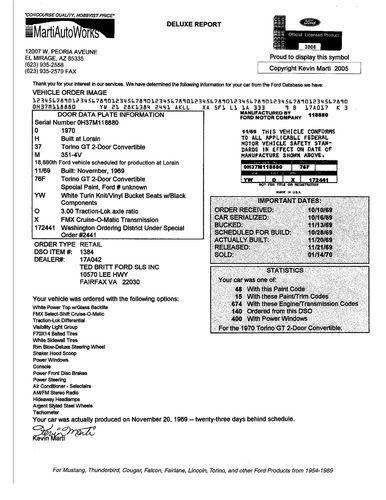

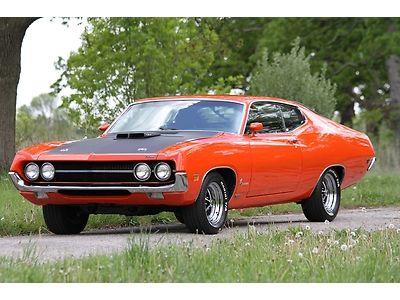

1970 Ford Torino Gt Convertible on 2040-cars

Tulsa, Oklahoma, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:351-4V

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 8

Make: Ford

Model: Torino

Trim: 2 Door Convertible GT

Options: Leather Seats

Drive Type: RWD

Power Options: Air Conditioning, Power Windows

Mileage: 533

Sub Model: GT Convertible

Exterior Color: Blue

Warranty: Vehicle does NOT have an existing warranty

Interior Color: White

Ford Torino for Sale

Rare torino cobra, factory "j" code ram air, 4-speed(US $69,000.00)

Rare torino cobra, factory "j" code ram air, 4-speed(US $69,000.00) 1975 ford gran torino elite in pristine showroom condition, hardtop 2-door 6.6l(US $9,800.00)

1975 ford gran torino elite in pristine showroom condition, hardtop 2-door 6.6l(US $9,800.00) 1972 gran torino sport 429 rare factory black numbers matching californa car(US $18,900.00)

1972 gran torino sport 429 rare factory black numbers matching californa car(US $18,900.00) 1968 torino formal roof(US $1,900.00)

1968 torino formal roof(US $1,900.00) 1972 ford torino base 5.0l currently registered! running project. clean title

1972 ford torino base 5.0l currently registered! running project. clean title Classic 1975 ford elite

Classic 1975 ford elite

Auto Services in Oklahoma

Tire Town ★★★★★

T Town Quality Cars ★★★★★

Southside Transmissions ★★★★★

Sharp Motors Inc ★★★★★

Sangster Robt Garage ★★★★★

R & R Bumper & Truck Accessories ★★★★★

Auto blog

Ford could post best-ever profits in Q1 2013

Tue, 23 Apr 2013Analysts are saying that Ford Motor Company may have earned a record $2.7 billion pretax profit in North America during the first quarter of 2013, a number that represents its highest first quarter profit ever. The impressive earnings are further proof that the American automaker is making a solid comeback as the economy begins to recover.

Morgan Stanley and JP Morgan Chase are estimating that Ford's first quarter North American profit may have topped 12 percent. The firm cited the automaker's fresh lineup, but noted that CEO Alan Mulally needs to uphold the pace as the company works to gain ground in the car and utility segments.

Ford's success has been led by increased demand for its F-Series pickup, the best-selling vehicle in the US for 31 years, and by the Fusion sedan that recently recorded its best-ever quarterly sales in the domestic market. Ford is expected to release its first-quarter revenue on Wednesday, of this week.

Ford will lay off 700 employees in Michigan

Fri, Apr 24 2015Lagging sales of compact and electric cars are starting to take their toll on automakers. Ford said Thursday it intends to lay off 700 employees who work at the Michigan Assembly Plant in Wayne, MI, over the next five months. The plant makes Ford Focus and C-Max vehicles. Sales of both have stalled in recent months. The layoffs affect 675 hourly and 25 salaries employees, and will begin in late June and continue through September, according to paperwork filed with state officials. The company expects to re-hire the affected employees elsewhere and use them on temporary basis throughout the summer. Ford spokesperson Kristina Adamski said the affected employees will be "first in line" for other jobs at nearby plants, and UAW vice president Jimmy Settles said he expected all would be re-hired at other southeast Michigan factories by "early 2016." Although industry sales have remained high overall, the growth has come from SUVs and pickup trucks. Conversely, compact cars and alternate-powered vehicles like the C-Max have struggled to find customers amid cheap gasoline prices. Focus monthly sales fell 14.5 percent year over year in March, and C-Max monthly sales dropped 22.9 percent over the same period. It was less than three years ago that Ford hailed the Michigan Assembly Plant as a model for its future, one that would quickly adapt to market conditions through a more flexible assembly process. The plant was retrofitted at a cost of $550 million so that the same assembly line could install electric, plug-in hybrid or gasoline powertrains. Ford produces the Focus, Focus ST, Focus Electric, C-Max Hybrid and C-Max Energi here. At the time, company officials said the flexible line was a way to "not be trapped with dedicated one-trick-pony plants where you have under-capacity or over-capacity situations," said Jim Tetreault, Ford's vice president of North American manufacturing, in November 2012. But that's exactly where Ford finds itself as consumers have turned away from both compact and gas-sipping hybrids and electrics as gas prices have fallen to a national average of $2.49 per gallon, according to Thursday's AAA Fuel Gauge Report. One year ago, gas prices averaged $3.70 per gallon. In perhaps a melancholy twist, the Ford Expedition and Lincoln Navigator that were phased out at Michigan Assembly by the retrofit are once again the types of vehicles that are sought after by consumers.

Rising aluminum costs cut into Ford's profit

Wed, Jan 24 2018When Ford reports fourth-quarter results on Wednesday afternoon, it is expected to fret that rising metals costs have cut into profits, even as rivals say they have the problem under control. Aluminum prices have risen 20 percent in the last year and nearly 11 percent since Dec. 11. Steel prices have risen just over 9 percent in the last year. Ford uses more aluminum in its vehicles than its rivals. Aluminum is lighter but far more expensive than steel, closing at $2,229 per tonne on Tuesday. U.S. steel futures closed at $677 per ton (0.91 metric tonnes). Republican U.S. President Donald Trump's administration is weighing whether to impose tariffs on imported steel and aluminum, which could push prices even higher. Ford gave a disappointing earnings estimate for 2017 and 2018 last week, saying the higher costs for steel, aluminum and other metals, as well as currency volatility, could cost the company $1.6 billion in 2018. Ford shares took a dive after the announcement. Ford Chief Financial Officer Bob Shanks told analysts at a conference in Detroit last week that while the company benefited from low commodity prices in 2016, rising steel prices were now the main cause of higher costs, followed by aluminum. Shanks said the automaker at times relies on foreign currencies as a "natural hedge" for some commodities but those are now going in the opposite direction, so they are not working. A Ford spokesman added that the automaker also uses a mix of contracts, hedges and indexed buying. Industry analysts point to the spike in aluminum versus steel prices as a plausible reason for Ford's problems, especially since it uses far more of the expensive metal than other major automakers. "When you look at Ford in the context of the other automakers, aluminum drives a lot of their volume and I think that is the cause" of their rising costs, said Jeff Schuster, senior vice president of forecasting at auto consultancy LMC Automotive. Other major automakers say rising commodity costs are not much of a problem. At last week's Detroit auto show, Fiat Chrysler Automobiles NV's Chief Executive Officer Sergio Marchionne reiterated its earnings guidance for 2018 and held forth on a number of topics, but did not mention metals prices. General Motors Co gave a well-received profit outlook last week and did not mention the subject. "We view changes in raw material costs as something that is manageable," a GM spokesman said in an email.