2014 Ford Fusion Se on 2040-cars

28739 State Road 54, Wesley Chapel, Florida, United States

Engine:1.5L I4 16V GDI DOHC Turbo

Transmission:6-Speed Automatic

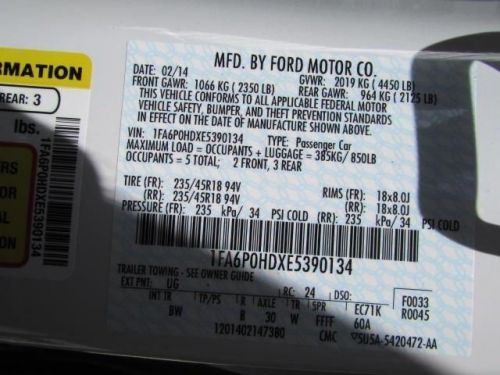

VIN (Vehicle Identification Number): 1FA6P0HDXE5390134

Stock Num: 14U90134

Make: Ford

Model: Fusion SE

Year: 2014

Exterior Color: White Platinum Tri-Coat Metallic

Interior Color: Charcoal Black

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 22

At Parks Ford of Wesley Chapel, we are pleased to be your true "full service" dealer for the Tampa Bay area. Whether you are searching for New/Used/Certified inventory, world class service, collision center, or friendly straight forward financing, we can help! We pride ourselves on having an excellent reputation, just check out our reviews.

Ford Fusion for Sale

2014 ford fusion se(US $30,195.00)

2014 ford fusion se(US $30,195.00) 2014 ford fusion se(US $30,300.00)

2014 ford fusion se(US $30,300.00) 2014 ford fusion se(US $30,895.00)

2014 ford fusion se(US $30,895.00) 2014 ford fusion s(US $22,795.00)

2014 ford fusion s(US $22,795.00) 2014 ford fusion hybrid s(US $23,692.00)

2014 ford fusion hybrid s(US $23,692.00) 2014 ford fusion se(US $25,055.00)

2014 ford fusion se(US $25,055.00)

Auto Services in Florida

Zeigler Transmissions ★★★★★

Youngs Auto Rep Air ★★★★★

Wright Doug ★★★★★

Whitestone Auto Sales ★★★★★

Wales Garage Corp. ★★★★★

Valvoline Instant Oil Change ★★★★★

Auto blog

Submit your questions for Autoblog Podcast #324 LIVE!

Tue, 12 Mar 2013We're set to record Autoblog Podcast #324 tonight, and our friend Peter Leung (a.k.a. BaronVonClutch), who writes about racing for Richland F1 is going to teach us how to love the vroom-vroom. Drop us your questions and comments regarding the rest of the week's news via our Q&A module below. Subscribe to the Autoblog Podcast in iTunes if you haven't already done so, and if you want to take it all in live, tune in to our UStream (audio only) channel at 10:00 PM Eastern tonight.

Discussion Topics for Autoblog Podcast Episode #324

Geneva Motor Show highlights from Zach

Rolling footage of the 2015 Ford Mustang hits YouTube [w/video]

Thu, 26 Dec 2013Just in time for the holidays: Ford took the 2015 Mustang to Route 66 to cook up rolling footage, and we've been given some of the leftovers ahead of the meal. There are no burnouts, no donuts, no revving, and thankfully, no music. It's just two minutes and 26 seconds of the new pony car running free in the desert.

So in case you needed more visualizing help, the video below will help you start imagining how you'll look in your 2014 Christmas present to yourself...

J Mays retiring from Ford design, succeeded by Moray Callum

Tue, 05 Nov 2013Ford's highly influential head of design, J Mays, has announced that he'll be retiring from his position after 33 years in the industry, 16 of which were at the Dearborn, MI-based company. Upon departure, he'll be succeeded as group vice president of design by Moray Callum. If that last name sounds familiar, yes, he's the brother of Jaguar's Ian Callum.

It's difficult to explain just how big of a role Mays had on not just Ford's design over the years, but on the entire industry. Before heading to Dearborn, Mays worked for Audi, BMW and then Volkswagen, where he was involved in concept cars that paved the way for design icons like the first-generation Audi TT and the Volkswagen New Beetle. As for his Ford resume, it's extensive.

Mays joined the company in 1997 as design director for Ford, Lincoln, Mercury and Mazda, as well as the Premier Automotive Group (Volvo, Land Rover, Jaguar and Aston Martin). He was heavily involved in the Ford Fusion, Focus, Fiesta, Taurus, F-150 and Mustang, while also contributing to concept cars like the Atlas, Evos, 427, Forty-Nine, Shelby GR-1, Lincoln MKZ and the MKC.