 u