2023 Gmc Acadia Denali on 2040-cars

Engine:2.0L Turbocharged

Fuel Type:Gasoline

Body Type:4D Sport Utility

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 1GKKNXL4XPZ181751

Mileage: 12479

Make: GMC

Trim: Denali

Features: --

Power Options: --

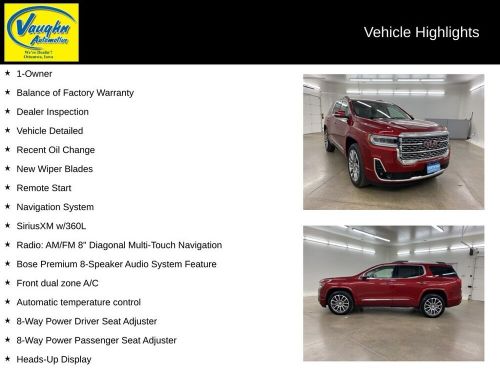

Exterior Color: Red

Interior Color: Dark Galvanized/Light Shale

Warranty: Unspecified

Model: Acadia

GMC Acadia for Sale

2022 gmc acadia sle(US $28,250.00)

2022 gmc acadia sle(US $28,250.00) 2024 gmc acadia denali(US $61,080.00)

2024 gmc acadia denali(US $61,080.00) 2023 gmc acadia sle(US $37,691.00)

2023 gmc acadia sle(US $37,691.00) 2022 gmc acadia fwd sle(US $28,277.00)

2022 gmc acadia fwd sle(US $28,277.00) 2024 gmc acadia elevation(US $43,995.00)

2024 gmc acadia elevation(US $43,995.00) 2008 gmc acadia sle 1 4dr suv(US $9,995.00)

2008 gmc acadia sle 1 4dr suv(US $9,995.00)

Auto blog

New Takata problem results in recall of 414 GM vehicles

Mon, Oct 19 2015An airbag-inflator rupture discovered by Takata during testing has resulted in a new recall affecting 414 vehicles from General Motors, including 395 of them in the US. This latest campaign covers 2015 model-year examples of the Buick LaCrosse, Cadillac XTS, Chevrolet Camaro, Equinox, Malibu, and GMC Terrain. There are no reported breaks in any of these vehicles on the road, and the company estimates only one percent of them actually have the faulty parts. According to documents submitted to the National Highway Traffic Safety Administration (as a PDF), one side-airbag inflator failed a cold test at -40 Fahrenheit "releasing high pressure gas and propelling the separated components apart." The supplier told GM about the failure the next day. In these vehicles, the safety device might not only burst but the bag could inflate incorrectly, as well. GM and Takata say that a cause is not yet known, but they are "conducting an investigation." GM will begin notifying affected owners via overnight mail on Oct. 19. Dealers will replace the side airbag modules on all of the affected vehicles with new components outside of the suspect lot. All of the removed parts will also be collected for further study. Takata's faulty front airbag inflators have resulted in a serious scandal for the supplier. Initial figures indicated 34 million US vehicles are need of repair, though more recent figures have knocked that down to 23.4 million bad parts in 19.2 million automobiles. GM was already among the dozen automakers with models to fix, and some of its pickups were affected, along with the Saab 9-2X and Pontiac Vibe. GM Statement: General Motors is recalling 395 cars and crossovers in the U.S. because one of the front seat side air bags inflators may be defective. In the event of a deployment, the air bag's inflator may rupture and the air bag may not properly inflate. The rupture could cause metal fragments to strike the vehicle occupants, potentially resulting in serious injury or death. GM is unaware of any incidents involving vehicles with these components, which were part of a lot in which one inflator failed acceptance testing at the supplier. Dealers will replace the side air bag module or modules in affected vehicles. Including Canada, Mexico and exports, the total population of the recall is 414, GM estimates 1 percent of the recalled vehicles may have the defect.

Fullsize GM SUVs have a problem that's making owners sick

Thu, Dec 31 2015Some fullsize SUV owners are getting sick, thanks to a buffeting and vibration problem in 2015 model year examples of the Chevy Tahoe and Suburban, Cadillac Escalade, and GMC Yukon. According to owners' complaints to the National Highway Traffic Safety Administration, the issue can vary from an annoying vibration inside the cabin to an experience so severe that it leads to dizziness and headaches. General Motors is aware of the complaints, but the fix isn't so simple. According to spokesperson Tom Wilkinson to Autoblog, the company "has been tracking this issue for a while." The problem has a fairly low incidence rate, but when it does occur the issue can be "uncomfortable and annoying for owners." There's no precise cause for the issue, Wilkinson claims, and in some cases, simply balancing the tires or changing the door seals can make it go away. However, not all of the fixes are so simple. AutoGuide dug deep into the problem and discovered a GM preliminary information bulletin that advised dealers to remove the headliner and to check the roof's bonds to the bows that go across the vehicle. However, that document included a note that the solution might not entirely eliminate things. According to AutoGuide, adding Dynamat insulation to the roof sometimes helped the problem. A GM spokesperson also told AutoGuide the company fixed the problem at the end of the 2015 model year, and didn't go into any more detail. This roof issue seems linked to some of the worst droning in these SUVs. According to one complaint from a 2015 Suburban owner to NHTSA: "Roof will not remain attached to the roof bows. This causes the buffeting similar to a window being down when all are up. The results span from annoying to painful." A 2015 Yukon owner claims to have another alleged cause for the problem in a NHTSA complaint from February 2015. This person brought their SUV to the dealer seven times over the course of four weeks for vibrations. The dealer replaced the driveshaft, suspension components, and more, but nothing worked. According to an engineer to the service adviser: "In an effort to prevent roll overs, they designed the frame and body mounts too stiff. There are 40 engineers working on issues, they have no solutions that work across the board." Wilkinson told Autoblog that GM is working with customers on an individual basis to rectify things. Since these are newer vehicles, dealers should also fix the problem under warranty.

Here are 12 electric pickups in the works

Wed, Oct 21 2020With the unveiling of the GMC Hummer EV, the list of planned electric pickups is expanding. Legacy automakers like Ford and Chevy have theirs coming, as do startups like Tesla, Rivian and Bollinger, as well as some lesser known brands. Here are all the electric pickup trucks we know to be in the works, along with a few that are being discussed or mulled over. GMC Hummer EV The 2022 GMC HUMMER EV is a first-of-its kind supertruck develop View 40 Photos We’ve seen it now, and itÂ’s the business. The GMC Hummer EV comes out swinging with 1,000 horsepower from GMÂ’s new Ultium electric powertrain program, a wealth of off-road features, a removable roof, Super Cruise and the revival of the Hummer name. WeÂ’ll see the first ones on the road next fall. Tesla Cybertruck Tesla Cybertruck at the Petersen Museum View 14 Photos Tesla revealed the Cybertruck last year with, ahem, unique styling, a number of powertrain options and a claimed range of up to 500 miles. It has a compressed paper dash, a ramp for the bed, and “shatterproof” windows. It has already racked up hundreds of thousands of reservations. It will be built in Texas. Rivian R1T 2021 Rivian R1T View 15 Photos EV startup Rivian revealed its R1T electric pickup toward the end of 2018 with a claimed 0-60 time of 3 seconds and a towing capability of 11,000 pounds. Preproduction began in September 2020 at RivianÂ’s factory in Normal, Illinois. Bollinger Motors B2 Bollinger Motors B2 side outdoors View 31 Photos BollingerÂ’s B2 electric pickup is a Class 3 off-roader with retro styling, removable roof panels, and a unique “frunkgate” with a pass-through down the center of the vehicle. It was created with both enthusiasts and workers in mind, with features that can get it to remote places (portal axles, hydro-pneumatic suspension) and to get things done (room for 40 2x4s, equipped with eight 110-volt outlets and one 220-volt outlet). Bollinger also plans to make the B2 Chassis Cab available for fleet customization. Ford F-150 Electric Electric Ford F-150 Towing View 9 Photos WeÂ’ve known this to be in the works since early 2019. Since then, details have trickled out. Back in June, Ford announced its F-150 Electric would be coming within two years. WeÂ’ve seen it pull a million pounds worth of train and trucks, heard it will have more power than any other F-150, and seen its LED-laden front end.