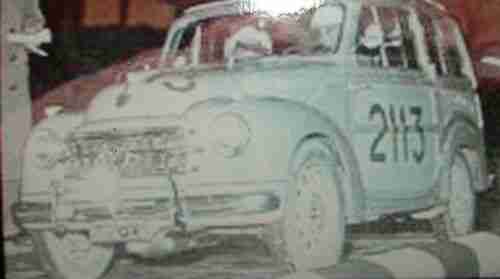

Fiat Classic Circa 1949 500c Topolino Belvedere "apribile" Station Wagon Rare ! on 2040-cars

Adelaide, SA, Australia

Body Type:Wagon

Vehicle Title:Clear

Engine:4 CYL 500 CC

Fuel Type:Gasoline

For Sale By:Private Seller

Exterior Color: TWO TONE BLUE

Make: FIAT

Model: 500

Trim: STATION WAGON

Drive Type: REAR

Mileage: 59,990

Fiat 500 for Sale

1 owner grigio (gray) fiat 500. bad credit, no credit financing available!(US $11,754.00)

1 owner grigio (gray) fiat 500. bad credit, no credit financing available!(US $11,754.00) 500 abarth w/ magneti marelli(US $22,000.00)

500 abarth w/ magneti marelli(US $22,000.00) 1971 fiat 500 l great runner low miles north carolina title

1971 fiat 500 l great runner low miles north carolina title 2012 pop 1.4l white

2012 pop 1.4l white Clean, one owner, navigation, sunroof, safety and convenience pkg w sat. radio(US $22,900.00)

Clean, one owner, navigation, sunroof, safety and convenience pkg w sat. radio(US $22,900.00) Very clean 1971 fiat 500(US $12,000.00)

Very clean 1971 fiat 500(US $12,000.00)

Auto blog

Officine Abarth Classiche dedicated to Scorpion heritage

Fri, Nov 20 2015It was only nine years ago that Fiat launched the Abarth brand as its dedicated performance division. But it didn't pull the name and logo out of thin air. Though it was essentially dormant for years, the Scorpion marque has a long history of tuning Italian pocket rockets for both road and race. And now it's launched a dedicated heritage division to manage its considerable history. Opening this week, the new Officine Abarth Classiche program will be responsible, among other things, for the restoration of vintage Abarth vehicles and the certification of their mechanical authenticity. Similar to the Ferrari Classiche department, private owners of classic Abarths will be able to send their pride and joy to the factory for service, maintenance, and restoration at the hands of factory technicians and with the benefit of the company's own archives. Work will be undertaken in a dedicated, thousand-square-foot workshop at the Mirafiori Abarth factory in Turin, and will of course include Abarth-tuned Fiats. But the program is also open to all the various Lancias, Alfa Romeos, Autobianchis, and Cisitalias fettled over the years by the Italian performance studio - to say nothing of the Zagato and Ghia prototypes. Beyond restoration, Officine Abarth Classiche will also organize special events for owners of vintage Abarth machinery, and undertake a comprehensive Abarth registry. It has also commissioned a book on the history of the marque, recreated company founder Carlo Abarth's office at the Mirafiori workshop, and even signed on Carlo's widow Anneliese Abarth to serve as a brand ambassador. It's an ambitious undertaking, and you can read about it in full – along with some history of the name – in the full press release below. Related Video: 18 November 2015 The Great Abarth Classiche Project - The great story of the performances and sporting grandeur of the Scorpion and the records it has broken is celebrated through the ambitious Abarth Classiche initiative.

Marchionne emailed Barra about merger between FCA and GM

Mon, May 25 2015Sergio Marchionne is adamant that global automakers will have to merge to remain profitable in the near future, and he'll tell that to anyone who's listening. Mary Barra, however, is not interested. According to The New York Times, the Fiat-Chrysler chief proposed a merger with General Motors via email to his counterpart back in March. Marchionne proposed meeting to discuss the matter, but Barra and her team reportedly rejected even entertaining the idea. This of course is not the first time Marchionne has raised the idea of a merger. He masterminded the marriage between Fiat and Chrysler, and reports have since suggested further mergers with Volkswagen, Peugeot, Ford, and others – including GM's own Opel unit. Some have taken his calls for consolidation as a weakness, but Marchionne insists that his empire is in good health – and that it's the industry as a whole which is in an untenable position. According to his view, automakers around the world need to align themselves into larger groups in order to reduce redundancy in investment, development and infrastructure – the duplication of which he terms as wasteful. "It's fundamentally immoral to allow for that waste to continue unchecked," said Marchionne to the Times. "I think it is absolutely clear that the amount of capital waste that's going on in this industry is something that certainly requires remedy," he said in a conference call with industry analysts late last month following the rejected GM approach. "A remedy in our view is through consolidation." News Source: The New York TimesImage Credit: Paul Sancya/AP Chrysler Fiat GM Sergio Marchionne merger fiat chrysler automobiles

Fiat Chrysler’s Sergio Marchionne throws more cold water on Tesla, EVs

Tue, Oct 10 2017Fiat Chrysler CEO Sergio Marchionne has once again sounded off on industry upstart Tesla and its wunderkind boss, Elon Musk. In the process, he doubled down on FCA's reluctance to follow its competitors headlong into electrifying its vehicle fleet, saying "we're not betting the bank on going fully electric in the next decade. It won't happen." Marchionne made his comments on Monday during remarks at the New York Stock Exchange, where he was marking the 70th anniversary of Ferrari. They come as Tesla struggles to ramp up production of its Model 3 sedan, its first mass-market offering, and the company continues to hemorrhage money. Here's what he said: "We still don't have a viable model for delivering an electric car. As much as I like Elon Musk, and he's a good friend, and actually he's done a phenomenal job of marketing Telsa, I remain unconvinced of a new economic viability of the model that he's pitching. So I think we need to be careful, because when we embrace electrification, and I made comments on the fact that we lose money on every Fiat 500, the electric that we sell in the U.S. Now that's reflective of the 2011-2010 costs in terms of components. Those costs have come down. If I were to do it again, I would certainly reduce the amount of the loss, but I would not make any money. And you can't run economic entities on losses. It doesn't happen. "So how do we find a convergence of technology bringing prices of components down and allows us to price accordingly — or we need to navigate through this process in a combined way between combustion and electrification to yield at least a minimum of economic returns that allows for our continuity? The last thing you want is me to be successful selling cars for 24 months and then go bust. That's not a good story. Especially in a place like this which rewards economic success. Let's not sit here and design our own future in the tank. Let's try and do it properly. We will do all the right things. We are investing without making a lot of noise on electrification. We will combine it with combustion to yield the right level of CO2. But we're not betting the bank on going fully electric in the next decade. It won't happen." It's not the first time Marchionne has publicly expressed doubts about Tesla's business plan.