2023 Fisker Ocean on 2040-cars

Sacramento, California, United States

Engine:Dual AC Electric Motors

Fuel Type:Electric

Body Type:SUV

Transmission:Single-Speed Fixed Gear

For Sale By:Dealer

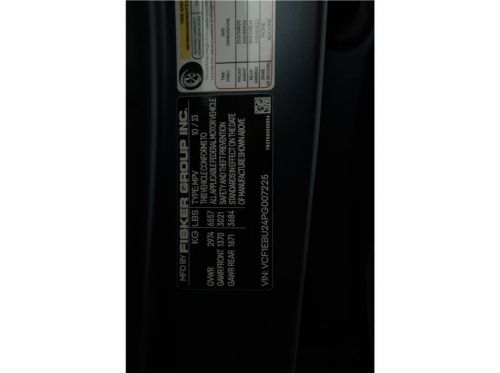

VIN (Vehicle Identification Number): VCF1EBU24PG007225

Mileage: 0

Make: Fisker

Model: Ocean

Features: --

Power Options: --

Exterior Color: Blue

Interior Color: --

Warranty: Unspecified

Fisker Ocean for Sale

2023 fisker ocean(US $37,499.00)

2023 fisker ocean(US $37,499.00) 2023 fisker ocean(US $37,499.00)

2023 fisker ocean(US $37,499.00) 2023 fisker ocean(US $37,499.00)

2023 fisker ocean(US $37,499.00) 2023 fisker ocean(US $37,499.00)

2023 fisker ocean(US $37,499.00) 2023 fisker ocean(US $37,499.00)

2023 fisker ocean(US $37,499.00) 2023 fisker ocean(US $37,499.00)

2023 fisker ocean(US $37,499.00)

Auto Services in California

Zip Auto Glass Repair ★★★★★

Z D Motorsports ★★★★★

Young Automotive ★★★★★

XACT WINDOW TINTING & 3M CLEAR BRA PAINT PROTECTION ★★★★★

Woodland Hills Honda ★★★★★

West Valley Machine Shop ★★★★★

Auto blog

The billionaire's passion behind Wanxiang's Fisker bid

Fri, Jan 24 2014If it weren't for billionaire Lu Guanqiu, founder of Chinese auto parts giant Wanxiang Group, the Fisker Automotive bankruptcy bailout deal might have closed earlier this month. Hong Kong tycoon Richard Li, along with Li's affiliate company Hybrid Tech Holdings, assumed their offer was going to be accepted. Instead, the US bankruptcy court judge called for an open auction bid for Fisker's assets on February 12. Lu made a few convincing points to the judge. There's another interesting part of the story that Lu didn't share it with the judge. If the Fisker deal doesn't work out, Lu and Wanxiang might increase their working relationship with Tesla Motors. Lu told US bankruptcy judge Kevin Gross that Wanxiang, which now owns Fisker's supplier of lithium batteries, A123 Systems, is better placed than Hybrid Tech Holdings to restart and expand production at Fisker. Better yet, Wanxiang could move production from Finland to the US. That was convincing enough for Gross to schedule the auction. Lu's move toward taking over ownership and restoring Fisker seems to be driven by two motivations: converting his company from a parts maker to an automaker; and to grow the yet-to-be profitable "new energy " business such as lithium battery and electric vehicle makers. For Lu, it's not so much about believing in Fisker – it's more about playing a leading role in electric vehicles – and that could come through deepening its connection to Tesla Motors. "Of course we want to pocket Fisker. But we will bid rationally," he said to Reuters. "Whatever the result, nothing can stop us from making electric cars." Check out more about Lu in this Reuters piece, including how he and six other farmers pooled together $500 in 1969 to start what would become Wanxiang. Featured Gallery Fisker Karma at Laguna Seca News Source: Reuters Government/Legal Green Fisker Tesla Electric wanxiang

Fisker-Foxconn EV partnership 'moving faster than expected'

Sun, Aug 8 2021U.S. electric automaker Fisker expects operating expenses to reach between $490 million and $530 million this year, a slight increase in its business outlook for the year that is driven by R&D spending on prototypes for its Ocean SUV, testing and validation of advanced technology, hiring and its "accelerating" partnership with Foxconn. The company, which reported its second-quarter earnings Thursday after market close, raised its business outlook for expectations for key non-GAAP operating expenses and capital expenditures for the full year up from its previous guidance of $450 million to $510 million. The earnings report pointed to R&D spending on prototype activities in 2021 driven by testing and validation on advanced driver assistance systems, powertrain and user interface. The company also noted an increase in spending on in-house costs, such as virtual validation software tools, hiring and virtual and physical testing to account for recently tightened Euro NCAP and IIHS safety regulations. Co-founder, CFO and COO Geeta Gupta Fisker added during an investor call that the company made a strategic decision to develop internal capabilities to test and validate, instead of relying solely on third parties. Co-founder and CEO Henrik Fisker said in an interview Thursday its partnership with Foxconn, which is "moving faster than expected," also is contributing to an increase in spending. "We were really aligned," Fisker said in an interview Thursday. "I mean it's a very unique business deal because we are both investing into this program; it's not like we just hired Foxconn to make a car." Fisker has two vehicle programs in the works. Its first electric vehicle, the Fisker Ocean SUV, will be assembled by automotive contract manufacturer Magna Steyr in Europe. The start of production is still on track to begin in November 2022, the company reiterated Thursday. Deliveries will begin in Europe and the United States in late 2022, with a plan to reach production capacity of more than 5,000 vehicles per month during 2023. Deliveries to customers in China are also expected to begin in 2023. Fisker Ocean at the track View 6 Photos In May, Fisker signed an agreement with Foxconn, the Taiwanese company that assembles iPhones, to co-develop and manufacture a new electric vehicle.

Recharge Wrap-up: Fisker owner Wanxiang owns a lot of US real estate, carmakers gaming EU emissions system

Thu, Apr 16 2015Wanxiang Group says it might now be China's largest corporate investor in American real estate. The owner of both Fisker Automotive and battery company A123 Systems, and parts supplier to Mazda and Chrysler, Wanxiang has invested in over 60 projects in the US since 2010. Returns on those investments have been "very, very, very" high, according to Wanxiang America President Pin Ni. "We can invest in clean energy, auto, real estate or anything, but the key is pegging it well to the economic cycle," says Ni. Read more at Bloomberg. Cars sold in 2014 in Europe are exceeding 2015 targets for emissions, but not necessarily for the right reasons. The cars produce 2.6 percent (or 123.4 g/km) less CO2 than cars sold in 2013, which is nearly 7 g/km less than 2015 targets. Unfortunately, these results are influenced in part by manufacturers taking advantage of flaws in the EU testing procedures for better results. Real-world fuel economy is about 31 percent less than official ratings. "These figures need to be treated with extreme caution," says Greg Archer, clean vehicles manager at Transport & Environment. Most of the measured improvement is being delivered through manipulating tests, not delivering real-world improvements. We need the new test to be introduced without further delay." Read more at DieselNet, or from Transport & Environment. Ballard will supply fuel cell modules for eight hydrogen-powered buses in China. Shipping later this year, the FCvelocityTM-HD7 power modules will power buses in multiple Chinese for cities. "We are now beginning to see meaningful evidence of growing demand for clean energy mass transportation alternatives in China, including both buses and trams," says Ballard President and CEO Randy MacEwen. "This demand is being driven by a pressing need to address China's challenging air quality issues, for which fuel cell technology is seen as an emerging option." Read more from Ballard in the press release below. Ballard Inks Deal to Supply Next-Generation Fuel Cell Power Product For Eight Buses in China April 15, 2015 Vancouver, Canada – Ballard Power Systems (NASDAQ: BLDP; TSX: BLD) today announced that it has received an order from a Chinese customer to supply its next-generation FCvelocityTM-HD7 power modules for 8 buses to be deployed in a number of Chinese cities. Ballard expects to ship all of the modules in 2015.