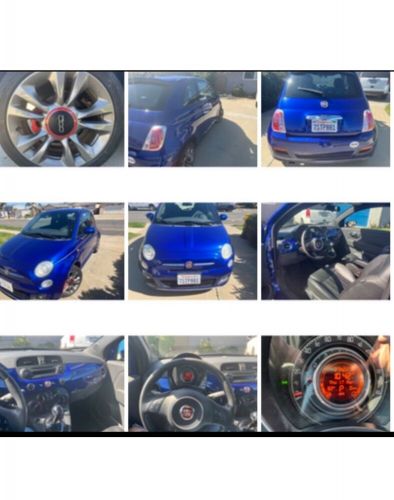

2014 Fiat 500 on 2040-cars

Crestline, California, United States

Vehicle Title:Clean

VIN (Vehicle Identification Number): 3C3CFFBR6ET207971

Mileage: 52500

Make: Fiat

Model: 500

Number of Seats: 4

Fiat 500 for Sale

1970 fiat 500 coupe - (collector series)(US $16,998.00)

1970 fiat 500 coupe - (collector series)(US $16,998.00) 2012 fiat 500 pop cabrio 5-spd(US $11,995.00)

2012 fiat 500 pop cabrio 5-spd(US $11,995.00) 1971 fiat 500 coupe - (collector series)(US $16,998.00)

1971 fiat 500 coupe - (collector series)(US $16,998.00) 2015 fiat 500 sport(US $3,900.00)

2015 fiat 500 sport(US $3,900.00) 2013 fiat 500 lounge(US $1,000.00)

2013 fiat 500 lounge(US $1,000.00) 2012 fiat 500 pop(US $290.00)

2012 fiat 500 pop(US $290.00)

Auto Services in California

ZD Autobody ★★★★★

Z Benz Company Inc ★★★★★

Www.Bumperking.Net ★★★★★

Working Class Auto ★★★★★

Whittier Collision Center #2 ★★★★★

West Tow & Roadside Servce ★★★★★

Auto blog

Sell your own: 2015 Fiat 500 Abarth

Wed, May 3 2017Looking to sell your car? We make it both easy and free. Quickly create listings with up to six photos and reach millions of buyers. Log in and create your free listings. Bred from the rich postwar history of Fiat and its competition counterpart, Abarth, Fiat Chrysler reintroduced the Fiat 500 Abarth to US showrooms in 2012. It had been a long time since US drivers had access to a small, easy-to-park Italian package. Mini's Cooper S provided Fiat Chrysler with the market research, and like Burger King locating next to a McDonald's, Fiat's 500 Abarth was ushered into US showrooms. With the 500 delivering just over 100 horsepower, the Abarth (a-BART) supplies a full 160 horsepower to the front wheels, along with an oh-so-flexible 170 pound-feet of torque. Driving through a five-speed manual (or available automatic), and planted on a short 90-inch wheelbase, the 500 Abarth offers the engagement your friends (prior to the iPhone) used to provide. Our 'for sale' 2015 example, located in Prescott, Arizona, looks to be in good cosmetic condition. With but 24,000 miles it should have plenty of high-revving life left in it. We'd always suggest a pre-purchase inspection, and those with rural zip codes should consider Fiat dealer support. But if looking for bang-for-the-buck (and the seller's 'ask' is right where it should be), there are few better options this side of $20,000. Please find the listing here. Related Video:

Marchionne ready to get tough with GM over merger

Mon, Aug 31 2015FCA CEO Sergio Marchionne absolutely refuses to let go of his dream of a merger with General Motors. With official discussions not happening, Marchionne now hints that a hostile takeover attempt of The General could be under consideration as a future strategy. In a massive interview with Automotive News, the boss explains why a tie-up with GM might be such a windfall for both automakers. By Marchionne's numbers, a merged GM-FCA would produce $30 billion a year in global earnings and 17 million vehicles annually. He claims these huge figures are based on analyzing plants around the world to find growth opportunities. So far, GM is refusing to sit down and look at the numbers, let alone even begin to negotiate. For now, Marchionne just wants to talk, but he's not against aggressive action, if necessary. He uses a bizarre metaphor in the interview to explain his feelings. "There are varying degrees of hugs. I can hug you nicely, I can hug you tightly, I can hug you like a bear, I can really hug you. Everything starts with physical contact," he said to Automotive News. "An attack on GM, properly structured, properly financed, it cannot be refused," he said in the interview. Marchionne is looking for partners, too. The UAW's significant stake in GM could be a strong ally, and he's reportedly recruiting activist investors for more help. Selling Magneti Marelli and spinning off Ferrari would put even more cash in the war chest. Both sides also have banks at their aid. While Marchionne received positive replies from some of his "Plan B" partners, he apparently lost interest in working with them. "Are they the people I wanted to get the response from? The answer is probably not. There are people who are interested in doing deals," he said in the interview. News Source: Automotive News - sub. req.Image Credit: Paul Sancya / AP Photo Earnings/Financials Chrysler Fiat GM Sergio Marchionne FCA merger

Fiat taps Mitsubishi for European pickup

Wed, 04 Jun 2014Mitsubishi is often derided in the US for its relatively boring lineup, Lancer Evolution aside, but the company is on the upswing worldwide, recently posting record global operating profits. The Japanese automaker may get a further boost in the near future from a rumored pickup truck deal with Fiat.

According to insider sources speaking to Automotive News Europe, Mitsubishi would reportedly build a variant of its widely respected L200 pickup truck for the Fiat Professional brand in Europe and Latin America starting in 2016. The L200 is larger than the Fiat Strada front-wheel-drive pickup already available in those markets, and it's available in rear- and four-wheel-drive configurations. The idea of adding a midsize truck to the commercial lineup was in the Fiat-Chrysler Automobiles five-year plan, but it didn't include any mention of a partnership to build it.

At first blush, the Mitsubishi agreement seems like an odd move, given that Fiat already owns pickup truck specialists Ram. However, according to ANE, the company had at one time planned to use a version of a new Dodge Dakota pickup for duty in Europe and Latin America, but the model never came to fruition.