2014 Fiat 500l Lounge on 2040-cars

800 N Central Expressway, McKinney, Texas, United States

Engine:1.4L I4 16V MPFI SOHC Turbo

Transmission:6-Speed Automatic with Auto-Shift

VIN (Vehicle Identification Number): ZFBCFACHXEZ021298

Stock Num: 14F179

Make: Fiat

Model: 500L Lounge

Year: 2014

Exterior Color: Green

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 12

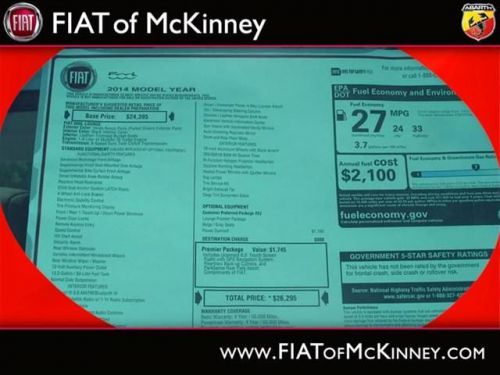

Move quickly! Special Financing Available: APR AS LOW AS 0% OR REBATES AS HIGH AS $1,500** Move quickly! This 2014 FIAT 500L Lounge is for FIAT aficionados the world over hunting for a noteworthy jewel*** This is the vehicle for you if you're looking to get great gas mileage on your way to work!!! Great safety equipment to protect you on the road: ABS, Traction control, Curtain airbags, Passenger Airbag, Front fog/driving lights...A wealth of standard amenities means that you no longer have to sacrifice: Leather seats, Bluetooth, Power locks, Power windows, Heated seats...

Fiat 500 for Sale

2014 fiat 500 lounge(US $25,250.00)

2014 fiat 500 lounge(US $25,250.00) 2014 fiat 500l lounge(US $28,245.00)

2014 fiat 500l lounge(US $28,245.00) 2014 fiat 500l trekking(US $26,095.00)

2014 fiat 500l trekking(US $26,095.00) 2013 fiat 500 sport turbo(US $21,893.00)

2013 fiat 500 sport turbo(US $21,893.00) 2014 fiat 500 lounge(US $22,250.00)

2014 fiat 500 lounge(US $22,250.00) 2014 fiat 500l trekking(US $23,995.00)

2014 fiat 500l trekking(US $23,995.00)

Auto Services in Texas

Zeke`s Inspections Plus ★★★★★

Value Import ★★★★★

USA Car Care ★★★★★

USA Auto ★★★★★

Uresti Jesse Camper Sales ★★★★★

Universal Village Auto Inc ★★★★★

Auto blog

FCA and Peugeot reportedly agree on merger

Wed, Oct 30 2019Citing a Wall Street Journal report, the Detroit Free Press says "Fiat Chrysler and PSA Groupe have agreed to merge." The Journal reported on talks between the two car companies only yesterday. It's said that Peugeot's board met yesterday to approve the deal, FCA's board met today, and an announcement could come as soon as tomorrow, Thursday. Both automakers have released statements, but neither company has released any information beyond admitting to ongoing talks. If the merger happens, the combined entity would become the world's fourth-largest carmaker with a $50 billion valuation, slotting in behind Toyota, the Volkswagen Group, and the Renault Nissan Mitsubishi alliance. Among the merger options possible, "an all-stock merger of equals" is the one analysts and Moody's seem to give the best grade. The reported merger would come about four months after FCA walked away from merger talks with Renault. FCA said the French government scuppered those talks over the role of Nissan in a reformed entity, but there were also brewing issues with French unions, and ongoing turmoil among Renault and Nissan leadership thanks to continuing fallout from ex-CEO Carlos Ghosn's arrest last year. FCA makes most of its revenue in the U.S. and rules Italy, while Peugeot is the second-best-selling automaker in Europe with its own brand in France and Opel in Germany. The two companies already have a partnership in Europe making vans, one that FCA CEO Mike Manley has spoken highly of. Among the list of obvious benefits in a potential merger, FCA would get access to Peugeot's small, modern platforms, $10.2 billion in cash, and electrified and hybrid architecture developments, the latter especially important to FCA as those are fields where it lags. Peugeot would get much easier access to the U.S. market, and the money-printing brands Jeep and Ram. A merged carmaker would have combined sales of nearly 9 million a year, based on 2018 results. By comparison, both Volkswagen and Toyota sell over 10 million cars a year, while the Renault-Nissan-Mitsubishi alliance almost 11 million. Peugeot CEO Carlos Tavares has proved he knows how to do turnarounds and mergers. After leaving a position as Carlos Ghosn's right-hand man in 2012, Tavares took over Peugeot in 2014, navigated a bailout from the French government and China's Dongfeng Motors in 2015, and turned PSA into a regional powerhouse.

FCA's Pentastar V6 gets more power, efficiency for 2016

Wed, Sep 2 2015Already a vital member of FCA's powertrain lineup, the 3.6-liter Pentastar V6 is receiving major efficiency improvements for 2016. Thanks to a massive amount of new tech attached to the mill, fuel economy is up six percent, and torque below 3,000 rpm jumps nearly 15 percent. The updates arrive first in the 2016 Jeep Grand Cherokee, but they should proliferate to other models eventually. At least in the Grand Cherokee, the tweaks push power up five horsepower to 295 ponies. FCA's engineers went through the Pentastar from top to bottom to eke out as much efficiency as possible. For example, there's now a two-speed variable-valve lift system that can run in low- or high-lift modes. This upgrade is responsible for 2.7-percent better economy, the company claims. A new intake manifold with longer runners and updated variable-valve times also helps boost the torque output. Further improvements come from pushing the compression ratio to 11.3:1, from 10.2:1 before. Perhaps most impressive is that despite all of the innovations, the latest Pentastar actually weighs four pounds less than the current version. Beyond the Pentastar improvements, all of the FCA US gasoline engines, except for the Viper's 8.4-liter V10, will be E15-compatible for 2016. The company says that it wants to be ready for the higher ethanol content fuel's greater use in the near future.

Marchionne's FCA-GM merger might come after Ferrari spinoff

Sat, Sep 5 2015Sergio Marchionne is continuing to rumble about working out a merger with General Motors, but don't expect anything big to happen before at least early next year. That's because Marchionne would likely wait for the Ferrari spin-off to be complete before beginning his next big deal, according to Automotive News. While the Ferrari IPO on the New York Stock Exchange is expected in the coming weeks, that only concerns 10 percent of the shares. The remaining 80 percent of stock is being distributed among shareholders in 2016. Piero Ferrari holds the final 10 percent with no intention to sell. This strategy allows FCA to claim 80 percent of the Prancing Horse's profits in the automaker's 2015 financial results. According to Automotive News, the tactic has other advantages, as well. FCA would be flush with cash by waiting for the spin-off to be complete, and it would keep Ferrari separate if a GM merger actually happens. Marchionne thinks Ferrari could be valued at over $11 billion in the IPO, and it could make FCA $3.3 billion richer when complete. Marchionne believes a combined FCA/GM could sell 17 million vehicles a year globally and rake in $30 billion in earnings. In the CEO's opinion, the two automakers are wasting money by developing components to do the same things on their vehicles. Although, so far the General's top execs are rebuffing all of his advances.