Ford Galaxie 500 Xl Fastback 1964 on 2040-cars

Muncie, Indiana, United States

|

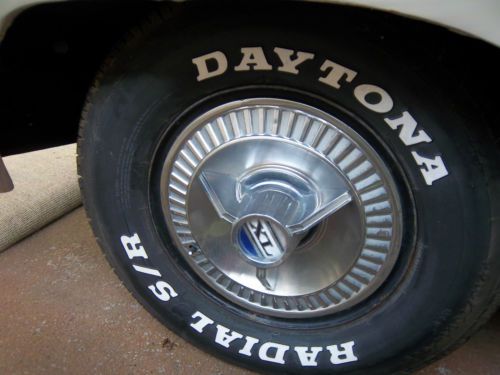

THE 1964 FORD GALAXIE XL 500 FASTBACK WAS THE FOURTH AND FINAL YEAR OF THIS BODY STYLE. WAS ASSEMBELD IN LOUISVILLE KENTUCKY. GRANDMOYHER DIED AND MY FATHER GOT THE CAR. MY DAD TOOK VERY GOOD CARE OF IT BUT DIDNT DRIVE IT MUCH, MY DAD DIED IN JULY AND NOW THE CAR IS MY MOTHERS . MOTOR HAS BEEN REBUILT AND MAINTAINED. NICE CAR AND GREAT MOTOR DOES EVEN MOVE WHEN IT RUNS. IT NEEDS SOME NEW TIRES, IT HAS 104,834 MILES. THIS WOULD MAKE A GREAT SHOW CAR, OR JUST A ROAD CAR. WE ARE SORRY ABOUT THE MILES, MOTHER OF AGE LOOKED AT THE TITLE WRONG. THANKS A LOT

|

Ford Galaxie for Sale

Auto Services in Indiana

Yocum Motor Sales ★★★★★

Webb Hyundai ★★★★★

Twin City Upholstery Ltd. ★★★★★

Tire Discounters ★★★★★

Spurlock Body & Paint Inc ★★★★★

Smith`s Towing ★★★★★

Auto blog

RWD Lincolns are coming, fate depends partly on MKZ success

Tue, 04 Dec 2012The product portfolio at Lincoln may seem a bit sparse at the moment, but if a report is to be believed, new products are on the way. TheDetroitBureau.com spoke with sources at Lincoln and Ford, who claimed the American premium brand is working on, perhaps more than one, rear-wheel-drive vehicle.

Lincoln would likely platform-share with the next-generation Ford Mustang to develop those RWD offerings in the early going. Moving forward, the report indicates that Lincoln could take the lead on other rear-drive projects in the future. As the RWD architecture continues to take shape, "most or all" of the front-wheel-drive portfolio will also be offered with all-wheel drive as an option, ala Audi.

But wait, there's more! The report also suggests that a replacement for the full-size MKS is on the way, as well as a new Navigator and a luxury crossover based on the current Ford Escape.

Ford sticking with manuals for RS models

Wed, Feb 4 2015Traditional stick-shift gearboxes may be losing ground quickly to dual-clutch transmissions, but Ford knows what hot hatch enthusiasts want. That's why it's sticking with manual transmissions on its RS models for the foreseeable future. The Blue Oval automaker caught our attention yesterday when it revealed the new Focus RS, packing an upgraded version of the turbo four from the Mustang, a trick new all-wheel-drive system and an old-school six-speed manual. After speaking to Ford's product chief Raj Nair at the hot hatch's launch, Autocar reports that the six-speed is here to stay. "All our current research says that customers really like these kinds of cars to have a manual gearbox," Nair told the British publication. "We'll keep looking at market trends, and of course we'll give customers what they want, but for now the manual stays." Autocar further suggests that the same principle will apply to any further Rallye Sport models, so if and when a Fiesta RS rolls around, it's likely it will stick with a stick as well. Although the less potent Focus ST is offered in diesel and wagon forms overseas, wherever it's sold and in whatever form, the six-speed stays a constant in that model as well, just as it does in the smaller Fiesta ST. That doesn't mean that other Ford Performance models won't go without a clutch pedal, though. The new GT employs a seven-speed dual-clutch gearbox and the new F-150 Raptor channels its muscle through a ten-speed automatic. But as far as Ford's hot hatches go, it looks like the manual will remain alive and well. Related Video: Featured Gallery 2016 Ford Focus RS News Source: Autocar Ford Hatchback Performance manual ford fiesta rs

Second-tier UAW workers promoted for first time after Ford hits quota

Mon, Feb 2 2015The United Auto Workers put out a statement on Friday that 55 Ford workers chosen by seniority would be moved from the Tier 2, entry-level pay rate of around $19 per hour to the Tier 1, non-entry-level rate of about $28 per hour. One of the stipulations in the 2011 UAW-Ford agreement was that only 20-percent of the total hourly workforce could be paid the Tier 2 wages agreed upon in 2007; after that, those workers had to be moved to Tier 1. Even so, the new Tier 1 status makes them less expensive to Ford than veteran Tier 1 workers because they receive fewer benefits. However, Automotive News had reported that same day that Ford was 69 workers shy of the limit, and when AN asked Ford about the situation Ford said it had "some room" on the entry-level roster. If workers do move to the higher pay grade, it will be the first time that's happened since the two-tier system was agreed. But it sounds like there's going to be some haggling between the UAW and Ford before that happens. Ford is the only one of the Detroit 3 automakers to have to work with a cap, since it didn't go through bankruptcy proceedings during The Great Recession; General Motors and Chrysler jettisoned the cap in 2009. GM is said to have 16 percent of its hourly workers at Tier 2 while Chrysler has 42 percent, but Fiat-Chrysler CEO Sergio Marchionne has long been opposed to the two-wage system. The UAW is preparing for its 2015 negotiations with the US automakers. It wants to eliminate the difference in pay by going to the higher scale, if there is a consensus among automakers it seems to be that they also want a single wage, but less than the higher scale, with the addition of profit-based bonuses. The recent statement from the labor union is below. UAW President Dennis Williams and UAW-Ford Vice President Jimmy Settles announced today that the union is delivering on its promise to convert workers DETROIT, Jan. 30, 2015 /PRNewswire/ -- UAW President Dennis Williams and UAW-Ford Vice President Jimmy Settles announced today that the union is delivering on its promise to convert workers making entry-level wages to traditional employees. "The 2011 UAW-Ford agreement allows for a contractual limit of entry-level employees. Once that threshold is surpassed, entry-level employees convert by seniority to 'regular, non-entry level employment.' At this time, fifty-five UAW-Ford workers will receive the wage increases, which put them in the category of non entry-level employment.

1970 ford galaxie xl 500 fastback 500

1970 ford galaxie xl 500 fastback 500 1964 ford galaxie 500

1964 ford galaxie 500 1964 ford galaxie 500xl

1964 ford galaxie 500xl 1966 ford galaxie 500 xl 4.7l

1966 ford galaxie 500 xl 4.7l 1963 ford galaxie 500 xl

1963 ford galaxie 500 xl Original condition 63 galaxie 500 convertible!! no reserve.

Original condition 63 galaxie 500 convertible!! no reserve.