Sle-2 Awd Suv 2.4l Cd Power Steering Abs 4-wheel Disc Brakes Aluminum Wheels A/c on 2040-cars

Latham, New York, United States

GMC Terrain for Sale

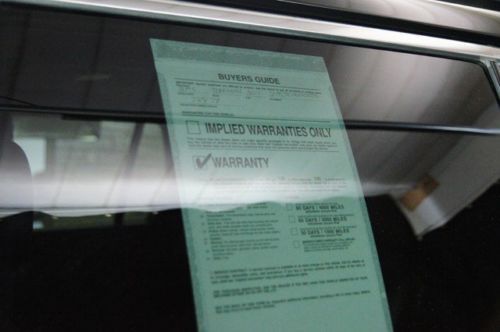

2012 gmc terrain 27,00 miles - excellent condition warranty 6 mo. come see!

2012 gmc terrain 27,00 miles - excellent condition warranty 6 mo. come see! Warranty sle-2 best color backup camera pioneer audio 18 inch alloys we finance(US $17,900.00)

Warranty sle-2 best color backup camera pioneer audio 18 inch alloys we finance(US $17,900.00) Fwd 4dr denali low miles suv automatic gasoline 2.4l dohc 4-cyl sidi black(US $30,489.00)

Fwd 4dr denali low miles suv automatic gasoline 2.4l dohc 4-cyl sidi black(US $30,489.00) 2014 gmc terrain sle rear cam pioneer audio alloys 12k texas direct auto(US $22,980.00)

2014 gmc terrain sle rear cam pioneer audio alloys 12k texas direct auto(US $22,980.00) 2011 gmc terrain slt awd leather sunroof rear cam 31k texas direct auto(US $24,480.00)

2011 gmc terrain slt awd leather sunroof rear cam 31k texas direct auto(US $24,480.00) Fwd 4dr sle-1 low miles suv automatic gasoline engine, 2.4l dohc 4-cyl sidi (spa

Fwd 4dr sle-1 low miles suv automatic gasoline engine, 2.4l dohc 4-cyl sidi (spa

Auto Services in New York

Zoni Customs ★★★★★

Williams Toyota Scion ★★★★★

Watertown Auto Repair Svc ★★★★★

VOS Motorsports ★★★★★

Village Automotive Center ★★★★★

V J`s Car Care ★★★★★

Auto blog

Second part of Forza Horizon 3 car list revealed early

Tue, Jul 26 2016We previously brought you the first portion of Forza Horizon 3's list of 350 cars last week, and today we're bringing you part two. Apparently Fairfax Media in Australia had the list and images early and published them on The Sydney Morning Herald's website . We say early because the publication's story reveals that Playground Games, the developer of the game, plans to make the official announcement on the Forza website this Wednesday. This set of virtual machinery brings us closer to the full list, which will continue to be revealed over the coming weeks. While this part is smaller than the first one, it still features a number of notable automobiles, including the Bugatti EB110 Super Sport, GMC Syclone and Ferrari Dino 246 GT. This list also adds more vintage Aussie machines, including the very cool 1974 Holden "Sandman" HQ panel truck. Fans of the Mad Max movies may remember Max's Sandman truck from the original film. Check out the list of new cars from The Sydney Morning Herald below and take at look their article for new images and insight on what the developers' goals were for the game. 2007 Alfa Romeo 8C Competizione 1970 AMC Rebel "The Machine" 1998 Aston Martin V8 Vantage V600 2011 Audi RS 5 Coupe 2011 BMW X5 M 1981 BMW M1 1992 Bugatti EB110 Super Sport 1970 Chevrolet Corvette ZR-1 1966 Chevrolet Nova Super Sport 2008 Dodge Viper SRT10 ACR 1969 Ferrari Dino 246 GT 1968 Ferrari 365 GTB/4 2011 Ferrari FF 1978 Ford Mustang II King Cobra 1956 Ford F-100 1991 GMC Syclone 2016 Holden Special Vehicles GTS Maloo 1951 Holden 50-2106 FX Ute 1974 Holden Sandman HQ panel van 2012 Infiniti IPL G Coupe 2015 Jaguar XFR-S 1997 Lamborghini Diablo SV 2014 Lamborghini Urus 2014 Land Rover Range Rover Supercharged 2005 Lotus Elise 111S 2013 Mazda MX-5 1990 Mercedes-Benz 190E 2.5-16 Evolution II 2013 Mercedes-Benz E 63 AMG 1999 Mitsubishi Lancer Evolution VI GSR 2008 Mitsubishi Lancer Evolution X GSR 2000 Nissan Silvia Spec-R 1977 Pontiac Firebird Trans Am 2010 Renault Megane RS 250 2008 Subaru Impreza WRX STi Related Video: News Source: The Sydney Morning HeraldImage Credit: Playground Games/Microsoft Auto News Bugatti Ford GMC Holden Technology video games forza motorsport forza horizon 3

2019 GMC Sierra interior looks just like the Silverado's

Thu, Feb 22 2018The GMC Sierra has pretty much always been a Chevy Silverado in disguise. There was maybe some fancier trim plus the availability of the ritzier Denali trim, but the differences mostly amounted to different makeup on identical twins. As we can see from the spy photos above, the yet-to-be-shown 2019 GMC Sierra will actually have a more distinctive exterior, but the interior will continue the me-too tradition. Immediately apparent is the fact that the whole dashboard is carryover. It's the same chunky, plasticky place to be that, while likely highly functional, did little to impress when unveiled at the Detroit Auto Show. Really, only the volume, tuning and climate control knobs look different from those in the Silverado. They appear to have a different ridged pattern on the edges, and are possibly a shinier, glossier finish. The steering wheel also looks different, with a chunkier center and more svelte spokes. The Sierra exterior would seem to be better differentiated. The headlights are very different in that they wrap around the fenders more so than on the Chevy. The grille looks more vertical and aggressive than the Silverado's. The wheel arches also differ in that the forward corners are rounded and the rears are more squared off. The GMC Sierra will be revealed March 1 in Detroit. As per usual, it will probably share all of its powertrain bits with the Silverado. That means at least 5.3- and 6.2-liter gasoline V8s and the new turbocharged 3.0-liter inline-six diesel engine. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

2015 Chevy Colorado to start at $20,100*, GMC Canyon at $20,995**

Tue, 05 Aug 2014General Motors has just announced pricing for its new midsize pickup trucks, the 2015 Chevrolet Colorado and GMC Canyon. Chevy's truck starts at $20,100, *not including $895 for destination, and the GMC starts at $20,995, **not including $925 for destination. These prices are for the base, extended cab models with the 200-horsepower, 2.5-liter inline four-cylinder engine.

Comparatively, these prices fit nicely with the $18,125 starting MSRP of the Toyota Tacoma and the $21,510 of the Nissan Frontier. Compared to the Colorado, the Canyon's extra $895 gets you niceties like LED running lamps, 16-inch alloy wheels, and a four-way power driver's seat.

Both trucks come standard with the 2.5-liter engine, and a more powerful, 305-hp 3.6-liter V6 will also be available. Pricing has not been announced for the upcoming diesel model, which is expected to launch for the 2016 model year.