2006 Gmc Yukon on 2040-cars

Salt Lake City, Utah, United States

Engine:8 Cylinder Engine

Fuel Type:Gasoline

Body Type:Sport Utility

Transmission:Automatic

For Sale By:Dealer

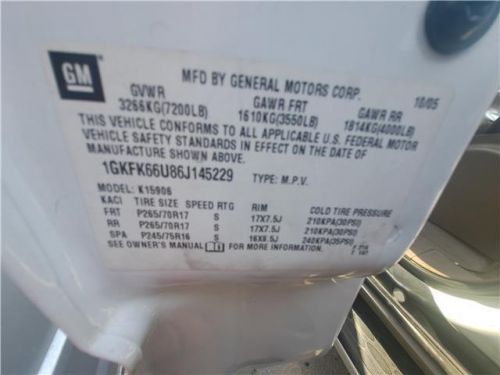

VIN (Vehicle Identification Number): 1GKFK66U86J145229

Mileage: 173273

Make: GMC

Drive Type: AWD

Horsepower Value: 335

Horsepower RPM: 5200

Net Torque Value: 375

Net Torque RPM: 4000

Style ID: 277575

Features: ENGINE, VORTEC 6000 V8 SFI (335 HP [249.8 KW] @...

Power Options: Steering, power

Exterior Color: White

Interior Color: --

Warranty: Unspecified

Model: Yukon

GMC Yukon for Sale

2024 gmc yukon denali(US $83,295.00)

2024 gmc yukon denali(US $83,295.00) 2011 gmc yukon 4wd 4dr 1500 slt(US $15,990.00)

2011 gmc yukon 4wd 4dr 1500 slt(US $15,990.00) 2023 gmc yukon slt(US $57,995.00)

2023 gmc yukon slt(US $57,995.00) 2018 gmc yukon denali(US $41,289.00)

2018 gmc yukon denali(US $41,289.00) 2024 gmc yukon sle(US $59,782.00)

2024 gmc yukon sle(US $59,782.00) 2015 gmc yukon denali(US $27,998.00)

2015 gmc yukon denali(US $27,998.00)

Auto Services in Utah

Supreme Muffler ★★★★★

Sunrise Tire ★★★★★

Sunburst Automotive Repair ★★★★★

Strong Volkswagen ★★★★★

Sierra RV ★★★★★

Sierra RV ★★★★★

Auto blog

Poor headlights cause 40 cars to miss IIHS Top Safety Pick rating

Mon, Aug 6 2018Over the past few months, we've noticed a number of cars and SUVs that have come incredibly close to earning one of the IIHS's highest accolades, the Top Safety Pick rating. They have great crash test scores and solid automatic emergency braking and forward collision warning systems. What trips them up is headlights. That got us wondering, how many vehicles are there that are coming up short because they don't have headlights that meet the organization's criteria for an "Acceptable" or "Good" rating. This is a revision made after 2017, a year in which headlights weren't factored in for this specific award. This is also why why some vehicles, such as the Ford F-150, might have had the award last year, but have lost it for this year. We reached out to someone at IIHS to find out. He responded with the following car models. Depending on how you count, a whopping 40 models crash well enough to receive the rating, but don't get it because their headlights are either "Poor" or "Marginal." We say depending on how you count because the IIHS actual counts truck body styles differently, and the Infiniti Q70 is a special case. Apparently the version of the Q70 that has good headlights doesn't have adequate forward collision prevention technology. And the one that has good forward collision tech doesn't have good enough headlights. We've provided the entire list of vehicles below in alphabetical order. Interestingly, it seems the Volkswagen Group is having the most difficulty providing good headlights with its otherwise safe cars. It had the most models on the list at 9 split between Audi and Volkswagen. GM is next in line with 7 models. It is worth noting again that though these vehicles have subpar headlights and don't quite earn Top Safety Pick awards, that doesn't mean they're unsafe. They all score well enough in crash testing and forward collision prevention that they would get the coveted award if the lights were better.

NHTSA closes 4-year GM investigation, issues common sense advisory [w/video]

Thu, Apr 9 2015Since January 2011, the National Highway Traffic Safety Administration has been investigating a possible problem with corroding brake lines in General Motors' GMT800-platform models, like the Chevrolet Silverado and Suburban and GMC Sierra, in states with salt on their roads in the winter. However, as opposed to launching a full recall of millions of vehicles, the government is issuing a common-sense safety advisory to all drivers in snowy states to keep their vehicle's undercarriage clean. It even has a video explaining things. "Older-model vehicles, often driven in harsh conditions, are subject to corrosion over long periods of time, and we need owners to be vigilant about ensuring they, their passengers, and others on the roads are safe," said NHTSA Administrator Mark Rosekind in the announcement of the end of the investigation. The agency was clear in its report that "brake line corrosion seen in the GM vehicles was not unique," and the government "has not identified a defect that would initiate a recall order." Instead NHTSA is advising drivers, especially those of vehicles from before 2007, to wash their vehicle's undercarriage in the winter and spring to remove salt or other de-icing chemicals. It also recommends regular checks by a mechanic to make sure everything is in proper order. According to the investigation documents, for just the GMT800 platform models, NHTSA found 3,645 complaints of brake line corrosion, which included allegations of 107 crashes and 40 injuries. The issue was found to be more common in vehicles over 10 years old. GM has released a statement (embedded below) that the company "supports the consumer advisory from NHTSA urging regular maintenance and care of brake lines on older vehicles." NHTSA Closes Investigation into Brake-Line Failures NHTSA 13-15 Thursday, April 9, 2015 Agency issues safety advisory on preventing undercarriage corrosion WASHINGTON – The Department of Transportation's National Highway Traffic Safety Administration (NHTSA) today issued a Safety Advisory and consumer video encouraging owners of model year 2007 and older trucks, SUVs and passenger cars to inspect brake lines and thoroughly wash the underside of their vehicles to remove corrosive salt after the long winter in order to prevent brake-line failures that increase the risk of a crash.

Engine block heater issues force GM to recall 324,226 diesel heavy duty trucks

Tue, May 7 2019General Motors has issued a recall on 324,226 diesel heavy duty trucks that could be susceptible to short circuits, and consequently, potential fire. The recall affects several models of heavy duty Chevrolet Silverados and GMC Sierras with optional engine block heaters. GM is recalling seven different truck models spread across three years. The recall affects the 2017-2019 Chevrolet Silverado 2500HD, 2017-2019 Silverado 3500HD, 2019 Silverado 4500HD, 2019 Silverado 5500HD, and 2019 Silverado 6500HD, plus the 2017-2019 GMC Sierra 2500HD and 2017-2019 Sierra 3500HD. Specifically, it includes these models with the 6.6-liter Duramax diesel engines and the optional engine block heater. The recall technically deals not with the engine block heater itself, but the way it is connected. According to NHTSA campaign No. 19V328000, the engine block heater cord or the terminals that link the cord to the heater could short circuit. A short circuit could potentially damage engine components and result in a fire. According to The Detroit News, 19 fires have been reported but nobody has been injured. GM has yet to figure out a fix, and thus has not yet released a notification schedule for affected customers. If you believe your vehicle is part of the recall, contact GM customer service at 1-586-596-1733 and use reference number N182206310.