2023 Fisker Ocean on 2040-cars

Sacramento, California, United States

Engine:Dual AC Electric Motors

Fuel Type:Electric

Body Type:Other

Transmission:Single-Speed Fixed Gear

For Sale By:Dealer

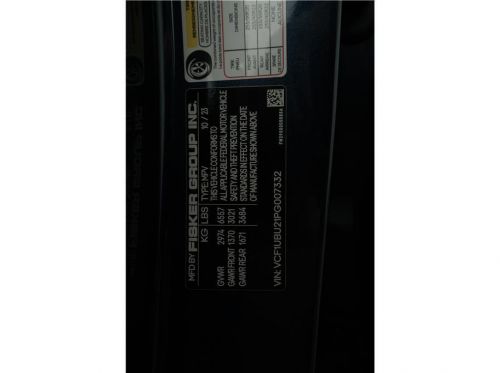

VIN (Vehicle Identification Number): VCF1UBU21PG007332

Mileage: 0

Make: Fisker

Model: Ocean

Features: --

Power Options: --

Exterior Color: Mariana

Interior Color: --

Warranty: Unspecified

Fisker Ocean for Sale

2023 fisker ocean(US $37,499.00)

2023 fisker ocean(US $37,499.00) 2023 fisker ocean(US $34,999.00)

2023 fisker ocean(US $34,999.00) 2023 fisker ocean(US $37,499.00)

2023 fisker ocean(US $37,499.00) 2023 fisker ocean(US $34,999.00)

2023 fisker ocean(US $34,999.00) 2023 fisker ocean(US $34,999.00)

2023 fisker ocean(US $34,999.00) 2023 fisker ocean(US $34,999.00)

2023 fisker ocean(US $34,999.00)

Auto Services in California

Yuba City Toyota Lincoln-Mercury ★★★★★

World Auto Body Inc ★★★★★

Wilson Way Glass ★★★★★

Willie`s Tires & Alignment ★★★★★

Wholesale Import Parts ★★★★★

Wheel Works ★★★★★

Auto blog

2017 Karma Revero starts at $130,000, and more new details about the reborn Fisker

Fri, Sep 9 2016It was not obvious that the eyes of the automotive world would focus on Huntington Beach, California today for the launch (sort of a relaunch) of the Karma Revero. The unlikely rebirth of the Fisker Karma has taken a long while, and you'll be forgiven if you thought that Fisker's bankruptcy filing in 2013 signaled the end of the swoopy plug-in hybrid. Sure, at the time there was talk of the Karma returning some day, but in the era of plug-in vehicle pioneers like Aptera, Bright Automotive, and Phoenix Motorcars fading away in the figurative pages of Chapter 11 filings, who really thought it would happen? Wanxiang, that's who. Based in China, Wanxiang bought the rights to the Fisker assests back in February 2014 for $149.2 million. As we learned today in Huntington Beach, there were only 22 Fisker employees left at that time. A year later, in March 2015, the new Karma Automotive had 203 employees. There were 697 in August 2016 and the plan calls for 967 by the end of 2016. That's just one example of the intentional and dramatic growth that Karma is putting into bringing the Revero to market. Or back to market. Whatever. Here are seven things we learned about the Revero and Karma Automotive. The MSRP will be $130,000. The Fisker Karma started at $103,000, so the Revero's new $130,000 starting price tag is a bit of a jump. Aside from colors, wheels, and calipers, there won't be many options, either. Of course, there's a lot that's new and different about the car, and that costs money, but if you couldn't afford a Fisker, don't bother shopping for a Revero. The gas engine and most of the remains the same, but there have been upgrades. Just like the Fisker, the Revero uses a 260-horsepower, turbocharged four-cylinder engine from General Motors. But on the electrical side, things have gotten better. DC fast-charging at 40 kW is now available and the on-board charger has been upgraded from 3.3 kW to 6.6 kW. The battery is similar (it still uses A123 cells, which isn't a surprise), but the capacity has been increased from 20.4 kWh to 21.4 kWh, which will be good for 50 miles or range. The 0-60 time has been dropped by a second to 5.4 seconds in Sport mode. Nothing has been finalized yet, but apparently Karma expects the EPA fuel efficiency numbers to be roughly the same as before. The infotainment system has been totally redone.

Weekly Recap: Aston Martin to add another sports car, new Lagonda sedan, EVs

Sat, Apr 11 2015Aston Martin will revamp and expand its lineup as part of a five-year plan laid out by the company's new executives. If it succeeds, the strategy will position Aston for growth as an independent automaker with a more stable future in its second century. Aston will replace all of the cars in its current lineup and add a fourth sports car to its stable. It currently has three: the DB9, Vanquish and Vantage. The unnamed sports car will be joined by a production version of the DBX concept – an all-wheel-drive electric car that treads near crossover territory – that was revealed at the Geneva Motor Show. Aston's electric strategy also includes a potential electric-powered Rapide. Eventually, Aston plans to build a new four-door Lagonda. Though Aston will diversify its portfolio and the range could expand to seven vehicles, it will limit production to around 7,000 units annually, said Aston Martin marketing and communications director Simon Sproule, who described the company's strategy in an interview with Autoblog. CEO Andy Palmer, who joined Aston last year from Infiniti, has also spoken recently about remaking the company for the future. EVs are a major part of Aston's future, Sproule stressed, because they allow the automaker to "balance" its portfolio. Aston is studying the feasibility of an electric Rapide and is working with an undisclosed engineering firm. It's likely to use a plug-in setup and would cost $200,000 to $250,000 or more. It could use either a rear-wheel or all-wheel-drive configuration. View 14 Photos "It's a study, but we're serious about it," Sproule said. He added for emphasis: "If not this, there will be an electric Aston Martin in the future." Aston has taken note of what Tesla has done with the brisk-driving Model S and decided that's the dynamic it wants for some of its own cars. Even though EVs don't emit the same sonorous note as a V12 – they're better than the alternative, Sproule said. "The sound of silence is much more preferable than the sound of a four-cylinder whining away under the hood of an Aston Martin," he said. Speaking of V12s, they're not going away. Aston will continue to make its own V12 engine, but will source its V8 from Mercedes-AMG (whose parent, Daimler, owns a small stake in Aston). While the V12 is sure to please the faithful, Aston admits EVs and the crossover-like DBX will rankle many. Sproule argues those are the moves that will keep Aston relevant.

Karma Automotive partners with BMW for powertrains

Thu, Nov 12 2015Now in the process of rising from the ashes of Fisker, the newly renamed Karma Automotive has announced a powertrain supply deal with BMW. Only instead of Karma providing BMW with technologies (as Tesla has for Daimler and Toyota), this deal goes the other way around. It is BMW that will be providing Karma with its powertrain components moving forward. Little in the way of specifics was disclosed regarding precisely what the supply deal will entail. However according to the statement below, it will include "high voltage battery charging systems and a wide range of hybrid and EV systems." BMW has demonstrated its competence in developing and manufacturing such components with vehicles like the i3 and i8, and ActiveHybrid versions of the 3 Series, 5 Series, and 7 Series sedans. Karma Automotive is what Chinese component manufacturer Wanxiang renamed the company formerly known as Fisker Automotive once it acquired the rights to the company and the Fisker Karma which it previously produced. The brand name, however, remained the property of Henrik Fisker's coachbuilding operation. The original Fisker Karma was powered by a 2.0-liter turbo four supplied by General Motors, with a lithium-ion battery pack from A123 systems. Karma Automotive Signs Supply Agreement With BMW COSTA MESA, Calif., Nov. 12, 2015 /PRNewswire/ -- Karma Automotive announced today that BMW has agreed to be a supplier in ensuring their vehicles are built with the highest quality automotive parts. BMW will supply Karma Automotive with their latest powertrain components, including high voltage battery charging systems and a wide range of hybrid and EV systems. Throughout automotive history, BMW has been globally recognized for engineering and manufacturing world-class products. They are a proven technology leader and renowned for conceiving and delivering groundbreaking innovations. Karma Automotive will integrate the first BMW components into its plug-in hybrid flagship vehicle, which will re-launch in 2016. The next generation of vehicles already in development will utilize more of BMW's powertrain technology. "The Wanxiang Group is giving Karma Automotive the opportunity to bring a stunning car back to the market, and the partnership with BMW and their outstanding track record is a great fit for the future," said Karma's CEO Tom Corcoran.