Well Maintatined on 2040-cars

Mansfield, Texas, United States

|

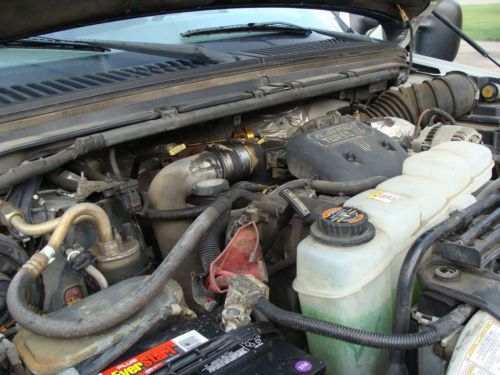

This truck was owned by Former Diesel Mechanic, Used to pull New Travel Trailers From Manufacture to Dealers. All High Way Miles, Reason for Sale is Death in the Family. |

Ford F-250 for Sale

1995 ford f-250 xlt extended cab pickup 2-door 7.3l(US $4,500.00)

1995 ford f-250 xlt extended cab pickup 2-door 7.3l(US $4,500.00) 2013 ford f-250 super duty platinum crew cab pickup 4-door 6.7l(US $51,500.00)

2013 ford f-250 super duty platinum crew cab pickup 4-door 6.7l(US $51,500.00) Very clean 1987 ford f-250 4wd

Very clean 1987 ford f-250 4wd 6.7l v8 diesel lariat leather lifted fx4 off road sync tow mp3 climate seats 4x4

6.7l v8 diesel lariat leather lifted fx4 off road sync tow mp3 climate seats 4x4 2000 ford f-250 superduty xlt extended cab(US $5,500.00)

2000 ford f-250 superduty xlt extended cab(US $5,500.00) 1997 f250 xlt crew cab hd powerstroke diesel(US $9,000.00)

1997 f250 xlt crew cab hd powerstroke diesel(US $9,000.00)

Auto Services in Texas

Zeke`s Inspections Plus ★★★★★

Value Import ★★★★★

USA Car Care ★★★★★

USA Auto ★★★★★

Uresti Jesse Camper Sales ★★★★★

Universal Village Auto Inc ★★★★★

Auto blog

Justin Bell makes a horrible policeman

Mon, 11 Nov 2013If you're wondering what type of person makes a good police officer, it seems a racecar driver doesn't. Let us rephrase that: Justin Bell, a racecar driver and the host of Motor Trend's World's Fastest Car Show, recently got behind the wheel of a 5.0-liter Ford Mustang police car with Sergeant Daniel Shrubb, co-founder of DRAGG (Drag Racing Against Gangs and Graffiti), and proved that his high-performance-driving skillset is a bit too aggressive for police duty.

While it's easy to get carried away in a Mustang GT, a patrol car driver must maintain some sort of restraint while pursuing a criminal, so as not to come off as a reckless driver to the public. We'll admit, some pursuit techniques are counter-intuitive to performance driving (stay off the gas in a lane-change exercise?), but Bell's judicious use of the handbrake can't be normal procedure.

Watch "The One With The Ford Mustang 5.0 Police Car" (yes, we caught the Friends reference too) below to see some shenanigans in one of Michigan's finest patrol cars.

GM details CEO Mary Barra's pay, contacts with investor David Einhorn

Wed, Apr 5 2017Earnings/Financials Chrysler Ford GM Sergio Marchionne Mary Barra Mark Fields david einhorn greenlight capital

2018 Ford Expedition vs other big SUVs: How it compares on paper

Fri, Nov 10 2017With our Alex Kierstein rightly impressed in his first-drive review of the new 2018 Ford Expedition, we decided to dig a little deeper into the numbers, and we came up with the spreadsheet below to highlight how the new 2018 Expedition compares on paper to its main full-size SUV competitors: the 2018 Chevy Tahoe and Suburban (and therefore the 2018 GMC Yukon), 2018 Toyota Sequoia and 2018 Nissan Armada. We also threw in the new, even bigger 2018 Chevrolet Traverse since, as you'll see, its massive dimensions should put it on the radar for anyone who needs loads of passenger and cargo space but doesn't care as much about towing. A few notes about the chart above. First, the 6.2-liter V8 that's included with the new-for-2018 Tahoe RST trim level is the standard engine on the GMC Yukon Denali. You can apply most of the Tahoe's numbers to the entire Yukon and Yukon XL lineup. Second, though we highlighted categories where the Traverse led, we also highlighted the runner-up full-size SUV, since this was ultimately about that segment. Traverse numbers are broadly applicable to the new Buick Enclave. Related Video: Chevrolet Ford GMC Nissan Toyota SUV Comparison consumer ford expedition gmc yukon chevy traverse toyota sequoia nissan armada chevrolet tahoe ford expedition max