2012 Fiat 500 Abarth - All Options, 5.6k Miles on 2040-cars

Costa Mesa, California, United States

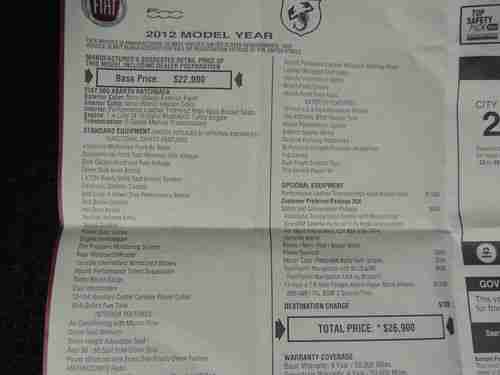

Body Type:Hatchback

Vehicle Title:Clear

Engine:1.4L 1368CC 83Cu. In. l4 GAS SOHC Turbocharged

Fuel Type:Gasoline

For Sale By:Private Seller

Make: FIAT

Model: 500

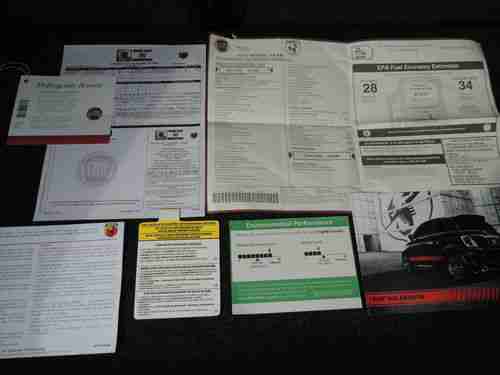

Warranty: Vehicle has an existing warranty

Trim: Abarth Hatchback 2-Door

Options: Sunroof, Leather Seats, CD Player, Navigation

Drive Type: FWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Mileage: 5,600

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows

Exterior Color: Black

Interior Color: Black and red

Number of Cylinders: 4

Fiat 500 for Sale

2012 pop used 1.4l i4 16v manual hatchback premium

2012 pop used 1.4l i4 16v manual hatchback premium 2012 fiat 500 gucci

2012 fiat 500 gucci Beautiful 1973 fiat 600l-real quality with rebuilt engine+delivery service(US $7,950.00)

Beautiful 1973 fiat 600l-real quality with rebuilt engine+delivery service(US $7,950.00)

Brand new loaded 2013 fiat 500 abarth cabrio! priced to sell asap!(US $29,600.00)

Brand new loaded 2013 fiat 500 abarth cabrio! priced to sell asap!(US $29,600.00) Fiat 500 rotisserie restored as new ! (shipping cost included in bidding price)(US $14,950.00)

Fiat 500 rotisserie restored as new ! (shipping cost included in bidding price)(US $14,950.00)

Auto Services in California

Zoe Design Inc ★★★★★

Zee`s Smog Test Only Station ★★★★★

World Class Collision Ctr ★★★★★

WOOPY`S Auto Parts ★★★★★

William Michael Automotive ★★★★★

Will Tiesiera Ford Inc ★★★★★

Auto blog

Fiat debuts 500 Ribelle, 500L Urbana Trekking

Sat, 08 Nov 2014Fiat has introduced a pair of special edition models at the 2014 Miami Auto Show, trotting out the 500 Ribelle and the 500L Urbana Trekking.

The smaller of the two, the compact 500 Ribelle, expands on the 500's retro-chic looks by adding a red roof, spoiler and mirror caps, which should contrast nicely with the limited color palette of Bianco, Billet Argento, Grigio and Nero Puro. Aside from the paint changes, Fiat has added gloss black headlight and taillight bezels and black wheels. The cabin comes with a choice of two upholstery colors: gray and red or gray and black.

The five-door 500L Urbana Trekking adds a few pieces of matte-painted trim, in the form of new mirror caps, side sills and body side molding. Matte-black, 17-inch wheels spice up the exterior and match the standard black roof, while Fiat's six selectable colors (Verde Bosco Perla, Rosso Perla, Giallo, Bianco, Grigio Scuro and Blue Tornado) add a degree of customization to the limited-edition five-door. For some reason, the pretty matte paint shown in the gallery was a one-off item for the debut car, and won't be offered to consumers. Gloss black interior trim pieces and a mix of black leather and leatherette change up the interior ever so slightly. Beats Audio and satellite radio are both standard features.

Buy a real Popemobile: the Pontiff's Fiat 500L

Sat, Jan 23 2016Pope Francis has urged people to drive "humble" cars, and he practiced what he preached during last year's US visit by riding in a Fiat 500L rather than a more opulent vehicle. The Archdiocese of Philadelphia will offer the chance to feel a little closer to His Holiness on January 29 by auctioning at least one of the Fiats from the Pope's trip at the Philadelphia Auto Show Black Tie Tailgate. All of the auction's proceeds will follow Pope Francis' desire to help the less fortunate. Half of the money will go to the Catholic Charities Appeal, which aids those that struggle with homelessness and poverty. The other half will be split equally among Mercy Hospice, Casa Del Carmen, and the Schools of Special Education of the Archdiocese of Philadelphia. "The Fiat is such an icon of Pope Francis' visit to Philadelphia and the auction of this vehicle serves as an extraordinary final event to close this memorable chapter in the City's history," Donna Crilley Farrell, Executive Director of the World Meeting of Families – Philadelphia 2015, said. FCA US let Pope Francis use two 500Ls while he was in Philadelphia, and the automaker then donated the cars to the Archdiocese, according to its director of communications Kenneth Gavin to Autoblog. The Archdiocese still hasn't decided whether to auction the other one at the Black Tie Tailgate, but the Fiat will be on display at the Philadelphia Auto Show from January 30 through February 7. It's difficult to put a price tag on these special vehicles, Gavin told Autoblog, but the Archdiocese hopes to get as much as possible for them to benefit the charities. FCA US and the US Secret Service have records of the cars' VINs from the trip, and the Archdiocese would show the winning bidder all the documentation to certify the vehicle's authenticity. Related Video: The Archdiocese of Philadelphia and World Meeting of Families – Philadelphia 2015 Offer Opportunity for Bidders to Own a FIAT 500L Used by Pope Francis During Historic Philadelphia Visit at the Philadelphia Auto Show Black Tie Tailgate Held at the Pennsylvania Convention Center on Friday, January 29, the auction will benefit the Catholic Charities Appeal, Catholic Social Services, Mercy Hospice, Casa Del Carmen, and the Archdiocesan Schools of Special Education.

Alfa Romeo will gain a Jeep Compass-based SUV

Fri, Nov 30 2018It was reported earlier this week that FCA would invest into its Italian factories to ramp up production at currently underutilized locations. Those plans have now been clarified with official information from FCA, as reported by Automotive News. The entire investment is worth $5.7 billion. First of all, Alfa Romeo will gain a new compact SUV based on the Jeep Compass architecture. The still-unnamed model will be available as a plug-in hybrid, and it will be built in Pomigliano, Italy. No U.S. availability has yet been announced, but it would not be odd to see the Compass-based model sold below the Stelvio in the States. The last time Alfa Romeo had anything similar in its model portfolio was when it offered Crosswagon-badged four-wheel-drive versions of the 156 and 159 wagons. As for the Jeep Compass itself, it will begin to be built at the Melfi plant in Italy. The rumored small "baby" Jeep slotting under the Renegade has not yet been officially mentioned. Fiat will introduce a battery electric 500, built in Turin, and the Pomigliano plant that will make the compact Alfa Romeo SUV will also be used to build a mild hybrid version of the Panda city car. The 500X will gain a PHEV variant. The Stelvio platform will also spawn a corresponding SUV for Maserati, and FCA also mentioned Maserati will introduce a new, unnamed model it will make in Modena. Automotive News quotes Italian press as saying this will be the Alfieri coupe and convertible, also offered as battery electric versions. Related Video: