Low Miles, No Accidents, Certified, 7-day Money-back Guarantee on 2040-cars

Atlanta, Georgia, United States

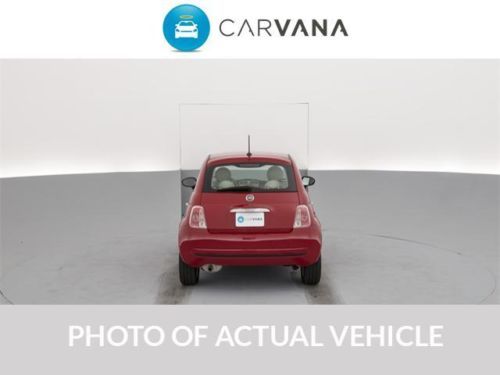

Fiat 500 for Sale

Fiat 500c - mocha latte - convertible - 1 owner - excellent condition awesome!!(US $16,900.00)

Fiat 500c - mocha latte - convertible - 1 owner - excellent condition awesome!!(US $16,900.00) 2014 fiat 500l easy new turbo 1.4l hatchback premium repairable rebuilder ez fix(US $13,995.00)

2014 fiat 500l easy new turbo 1.4l hatchback premium repairable rebuilder ez fix(US $13,995.00) 2012 fiat 500 abarth edition/like brand new/12k miles/$3k in extras/loaded!!!!!!(US $17,995.00)

2012 fiat 500 abarth edition/like brand new/12k miles/$3k in extras/loaded!!!!!!(US $17,995.00) Fiat 500 pop 2013 like new .(US $13,300.00)

Fiat 500 pop 2013 like new .(US $13,300.00) 1974 fiat 500 excellent condition

1974 fiat 500 excellent condition 2012 fiat 500 sport no reserve

2012 fiat 500 sport no reserve

Auto Services in Georgia

ZBest Cars ★★★★★

Woody Butts Automotive ★★★★★

Williamson`s Used Cars Inc ★★★★★

Watson Transmissions ★★★★★

Ward`s Auto Paint & Bodyworks ★★★★★

Walker`s Auto Repair ★★★★★

Auto blog

So, just how different are the Fiat 124 Spider and Mazda MX-5 Miata?

Wed, Nov 18 2015"We leveraged a great platform." That's how Bob Broderdorf, Jr., Fiat's North American director, summarizes the creation of the 124 Spider. We all know Fiat's new roadster shares its underpinnings with the fourth-generation Mazda MX-5 Miata, but there are a lot of key differences to keep them separate in the eyes of consumers. Mazda may have engineered the platform, but Fiat added many of its own touches. Here, we'll take a closer look at the spec sheets of the two cars, and summarize the major differences between the Japanese and Italian roadsters. If you need a refresher, read our full First Drive of the 2016 MX-5 Miata, and glance at all the Fiat 124 Spider details in this post. Design Fiat Chrysler design lead Ralph Gilles is super excited about this car. "I think it's going to change lives," he told the assembled media at an event in Auburn Hills, MI, earlier this month. Yes, it's definitely exciting to add a small roadster to any lineup, especially one that uses such a proven platform. But we're not sure people are going to get all that jazzed about it from a design standpoint. You'll either love it or hate it, and we're kind of leaning toward the latter. Every single body panel is new, and the design is "100 percent Italian." There are a number of creases and angles throughout the exterior, with a squared-off rear end and rectangular taillamps. Fiat trusts you'll be able to spot the similarities between the new 124 Spider and the original, but we're not so sure. We can see a bit of the old car's grille on the new car's face, and the dual hood blisters are a nice throwback touch, but that's about it. Trust us when we say that this car looks way better in photos. In person, it really didn't wow us. Of course, beauty is in the eye of the beholder. One colleague told us his wife, a long-time Miata owner, hates the look of the new one but will absolutely adore the Fiat. Good for her, and good for Fiat. But based on design alone, we'll take the Mazda every single time. What about you? Dimensions When Broderdorf said Fiat leveraged the Miata's platform, that means the Italians took it as-is. The two cars ride on an identical, 90.9-inch wheelbase. The front and rear tracks lengths are the same, at 58.9 and 59.1 inches, respectively. But that's where the similarities end.

2014 Fiat 500L Trekking takes the hatchback into the big leagues

Wed, 28 Nov 2012Didn't think it was possible to pull and pry at the diminutive Fiat 500 with enough gumption to make the Italian hatchback qualify as a large car (according to the EPA, at least)? Witness the Fiat 500L Trekking, seen above. It's a full 26-inches longer than the regular 500, and it's grown six-inches taller and wider.

All that stretching means there is 42 percent more interior room in the 500L than the standard car, which means it's a good thing the only engine available is Fiat's 1.4-liter MultiAir turbo four-cylinder engine, as seen in the Abarth, with 160-horsepower and 184 pound-feet of torque. A manual gearbox is standard, and a dual-clutch automatic is optional, each with six gears.

The Trekking model features unique front and rear fascias and 17-inch alloy wheels to set it apart from the base 500L, and the black wheel arch and body-side sill moldings make it look more aggressive. Want to know more? Check out the high-res gallery above and scroll down below for the press release.

We need the sound of the Abarth 124 Spider in our lives

Tue, Apr 5 2016We've come to expect a certain sound to come from an Italian roadster, whether it's a Maserati, Ferrari, Lamborghini, or Pagani. But where those all boast eight, 10, or even 12 cylinders – naturally aspirated or otherwise – the comparatively humble little Fiat 124 Spider packs a turbo four. And that type of engine seldom offers the kind of sonorous exhaust note that the big boys can make. Fortunately the chianti-swilling grease monkeys at Officine Abarth are on the case. Fiat's performance brand revealed its take on the new Mazda-based roadster at the Geneva Motor Show a month ago, incorporating all manner of enhancements over the standard model. That includes a modest 10-horsepower boost over stock and a Record Monza exhaust. And as you can hear from this video, captured at a Ferrari event somewhere in Europe, it gives the new Scorpion roadster a real audible sting in its tail. Unfortunately the version we get Stateside – revealed as the Fiat 124 Spider Elaborazione Abarth at the New York Auto Show – lacks some its European counterpart's enhancements, including those extra 10 cavalli. The car in this video is Euro-spec, and Road & Track reports the US model will be "more refined" though still capture the Abarth spirit. Related Video: