2010 Gmc Yukon Denali on 2040-cars

100 Loop Rd, Dayton, Ohio, United States

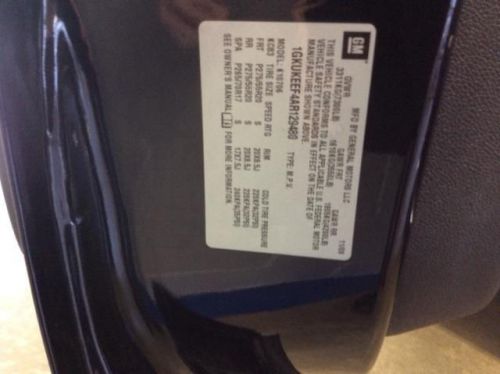

Engine:6.2L V8 16V MPFI OHV Flexible Fuel

Transmission:6-Speed Automatic

VIN (Vehicle Identification Number): 1GKUKEEF4AR129480

Stock Num: 015809

Make: GMC

Model: Yukon Denali

Year: 2010

Exterior Color: Black

Interior Color: Ebony

Options: Drive Type: AWD

Number of Doors: 4 Doors

Mileage: 74485

AWD, SUNROOF/MOONROOF, **CLEAN CARFAX HISTORY**, **DVD/REAR ENTERTAINMENT/TV**, **LEATHER**, **NAVIGATION/GPS**, HAS WARRANTY!!, LOCAL TRADE, and WE WANT YOUR VEHICLE!. Don't pay too much for the family SUV you want...Come on down and take a look at this beautiful-looking 2010 GMC Yukon. Awarded Consumer Guide's rating of a Large SUV Best Buy in 2010. Lots of get-up-and-go for an outstanding price in this so-much-fun to drive Yukon. The Voss Auto Network is celebrating 40 years in creating higher standards in sales and service. Voss - built on trust, driven by integrity. Creating higher standards for over 40 years with our Best Price, Best Value, Guarantee. Come experience for yourself! Call us today to schedule a hassle-free test drive! Built on trust. Driven by Integrity. We are proud to announce that Voss Chevrolet was awarded the Better Business Bureau 2011 Eclipse Integrity Award! We are OHIO'S #1 VOLUME GM CERTIFIED DEALER, we've been creating higher standards for over 40 years! All GM Certified vehicles come with a 3-Day, 150 miles satisfaction guarantee. Stop in and see us today!

GMC Yukon for Sale

2012 gmc yukon sle

2012 gmc yukon sle 2015 gmc yukon slt(US $57,708.00)

2015 gmc yukon slt(US $57,708.00) 2015 gmc yukon xl 1500 slt(US $60,991.00)

2015 gmc yukon xl 1500 slt(US $60,991.00) 2015 gmc yukon slt(US $58,299.00)

2015 gmc yukon slt(US $58,299.00) 2015 gmc yukon slt(US $59,358.00)

2015 gmc yukon slt(US $59,358.00) 2015 gmc yukon slt(US $60,513.00)

2015 gmc yukon slt(US $60,513.00)

Auto Services in Ohio

Zig`s Auto Service Inc ★★★★★

World Auto Network ★★★★★

Woda Automotive ★★★★★

Wholesale Tire Co ★★★★★

Westway Body Shop ★★★★★

Toth Buick GMC Trucks ★★★★★

Auto blog

2016 GMC Terrain Denali Quick Spin

Tue, Nov 3 2015Here's a bewildering statistic – General Motors sold over 347,000 GMC Terrain and Chevrolet Equinox crossovers in 2014, making the Theta platform twins the best selling vehicles in their segment. GM sold more Equinox/Terrain crossovers than Honda did CR-Vs, Ford did Escapes, and Toyota did RAV4s. After a week behind the wheel of the 2016 Terrain Denali, we can't fathom why GMC's entry, which accounts for nearly a full third of GM's annual small CUV sales, has been so popular. An inefficient engine, cheap interior plastics, uncomfortable seats, a shortage of technology, and a high price left us questioning why anyone would order this Denali over a Titanium-trim Ford Escape, a Jeep Cherokee Limited, or a Hyundai Santa Fe Sport with the Unlimited Package. Driving Notes While looks are subjective, we'd posit that GMC didn't go far enough with its 2016 mid-cycle refresh. New accents on the front bumper, a tweaked grille surround, and LED running lights round out the changes up front, while the rear gets a slightly different bumper. GMC claims there's a new hood, although we challenge you to pick out the differences – here are the official galleries for the 2013 and 2016, if you'd like to try. GMC missed a tremendous opportunity here. New headlights, some restyled taillights, and tweaked mirrors would have given the impression of a more significant refresh. As it stands, these changes don't add up to much. GMC also claims it made changes in the cabin, adding a "revised instrument panel center stack." Aside from the missing CD slot, which has been replaced with an oddly shaped and not terribly useful shelf, it's hard to spot much of a difference. The Terrain Denali's cabin materials feel cheap. You'll be spending at least $35,000 to park one of these in your driveway, but aside from the leather-and-faux-wood steering wheel, no material feels worthy of that price tag inside. The lower dash plastics are hard and scratchy, the center stack feels hollow and creaks when pressed on, and the too-small shade over the seven-inch display feels flimsy. The upper dash is covered in a cheap-feeling, leather-like material that looks unchanged from when the Terrain Denali debuted back in model year 2013. These materials don't make sense in a vehicle that, as tested, exceeded $41,000. The most egregious thing about the refreshed Terrain is the lack of content.

GM shows off 'digital vehicle platform' enabling more in-car tech and OTA updates

Wed, May 22 2019It appears to have dropped the sobriquet "Global B," but General Motors' new electrical architecture has bowed in drawings and video. This is the "digital vehicle platform" GM president Mark Reuss spoke to Reuters about in 2015, saying it would move a great deal of a vehicle's computer work to the cloud and enable over-the-air updates. Reuss took the microphone for the debut, too, saying, "Our new digital vehicle platform and its eventual successors will underpin all our future innovations across a wide range of technological advancements, including EVs and expanded automated driving." The system will go into production later this year, appearing in dealerships first either on the 2020 Cadillac CT5 or the mid-engined 2020 Chevrolet Corvette. Yes, these are the same electronics cited for delaying the launch of the C8 Corvette over excessive draw, security and getting the more-than-100 computer modules to communicate seamlessly. When Car and Driver asked about that, GM replied with "No comment." Volkswagen's having the same issues with the Mk8 Golf right now, though, so GM isn't alone, and this will be the new normal among OEMs for a while. What's certifiable is that the new architecture is robust enough to handle 4.5 terabytes of data per hour, which is five times what GM's current wiring can handle. And thanks to Ethernet connections of 100 Mbps, 1 Gbs and 10 Gbs, communication within and without the vehicle happens much faster. The advances mean better screen resolutions, better battery management for hybrids and electric vehicles, the capability for over-the-air updates and "functionality upgrades throughout the lifespan of the vehicle." Cadillac's Super Cruise has already been lined up as a leading candidate for constant improvements in the driving assistance suite, a key part of GM's "vision for a world with zero crashes, zero emissions and zero congestion." And whenever GM decides to take the plunge, it will mean a 48-volt electrical system. More than 300 specialists worked on the digital platform, and security was a huge part of the task. We've already heard that GM consulted with Boeing and military contractors on how to prevent hacking. The carmaker has an internal Product Cybersecurity group that reached out to the research community, and created a "bug bounty" program to crowdsource uncovering any flaws.

2014 Chevy Silverado details continue to dribble out

Wed, 03 Apr 2013PickupTrucks.com has gotten its hands on a few more details concerning the 2014 Chevrolet Silverado and the 2014 GMC Sierra. General Motors held a conference call on the two trucks, allowing Jeff Luke, executive chief engineer for both, to answer a few questions. Luke said truck buyers are largely concerned with power and fuel economy, and as such, GM will continue to explore new methods of providing both. That may translate into any number of drivetrain permutations, including light-duty diesel engines, eight-speed transmissions or even a twin-turbocharged V6.

What's more, both the 2014 Silverado and its GMC twin will boast a tow rating of 11,500 pounds, but only when equipped with a max-trailering package. Without that special package, the rating drops to 10,200 lbs for regular cabs and 9,700 lbs for crew cabs. Buyers will no longer be able to opt for a 4.10 gear ratio.

We're also excited to hear that GM plans on making the Z71 package into something more than just a few a stickers. While Luke didn't go into details, PickupTrucks.com says "it will get significant improvements in the future." Head over to the site for a quick rundown of the call's highlights.