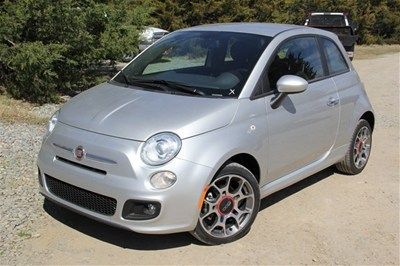

2012 Sport 1.4l Silver on 2040-cars

Bonham, Texas, United States

Vehicle Title:Clear

Engine:1.4L 1368CC 83Cu. In. l4 GAS SOHC Naturally Aspirated

Body Type:Hatchback

Fuel Type:GAS

Interior Color: Other

Make: Fiat

Model: 500

Warranty: Vehicle does NOT have an existing warranty

Trim: Sport Hatchback 2-Door

Number of doors: 2

Drive Type: FWD

Mileage: 62,978

Number of Cylinders: 4

Exterior Color: Silver

Fiat 500 for Sale

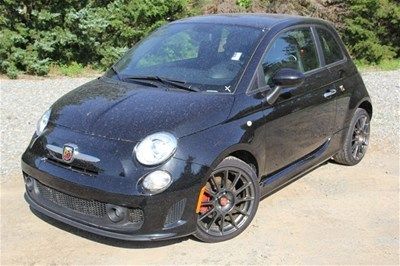

2012 abarth 1.4l black(US $20,999.00)

2012 abarth 1.4l black(US $20,999.00) 2012 abarth 1.4l grey(US $22,999.00)

2012 abarth 1.4l grey(US $22,999.00) 2dr hb abarth new hatchback manual 1.4l 16-valve i4 multi-air turbo engine red

2dr hb abarth new hatchback manual 1.4l 16-valve i4 multi-air turbo engine red 2012 fiat 500 pop auto cruise ctrl xenons only 114 mi! texas direct auto(US $15,780.00)

2012 fiat 500 pop auto cruise ctrl xenons only 114 mi! texas direct auto(US $15,780.00) 2012 abarth 1.4l white(US $23,999.00)

2012 abarth 1.4l white(US $23,999.00) Fiat 500 l classic -lusso model. super clean! registered in california! no rust!(US $14,999.99)

Fiat 500 l classic -lusso model. super clean! registered in california! no rust!(US $14,999.99)

Auto Services in Texas

Zoil Lube ★★★★★

Young Chevrolet ★★★★★

Yhs Automotive Service Center ★★★★★

Woodlake Motors ★★★★★

Winwood Motor Co ★★★★★

Wayne`s Car Care Inc ★★★★★

Auto blog

Ram ProMaster City getting facelift courtesy of Fiat Doblo?

Thu, 13 Mar 2014Our intrepid spy photographers have caught prototypes for a new Fiat Doblo. Now we know what you might be thinking (particularly if you didn't take note of the headline): why would we care about an automaker conducting a facelift on a European cargo van? Normally we wouldn't, only the Fiat Doblo has another name, under which it will be shortly be sold here in America: Ram ProMaster City.

Announced just months ago, the ProMaster City is the smaller counterpart to the Ram ProMaster, which itself is also a rebadged cargo van from Fiat Professional. Think of it as a Chrysler version of the Ford Transit and Transit Connect lineup - European vans being brought Stateside by automakers that operate on both sides of the Atlantic.

But despite the official announcement of the vehicle's pending arrival, we still haven't seen the PMC yet. The disguised Doblo prototypes pictured here appear to be wearing a completely new front end and some cosmetic revisions to their tail ends, too. We can't see anything in the interior, but the fact that it was completely covered up suggests that Fiat is working on overhauling that, as well.

Fiat buying rest of Chrysler in $4.35 billion deal, IPO avoided

Wed, 01 Jan 2014Chrysler will now become a wholly owned member of the Fiat family, as it's been announced that the 41.46-percent stake in the Auburn Hills, MI-based manufacturer owned by the United Auto Workers' VEBA trust fund will be sold to the Italian company. Concluding the agreement will mark the closure of a piecemeal purchase process that could have resulted in an initial public offering.

The total cost of the sale will see the VEBA healthcare trust receive $4.35 billion, $3.65 billion of which will come from Fiat. $1.75 billion of that will be cash, while an additional $1.9 billion will be part of a "special distribution." An additional $700 million will be paid over four separate installments according to reports from Automotive News Europe and USA Today, although the shares will belong to Fiat following the first payment. The deal was reportedly initially struck on Sunday (though it is just being announced today), and is being portrayed as particularly good news for Fiat and Chrysler, which have now prevented the remaining shares going to the stock market in a UAW-forced IPO.

"The unified ownership structure will now allow us to fully execute our vision of creating a global automaker that is truly unique in terms of mix of experience, perspective and know-how, a solid and open organization that will ensure all employees a challenging and rewarding environment," Fiat CEO Sergio Marchionne said in a statement.

Stellantis launching at least 25 EVs for America by 2030

Tue, Mar 1 2022Stellantis has announced a wide-ranging plan for the company through 2030 covering everything from product to financials. The product plans are what really caught our attention, particularly for the surprise reveal of the first electric Jeep, as well as new teasers of the electric Ram 1500. But the company also provided more broad details on what we'll be seeing in the future including both electric cars and hydrogen fuel cell vehicles. All of the plans are in service of the Stellantis goal of reaching net zero carbon emissions by 2038. On that way, it plans for all European vehicle sales and half of all American sales to be electric by 2030. It will launch 75 new electric vehicles by that year, and at least 25 of them will be coming to the U.S. The first of those electric cars will be the aforementioned Jeep in 2023, but many Stellantis models will follow close behind. The electric Ram ProMaster will launch in 2023 as well. In 2024, we'll see the electric Ram (and its plug-in hybrid counterpart), two more Jeeps (an off-road model and a family-oriented model) and the Dodge electric muscle car. We'll get a preview of the Dodge with a concept this year. Then in 2025, Chrysler will launch its electric car, likely based on the Airflow concept. Stellantis has previously announced Chrysler will be fully electric by 2028, and it further announced that Alfa Romeo and Maserati will be fully electric by 2030. Stellantis is also working on hydrogen fuel cell vehicles, mainly for commercial use. For the U.S., it plans on offering a large, ProMaster-size hydrogen van in 2025. That year or a little later, it also has plans for a hydrogen heavy-duty pickup truck, presumably Ram 2500 and 3500. Stellantis CEO Carlos Tavares noted that among the benefits of hydrogen for large and commercial vehicles is being able to avoid compromising payload capacity, since hydrogen powertrains are lighter than giant batteries. Hydrogen filling times are quick relative to charging, too. The company will continue working on and offering advanced driver aids. This year it will offer hands-free cruise control like GM's Super Cruise and Ford's BlueCruise. In 2024, the company intends to introduce a system that is hands-free and won't require the driver to be watching it the entire time. The technology is being developed alongside BMW. These are, of course, broad plans, and they could change as time goes on. Expect more details as we get closer to individual product releases.