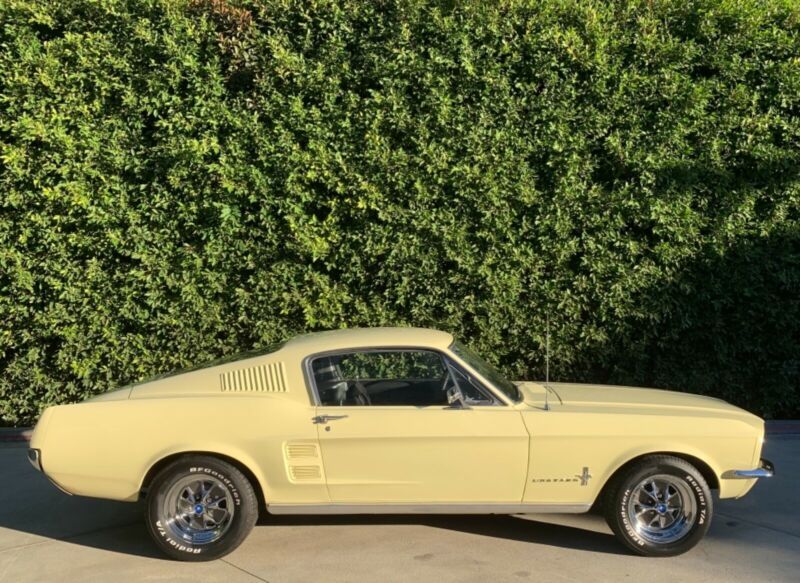

1967 Ford Mustang on 2040-cars

Medford, Oregon, United States

Retains its factory 289-2V C-4 Automatic

Still a Springtime Yellow with Black standard interior

Original Floor Pans - Original Quarter Panels - Original Engine Aprons

Remains all stock & original. Being repainted once its original color years ago. Been garaged and well taken care

of. Beautiful straight original body, solid. The factory 289 still retains a 2 barrel. Running and driving well.

Brakes & shifts just fine. New 15' style steel wheels with BFGoodrich Tires.

Ford Mustang for Sale

1966 ford mustang pony interior(US $20,300.00)

1966 ford mustang pony interior(US $20,300.00) 1965 ford mustang(US $14,980.00)

1965 ford mustang(US $14,980.00) 1965 ford mustang restored 1965 ford mustang fastback(US $16,100.00)

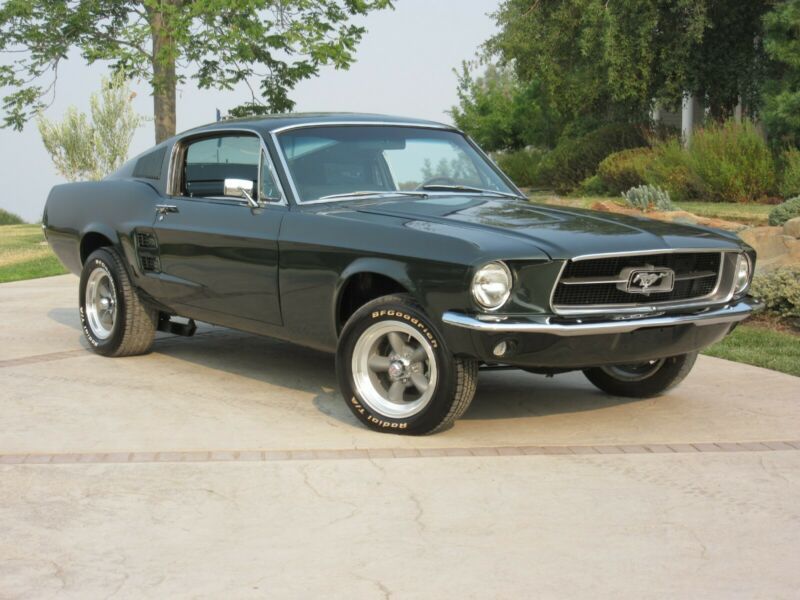

1965 ford mustang restored 1965 ford mustang fastback(US $16,100.00) 1967 ford mustang bullitt fastback 347 stroker(US $20,300.00)

1967 ford mustang bullitt fastback 347 stroker(US $20,300.00) 1968 shelby cobra gt500(US $28,700.00)

1968 shelby cobra gt500(US $28,700.00) 1968 ford mustang(US $19,460.00)

1968 ford mustang(US $19,460.00)

Auto Services in Oregon

Vo`s Auto Repair Inc ★★★★★

Tru Autobody & Collision Repair LLC ★★★★★

Transmission Exchange Co ★★★★★

Toy Doctor ★★★★★

T & M Towing ★★★★★

Sun Scape Window ★★★★★

Auto blog

Ford Tourneo ready for duty in Connect, Courier and Custom flavors [w/videos]

Wed, 06 Mar 2013Ford was relatively quiet at the Geneva Motor Show, but it did take the opportunity to roll out its new family of Tourneo vans: the Courier, Connect, Grand Connect and Custom. As the passenger version of the Transit cargo vans, the new range of Tourneo models vary from the B-segment Courier up to the fullsize Custom. The Connect and Grand Connect are based on the redesigned 2014 Ford Transit Connect.

With an overall length just three inches longer than the Fiesta hatchback, the Tourneo Courier seats four to five passengers, and it offers a choice of three engines: the 1.0-liter EcoBoost or two small diesels. Like the 2014 Transit Connect was saw in Paris last year, the Tourneo Connect comes in a five-seat configuration while the Grand Connect can seat seven. Finally, the Tourneo Custom seats up to nine passengers, and it is available in two lengths up to 210 inches long putting it just six inches shorter than a standard-length E-Series van and about a foot longer than the Explorer.

Check out our live image galleries, and be sure to scroll down below for the press release and to watch some videos.

2015 Ford Mustang: Obsessively covered [w/videos + poll]

Thu, 05 Dec 2013Here at Autoblog, we've officially stamped December 5, 2013, as Ford Mustang Day. Sure, the sixth-generation Pony Car started leaking out onto the web days ago, but all of the official, non-embargoed hotness has come out today. And man, there's been a lot.

In terms of new car debuts, this is a really big one - not unlike all of the Corvette madness that kicked off the 2013 automotive season. So to make sure you haven't missed anything, here's a wrap-up of everything you need to know about the 2015 Ford Mustang.

Deep Dive: 2015 Ford Mustang

Enterprise working with renter's insurance to cover $47k Mustang stolen from its lot

Sat, 11 Jan 2014There was more than a bit of public indigence following the recent story of Enterprise Rent-A-Car billing a customer $47,000 to replace a Ford Mustang GT Convertible stolen from a Nova Scotia lot. To recap: Kristen Cockerill rented the Mustang for two days, returned it to the lot on a Sunday and left the keys in a secure dropbox only for Enterprise employees to find the car gone the next day.

Despite Enterprise policies stating that customers are responsible for vehicles dropped on off-days, the company has admitted that the situation could've been handled a bit better.

In a recent statement, Enterprise has backed off the big-bill story, and claims to be working with Cockerill and her insurance company to resolve the issue. Further, the Enterprise general manager overseeing Nova Scotia has spoken with the harried renter, and apologized "for the way this claim was handled during the last few months."