2023 Fisker Ocean on 2040-cars

Sacramento, California, United States

Engine:Dual AC Electric Motors

Fuel Type:Electric

Body Type:Other

Transmission:Single-Speed Fixed Gear

For Sale By:Dealer

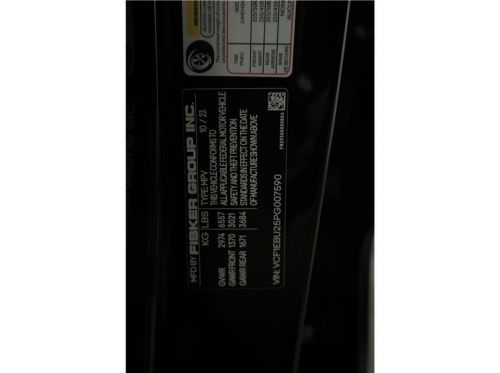

VIN (Vehicle Identification Number): VCF1EBU25PG007590

Mileage: 0

Make: Fisker

Model: Ocean

Features: --

Power Options: --

Exterior Color: Night Drive

Interior Color: --

Warranty: Unspecified

Fisker Ocean for Sale

2023 fisker ocean(US $34,999.00)

2023 fisker ocean(US $34,999.00) 2023 fisker ocean(US $37,499.00)

2023 fisker ocean(US $37,499.00) 2023 fisker ocean(US $34,999.00)

2023 fisker ocean(US $34,999.00) 2023 fisker ocean(US $37,499.00)

2023 fisker ocean(US $37,499.00) 2023 fisker ocean(US $34,999.00)

2023 fisker ocean(US $34,999.00) 2023 fisker ocean(US $34,999.00)

2023 fisker ocean(US $34,999.00)

Auto Services in California

Zenith Wire Wheel Co ★★★★★

Yucca Auto Body ★★★★★

World Famous 4x4 ★★★★★

Woody`s & Auto Body ★★★★★

Williams Auto Care Center ★★★★★

Wheels N Motion ★★★★★

Auto blog

This is Henrik Fisker's idea of a yacht

Mon, Apr 11 2016He's done cars, he's done motorcycles, and now Henrik Fisker is branching out into boats. The Danish designer revealed the first fruit of his new collaboration with Italian shipyard Benetti at the Singapore Yacht Show last week. The Benetti Fisker 50 superyacht concept calls for a vessel measuring 164 feet, or roughly the length of 10 Karmas parked nose to tail. In that space, Fisker and Benetti envision fitting a spacious salon, a top-deck lounge, swimming pool, sunbathing decks, and "beach club" swim platform, plus six guest cabins, and quarters for 11 crew members. All that spread across three decks with floor-to-ceiling glass walls. The master suite alone boasts a library, fold-down balcony, fireplace, and a private staircase to the upper deck with a home theater that can be converted into a gym. The yacht is designed to be built using carbon fiber, reclaimed wood, and other exotic materials. Of course it would be up for the eventual commissioning owner to specify the vessel to his or her needs from the shipyard in Tuscany. That includes the powertrain combination, but true to the Fisker name, a hybrid propulsion system will be on offer. Solar panels are also part of the design. Given the high cost associated with commissioning a yacht this size, it may be a while before Benetti finds a buyer – much less actually gets it out on the open water. Fortunately the shipyard has other projects under way, as does Fisker: the designer recently revealed Vipers, Mustangs, and Aston Martins, all rebodied in his signature style – and even teamed up with Bob Lutz and company to relaunch the Karma as the VLF Destino, ditching the hybrid powertrain for a supercharged V8. OFFICIAL REVEAL OF Benetti "Fisker 50" concept – ready to be built -A 164 feet superyacht concept designed by Henrik Fisker -Dynamic sporty three decks -Offering ultimate luxury living on board -Convertible upper deck from movie theatre to gym area -Advanced solar panels provide ambient deck lighting, using solar power stored during the day April 8, 2016 – SINGAPORE – Entrepreneur and acclaimed international designer Henrik Fisker and influential global superyacht builder Benetti revealed the concept of a 50 meter – (164 feet) superyacht, Benetti "Fisker 50". Benetti and Fisker have worked on this partnership throughout 2015 to fully engineer the feasibility of this production-optimized superyacht.

Fisker earnings call touts the Ocean's arrival, teases the Pear

Tue, Feb 28 2023Henrik Fisker's on his third go as head of an independent carmaker. It started with Fisker Coachbuild, putting new bodies on German sports cars to create the Tramonto and Latigo. His dreams soon went electric with Fisker Automotive and the Karma. The latest dream revision birthed Fiker Inc, the company behind the Ocean. Based on details provided during the company's Q4 and full-year 2022 results call with analysts, the third time could well and truly be the charm. The bullet points are a startup's dream. There are 56 Ocean prototypes on the roads, 15 of them in partner Magna Steyr's fleet for daily testing and validation. Fisker Inc spent less money than expected in 2022 ($702 million) and has more cash on hand than expected. And if things go smoothly in 2023, the predicted spend and gross margin could leave Fisker Inc with "potentially positive EBITDA [Earnings Before Interest, Taxes, Depreciation, and Amortization] for 2023." Huge if it happens. If there's slightly mixed news, it's with the Q1 2023 timeline. The good bit is that Fisker says homologation programs in the U.S. and seven European countries are "progressing well," the processes expected to conclude in March. After that, the company needs to secure final regulatory approvals from the U.S. EPA, California's Air Resources Board, and the seven international regions. Fisker touted the broad market strategy as lowering risk since getting approved in multiple markets would give the company the option to go where demand is greatest. The target has been to get the first 300 Ocean units delivered by the end of March, Fisker saying the company secured supplier commitments for the quarterly and annual build schedules. With the amount of paperwork yet to be done, though, hitting the March deadline could be close. After that, according to the CEO, it's back to uncut good news. Those homologation programs have apparently shown ranges better than expected for the Ocean. Instead of the 350-mile range predicted on the U.S. regime, Fisker thinks "it's going to be closer to 360 [miles]." Instead of the Europe's WLTP prediction of 630 kilometers, he said, "I think this will be closer to 700." As of the end of February, the company is sitting on roughly 65,000 reservations or orders for the Ocean. The goal is to manufacture 42,000 units this year, the ramp-up going from 300 in Q1 to 8,000 in Q2, more than 15,000 in Q3, and at least 19,000 in Q4.

Fisker Alaska electric pickup is one of the coolest Cybertruck and F-150 Lightning rivals yet

Sat, Aug 5 2023The Fisker Alaska electric pickup truck. Fisker US EV startup Fisker unveiled an electric pickup to take on the Tesla Cybertruck and Rivian R1T. Fisker says the Alaska will start at $37,900 after incentives and go on sale in early 2025. It offers an ingenious bed that extends from 4.5 feet to 9.2 feet. EV startup Fisker wants to snag a chunk of America's pickup market from giants like Ford and GM. The company on Thursday laid out plans for its next batch of products, including a very cool truck called the Alaska. Fisker didn't mention too many details, but we now know a few things about the upcoming truck. "I think it's very important for us to say that we want to create unique vehicles," company CEO and designer Henrik Fisker said during the event. The Fisker Alaska electric pickup truck. Fisker Fisker says it'll start at $45,400, or $37,900 after a $7,500 federal tax credit. That should make it one of the most affordable electric trucks in the US when it goes on sale sometime in early 2025. The F-150 Lightning (a bigger truck, but still) was supposed to start at just under $40,000, but rising materials costs have pushed the entry-level model to $51,990. The Rivian R1T, a bigger, higher-end offering than the Alaska, costs $73,000 and up. The Fisker Alaska electric pickup truck. Fisker That makes the Alaska look like a mighty compelling deal, if Fisker can keep the price where it is. There's also currently nothing like it. All the electric pickups out right now — the Lightning, GMC Hummer EV, and R1T — are fairly large. The soon-to-be-released Tesla Cybertruck looks like a pretty big boy too. Fisker revealed three brand-new electric models and a new version of its Ocean SUV during an event in California. Fisker Fisker says the Alaska will fit somewhere between the compact and midsize categories. So think bigger than a Ford Maverick and smaller than a Toyota Tacoma. It could strike a chord with buyers who want an electric truck for casual errands but don't need anything huge. During Thursday's product-reveal event, Fisker's CEO said the company didn't want to compete with full-size trucks and wanted to build a pickup that works well as a daily driver. The Fisker Alaska electric pickup truck. Fisker Still, he wanted the Alaska to provide pickup utility when people need it. Thanks to a retractable wall between the cab and bed, the Alaska's 4.5-foot bed can fit items as long as 9.2 feet — if you fold the back seats and drop the tailgate.