2012 Ford Flex Sel Awd Damaged Salvage Runs! Low Miles Loaded Priced To Sell!! on 2040-cars

Salt Lake City, Utah, United States

Body Type:SUV

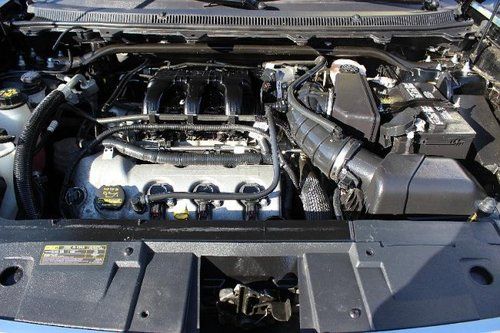

Engine:3.5L V6 DOHC 24V

Vehicle Title:Salvage

Fuel Type:Gasoline

For Sale By:Dealer

Interior Color: Gray

Make: Ford

Number of Cylinders: 6

Model: Flex

Trim: SEL AWD

Drive Type: AWD

Options: Sunroof, 4-Wheel Drive, Leather Seats, CD Player

Mileage: 30,046

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Sub Model: SEL AWD

Exterior Color: Black

Ford Flex for Sale

2011 ford flex sel 7-pass htd seats pano sunroof 30k mi texas direct auto(US $24,980.00)

2011 ford flex sel 7-pass htd seats pano sunroof 30k mi texas direct auto(US $24,980.00) Ford flex limited low miles 4 dr suv automatic gasoline 3.5l v6 ti-vct tuxedo bl

Ford flex limited low miles 4 dr suv automatic gasoline 3.5l v6 ti-vct tuxedo bl Awd limited navigation backup camera leather dvd clean carfax we finance

Awd limited navigation backup camera leather dvd clean carfax we finance 2013 ford flex sel all wheel drive one owner clean carfax must see!(US $26,900.00)

2013 ford flex sel all wheel drive one owner clean carfax must see!(US $26,900.00) Clean ltd awd 3.5l nav cd mp3 player satellite radio ready premium sound system

Clean ltd awd 3.5l nav cd mp3 player satellite radio ready premium sound system Sel convenience pkg sync 7-passenger moonroof clean!(US $17,910.00)

Sel convenience pkg sync 7-passenger moonroof clean!(US $17,910.00)

Auto Services in Utah

Young Chevrolet ★★★★★

Utah Auto Wrecking of St George ★★★★★

Tunex ★★★★★

The Junk Car Buyer ★★★★★

Sherms Store Inc ★★★★★

Shane`s Automotive ★★★★★

Auto blog

Ford and GM link bonus checks to quality scores

Tue, 29 Apr 2014The poor first quarter earnings of Ford and General Motors are having an effect all the way up the food chain. Both automakers struggled with recalls in the first three months of the year, and, according to The Detroit News, they have responded by increasing the percentage of bonuses tied to vehicle quality for salaried workers, including top executives.

GM announced that 25 percent of bonuses (up from 10 percent) for all salaried workers would be tied to its vehicle quality standards. The automaker revealed in its financial report that it spent $1.3 billion on recall-related repairs in the first quarter, and net income was down 86 percent.

Ford also increased the quality proportion of bonuses for about 26,000 salaried workers all the way up to CEO Alan Mulally from 10 percent to 20 percent. The company announced in its report that the amount paid out in warranty and recall claims was about $400 million higher than expected in the first quarter. Its net income fell 39 percent from the previous year. "The change reflects how critical quality is to our overall business," said spokesperson Todd Nissen speaking to Autoblog.

Is Tesla's next project an F-150 competitor? [w/poll]

Wed, 13 Nov 2013What's the future look like for Tesla after it launches the Model X CUV and possibly a smaller, sub-Model S sedan? Would you believe a pickup truck? Yes, Tesla could be looking to use its EV know-how to take the fight to Ford and the F-150, based on comments made by company founder Elon Musk.

"If you're trying to replace the most gasoline miles driven, you have to look at what people are buying," Musk said during an impromptu Q&A session following a speech at Business Insider's Ignition conference. "[The F-150 is] the best selling car in America. If people are voting that's their car, then that's the car we have to deliver."

And while the idea of electric pickup may sound kind of absurd to some, Musk makes a very valid point - if Tesla's goal is to replace gas miles with electrical miles, it simply can't afford to ignore pickups.

Rising aluminum costs cut into Ford's profit

Wed, Jan 24 2018When Ford reports fourth-quarter results on Wednesday afternoon, it is expected to fret that rising metals costs have cut into profits, even as rivals say they have the problem under control. Aluminum prices have risen 20 percent in the last year and nearly 11 percent since Dec. 11. Steel prices have risen just over 9 percent in the last year. Ford uses more aluminum in its vehicles than its rivals. Aluminum is lighter but far more expensive than steel, closing at $2,229 per tonne on Tuesday. U.S. steel futures closed at $677 per ton (0.91 metric tonnes). Republican U.S. President Donald Trump's administration is weighing whether to impose tariffs on imported steel and aluminum, which could push prices even higher. Ford gave a disappointing earnings estimate for 2017 and 2018 last week, saying the higher costs for steel, aluminum and other metals, as well as currency volatility, could cost the company $1.6 billion in 2018. Ford shares took a dive after the announcement. Ford Chief Financial Officer Bob Shanks told analysts at a conference in Detroit last week that while the company benefited from low commodity prices in 2016, rising steel prices were now the main cause of higher costs, followed by aluminum. Shanks said the automaker at times relies on foreign currencies as a "natural hedge" for some commodities but those are now going in the opposite direction, so they are not working. A Ford spokesman added that the automaker also uses a mix of contracts, hedges and indexed buying. Industry analysts point to the spike in aluminum versus steel prices as a plausible reason for Ford's problems, especially since it uses far more of the expensive metal than other major automakers. "When you look at Ford in the context of the other automakers, aluminum drives a lot of their volume and I think that is the cause" of their rising costs, said Jeff Schuster, senior vice president of forecasting at auto consultancy LMC Automotive. Other major automakers say rising commodity costs are not much of a problem. At last week's Detroit auto show, Fiat Chrysler Automobiles NV's Chief Executive Officer Sergio Marchionne reiterated its earnings guidance for 2018 and held forth on a number of topics, but did not mention metals prices. General Motors Co gave a well-received profit outlook last week and did not mention the subject. "We view changes in raw material costs as something that is manageable," a GM spokesman said in an email.