2001 Gmc Sierra 1500 on 2040-cars

Kent, Washington, United States

For Sale By:Dealer

Year: 2001

VIN (Vehicle Identification Number): 1GTEC14W01Z334334

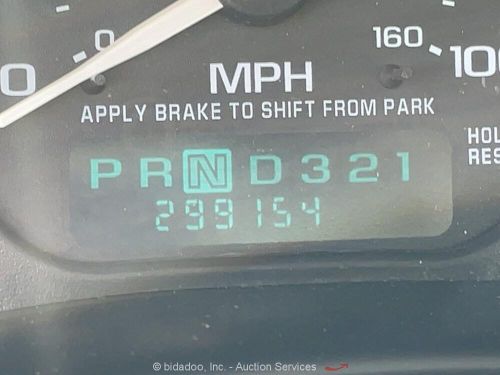

Mileage: 299154

Documentation & Handling Fee: $341.20

Model: Sierra 1500

Make: GMC

Drive Type: 2WD

Exterior Color: White

Interior Color: Grey

GMC Sierra 1500 for Sale

2015 gmc sierra 1500 k1500 sle(US $40,000.00)

2015 gmc sierra 1500 k1500 sle(US $40,000.00) 2023 gmc sierra 1500 slt(US $38,002.30)

2023 gmc sierra 1500 slt(US $38,002.30) Just seeing if anyone’s interested. has dual exhaust and runs and drives great.(C $6,500.00)

Just seeing if anyone’s interested. has dual exhaust and runs and drives great.(C $6,500.00) 2017 gmc sierra 1500 crew cab slt z71 4x4(US $25,950.00)

2017 gmc sierra 1500 crew cab slt z71 4x4(US $25,950.00) 2014 gmc sierra 1500 4.3l v6 rwd accident free!(US $16,995.00)

2014 gmc sierra 1500 4.3l v6 rwd accident free!(US $16,995.00) 2024 gmc sierra 1500(US $52,999.00)

2024 gmc sierra 1500(US $52,999.00)

Auto Services in Washington

Woodinville Auto Body ★★★★★

Winning Attractions ★★★★★

Westside Car Care ★★★★★

West Seattle Aikikai ★★★★★

Wenatchee Valley Salvage ★★★★★

Washington Used Tire & Wheel ★★★★★

Auto blog

2020 GMC Sierra gets small price bumps, package discounts and tweaks

Fri, Mar 27 2020A couple of months ago we covered a brace of changes GMC made to the 2020 Sierra 1500. Those included availability of the 2.7-liter turbocharged four-cylinder with 310 horsepower and 348 pound-feet of torque, the 5.3-liter V8 getting the 10-speed automatic transmission, the CarbonPro Editions debuting for AT4 and Denali trims, and a new bed view camera. But GMC has made a few more smaller changes throughout, as GM Authority found, part of a detailed overhaul among GM's pickup lines that's already changed trim names, trim volume, and prices on the Chevrolet Canyon and GMC Colorado. We'll start with MSRP adjustments on the 2020 Sierra: 4WD drivetrains in SLT, and the AT4, and Denali trims that only come in 4WD, see a price increase of $200. There are also more MSRPs to consider this year, with a handful of new Elevation models filling price gaps. The only changes inside are AT4-logoed all-weather floor liners that come standard for that trim, and adaptive cruise control joining the Driver Alert Package II available on the SLT, AT4, and Denali trims. Speaking of packages, the Value Packages represent truth in advertising. The new base-model Sierra Sierra Value Package costs $860 to combine the Convenience Package and Trailering Package. Those two cost $1,640 when ordered separately. Sticking with the base trim, the Chrome Exterior Package disappears because the chrome bumpers it added are now the standard finish. Black bumpers front and rear can be ordered at no charge, and the 17-inch Bright Silver painted aluminum wheels can be ordered alone. One trim up, the SLE Value Package lumps Convenience and Trailering, too, but it only costs $380, which is $15 less than the Trailering Package by itself. The Elevation Value Package gets cut by $1,330 to $585. On the AT4 trim, GMC dropped the price of the CarbonPro Package from $1,060 to $560, and the Premium Package comes down by $500 as well. The same $500 discount applies to the SLT Premium Package. The new 2.7-liter turbocharged four-cylinder is the optional engine on the base, SLE, and Elevation trims, saving $235 on the first trim and $395 on the other two compared to ordering the standard 4.3-liter EcoTec V6. Smokey Quartz Metallic exterior paint is expected to disappear come Q2. Two new wheels enter the range in the upper reaches, one being a 20-inch Carbon Grey painted rim available on the AT4 CarbonPro Edition.

Watch the 2022 GMC Hummer EV launch using its Watts to Freedom mode

Thu, Jul 1 2021It’s nearly the July Fourth weekend, and GM is celebrating Independence Day a little earlier than most. The celebration comes in the form of a GMC Hummer EV demonstrating Watts to Freedom, or WTF, mode for us on video. You can watch it at the top of this post, but the idea is rather simple. ItÂ’s just a video of a Hummer development vehicle accelerating as quickly as it can from 0-60 mph and beyond. GMC claims its 1,000-horsepower electric Hummer is capable of hitting the 0-60 mph mark in “approximately 3 seconds,” which is borderline terrifying for how large of a vehicle it is. The super-quick time is possible when using the Watts to Freedom launch control mode, which “channels the propulsion systemÂ’s tremendous power into acceleration bursts.” The truck will still be plenty fast when accelerating normally, but WTF mode is what you should use to unlock its full potential. GMCÂ’s video shows us the graphics it uses in the digital cluster to signal Watts to Freedom is activated, and the whole sequence looks like it leans on U.S. military themes for both design and phrasing. For example, GMC lets you know that Watts to Freedom is ready via an “Armed” message in the cluster. The 2022 GMC HUMMER EV is a first-of-its kind supertruck develop View 40 Photos Instead of a rumbling exhaust and screeching tires, the Hummer appears to silently launch with all four tires grabbing on and catapulting the truck away. It looks quick as it throws all of the weight rearward into an accelerative squat. And in case you missed it, thatÂ’s a lot of weight — GMC says itÂ’ll tip the scale at 9,046 pounds. GMC has previously said that production will begin in late 2021, and this video continues to confirm that timeframe with a note saying “initial availability Fall 2021.” Do keep in mind that only the sold-out Launch Edition is coming at that time. Other cheaper variants will follow in the years to come. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. GMC Hummer EV reveal

2016 GMC Terrain Denali Quick Spin

Tue, Nov 3 2015Here's a bewildering statistic – General Motors sold over 347,000 GMC Terrain and Chevrolet Equinox crossovers in 2014, making the Theta platform twins the best selling vehicles in their segment. GM sold more Equinox/Terrain crossovers than Honda did CR-Vs, Ford did Escapes, and Toyota did RAV4s. After a week behind the wheel of the 2016 Terrain Denali, we can't fathom why GMC's entry, which accounts for nearly a full third of GM's annual small CUV sales, has been so popular. An inefficient engine, cheap interior plastics, uncomfortable seats, a shortage of technology, and a high price left us questioning why anyone would order this Denali over a Titanium-trim Ford Escape, a Jeep Cherokee Limited, or a Hyundai Santa Fe Sport with the Unlimited Package. Driving Notes While looks are subjective, we'd posit that GMC didn't go far enough with its 2016 mid-cycle refresh. New accents on the front bumper, a tweaked grille surround, and LED running lights round out the changes up front, while the rear gets a slightly different bumper. GMC claims there's a new hood, although we challenge you to pick out the differences – here are the official galleries for the 2013 and 2016, if you'd like to try. GMC missed a tremendous opportunity here. New headlights, some restyled taillights, and tweaked mirrors would have given the impression of a more significant refresh. As it stands, these changes don't add up to much. GMC also claims it made changes in the cabin, adding a "revised instrument panel center stack." Aside from the missing CD slot, which has been replaced with an oddly shaped and not terribly useful shelf, it's hard to spot much of a difference. The Terrain Denali's cabin materials feel cheap. You'll be spending at least $35,000 to park one of these in your driveway, but aside from the leather-and-faux-wood steering wheel, no material feels worthy of that price tag inside. The lower dash plastics are hard and scratchy, the center stack feels hollow and creaks when pressed on, and the too-small shade over the seven-inch display feels flimsy. The upper dash is covered in a cheap-feeling, leather-like material that looks unchanged from when the Terrain Denali debuted back in model year 2013. These materials don't make sense in a vehicle that, as tested, exceeded $41,000. The most egregious thing about the refreshed Terrain is the lack of content.