2012 Sport 1.4l Red on 2040-cars

Bonham, Texas, United States

Vehicle Title:Clear

Engine:1.4L 1368CC 83Cu. In. l4 GAS SOHC Naturally Aspirated

Body Type:Hatchback

Fuel Type:GAS

Interior Color: Other

Make: Fiat

Model: 500

Warranty: Vehicle does NOT have an existing warranty

Trim: Sport Hatchback 2-Door

Number of doors: 2

Drive Type: FWD

Mileage: 28,286

Number of Cylinders: 4

Exterior Color: Red

Fiat 500 for Sale

2012 sport 1.4l silver(US $13,999.00)

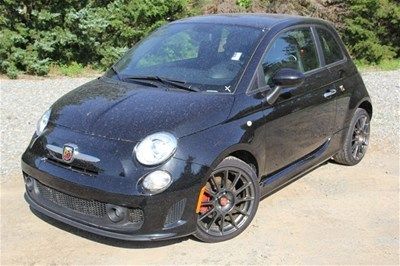

2012 sport 1.4l silver(US $13,999.00) 2012 abarth 1.4l black(US $20,999.00)

2012 abarth 1.4l black(US $20,999.00) 2012 abarth 1.4l grey(US $22,999.00)

2012 abarth 1.4l grey(US $22,999.00) 2dr hb abarth new hatchback manual 1.4l 16-valve i4 multi-air turbo engine red

2dr hb abarth new hatchback manual 1.4l 16-valve i4 multi-air turbo engine red 2012 fiat 500 pop auto cruise ctrl xenons only 114 mi! texas direct auto(US $15,780.00)

2012 fiat 500 pop auto cruise ctrl xenons only 114 mi! texas direct auto(US $15,780.00) 2012 abarth 1.4l white(US $23,999.00)

2012 abarth 1.4l white(US $23,999.00)

Auto Services in Texas

Zepco ★★★★★

Z Max Auto ★★★★★

Young`s Trailer Sales ★★★★★

Woodys Auto Repair ★★★★★

Window Magic ★★★★★

Wichita Alignment & Brake ★★★★★

Auto blog

Macron and Le Pen decry 'shocking' Stellantis CEO pay

Mon, Apr 18 2022PARIS — French President Emmanuel Macron and his far-right challenger in the French presidential vote, Marine Le Pen, on Friday both decried as “shocking” the multimillion euro payout to the CEO of carmaker Stellantis. Stellantis CEO Carlos TavaresÂ’ remuneration package of 19.15 million euros just a year after the company was formed became an issue as Macron and Le Pen campaigned ahead of the April 24 runoff vote. Polls show purchasing power and inflation are a top voter concern. Stellantis was formed last year through the merger of PSA Peugeot and Fiat Chrysler Automobiles. Centrist President Emmanuel Macron, perceived by many voters as being too pro-business, called the pay package “astronomical” and pushed for a Europe-wide effort to set ceilings on “abusive” executive pay. “ItÂ’s shocking, itÂ’s excessive,” he said Friday on broadcaster France-Info. “People canÂ’t have problems with purchasing power, difficulties, the anguish theyÂ’re living with, and see these sums. Otherwise, society will explode.” Far-right leader Marine Le Pen, who enjoys support from many working-class voters, called for bringing in more workers as shareholders. “Of course itÂ’s shocking, and itÂ’s even more shocking when it is the CEOs who have pushed their society into difficulty,” she said Friday on BFM television. “One of the ways to diminish this pay, which is often out of proportion with economic life, is perhaps to allow workers in as shareholders.” Stellantis continued to back the package despite a 52.1% to 47.9% vote rejecting it at an annual shareholders' meeting chaired from the Netherlands, where the company is legally based, on Wednesday. The company, citing Dutch civil code, noted that the vote is advisory and not binding. The company later said in a statement that it took note of the vote, and will explain in an upcoming 2022 remuneration report “how this vote has been taken into account.” In the 2021 report, the company identified peer group companies that it used as a salary benchmark, including U.S. companies like Boeing, Exxon Mobile, General Electric as well as carmakers Ford and General Motors. Stellantis, whose brands include Peugeot, Fiat, Jeep, Opel and Maserati, reported net profits last year had tripled to 13.4 billion euros ($15.2 billion). The French government is the third-largest shareholder in Stellantis, with a 6.15% stake through the Bpifrance Participations S.A. French public investment bank.

FCA recalls 1.25M trucks for software error in fatal crash

Fri, May 12 2017WASHINGTON - Fiat Chrysler Automobiles said Friday it would recall more than 1.25 million pickup trucks worldwide to address a software error linked to reports of one crash death and two injuries. The error code could temporarily disable the side air bag and seat belt pretensioner deployment during a vehicle rollover spurred by a significant underbody impact, such as striking onroad debris or driving off-road, the Italian-American automaker said. The company will reprogram computer modules in the affected vehicles to address this error. The recall covers 1.02 million 2013-16 Ram 1500 and 2500 pickups, and 2014-2016 Ram 3500 pickups in the United States, 216,007 vehicles in Canada; 21,668 in Mexico; and 21,530 outside North America, the automaker said. Fiat Chrysler said the recall would begin in late June. In the event of the software error code, the problem could temporarily be addressed by turning the vehicle off and then on, the company said. The automaker told the U.S. National Highway Traffic Safety Administration it began investigating the issue in December after it received notice of a suit involving a 2014 Ram 1500 in which the airbag failed to deploy in a rollover crash.Reporting by David ShepardsonRelated Video: Recalls Chrysler Fiat Truck FCA airbag fiat chrysler automobiles

NHTSA investigating Harman Kardon for software vulnerabilities

Mon, Aug 3 2015The National Highway Traffic Safety Administration is investigating infotainment units from Harman Kardon, which produces FCA's Uconnect, to determine if Harman Kardon systems used by other companies are also vulnerable to hackings. Researchers discovered a hole in the cellular connection to the Uconnect infotainment in a Jeep Cherokee. They were able to exploit it to gain access to the vehicle's brakes, radio, and other systems. In the wake of the hack, FCA pledged to send out 1.4 million USB drives to update the software. Politicians also attacked the automaker for not reporting the problem sooner, and NHTSA opened an investigation to find whether the fix worked. INVESTIGATION Subject : Software security vulnerability Date Investigation Opened: JUL 29, 2015 Date Investigation Closed: Open NHTSA Action Number: EQ15005 Component(s): EQUIPMENT All Products Associated with this Investigation Equipment Brand Name Part No. or Model No.Production Dates HARMAN KARDON R3R4 - Details Manufacturer: HARMAN INTERNATIONAL SUMMARY: On July 23, 2015, Fiat Chrysler Automobiles (FCA) submitted a safety recall report to NHTSA concerning a software security defect condition in approximately 1.4 million model year (MY) 2013 through 2015 vehicles equipped with Uconnect 8.4A (RA3) and 8.4AN (RA4) radios manufactured by Harman Kardon (Recall 15V-461). According to FCA, software security vulnerabilities in the recalled vehicles could allow unauthorized third-party access to, and manipulation of, networked vehicle control systems. Unauthorized access or manipulation of the vehicle control systems could reduce the driver?s control of the vehicle increasing the risk of a crash with an attendant increased risk of injury to the driver, other vehicle occupants, and other vehicles and their occupants within proximity to the affected vehicle. This EQ is being opened to obtain information from the supplier of Chrysler Uconnect units to determine the nature and extent of similarities in other infotainment products provided to other vehicle manufacturers. If sufficient similarities exist, the investigation will examine if there is cause for concern that security issues exist in other Harman Kardon products. Related Video: