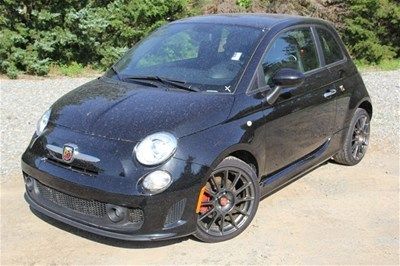

2012 Abarth 1.4l Black on 2040-cars

Bonham, Texas, United States

Vehicle Title:Clear

Engine:1.4L 1368CC 83Cu. In. l4 GAS SOHC Turbocharged

Body Type:Hatchback

Fuel Type:GAS

Interior Color: Other

Make: Fiat

Model: 500

Warranty: Vehicle does NOT have an existing warranty

Trim: Abarth Hatchback 2-Door

Number of doors: 2

Drive Type: FWD

Mileage: 48,538

Number of Cylinders: 4

Exterior Color: Black

Fiat 500 for Sale

2012 abarth 1.4l grey(US $22,999.00)

2012 abarth 1.4l grey(US $22,999.00) 2dr hb abarth new hatchback manual 1.4l 16-valve i4 multi-air turbo engine red

2dr hb abarth new hatchback manual 1.4l 16-valve i4 multi-air turbo engine red 2012 fiat 500 pop auto cruise ctrl xenons only 114 mi! texas direct auto(US $15,780.00)

2012 fiat 500 pop auto cruise ctrl xenons only 114 mi! texas direct auto(US $15,780.00) 2012 abarth 1.4l white(US $23,999.00)

2012 abarth 1.4l white(US $23,999.00) Fiat 500 l classic -lusso model. super clean! registered in california! no rust!(US $14,999.99)

Fiat 500 l classic -lusso model. super clean! registered in california! no rust!(US $14,999.99) 1968 fiat 500 black with red interior. beautiful car and delivery service offer(US $12,000.00)

1968 fiat 500 black with red interior. beautiful car and delivery service offer(US $12,000.00)

Auto Services in Texas

Wolfe Automotive ★★★★★

Williams Transmissions ★★★★★

White And Company ★★★★★

West End Transmissions ★★★★★

Wallisville Auto Repair ★★★★★

VW Of Temple ★★★★★

Auto blog

Peugeot maker PSA posts record profits ahead of FCA merger

Wed, Feb 26 2020PARIS — Peugeot maker PSA Group said its profitability reached a record high in 2019 but the French carmaker forecast falling industry sales in Europe this year as it pursues its merger with Fiat Chrysler, which is strong in North America. PSA has trimmed costs in areas such as the procurement of components as it has integrated its acquisition of Opel and Vauxhall, boosting operating margins to 8.5% last year. The group, which also produces cars under the Citroen and DS brands, offset a slump in vehicle sales by selling pricier SUV models, with launches including the Citroen C5 Aircross helping to lift revenues by a higher-than-expected 1% to $81.2 billion (74.7 billion euros). That helped it stand out in a car market where some rivals including France's Renault have struggled with sliding revenues and profits, amid a broader downturn in demand. PSA's group net profit increased 13.2% to a record 3.2 billion euros, and the company increased its dividend against 2019 results to 1.23 euros per share, up 58% from 2018 levels. The carmaker was "once again very solid", analysts at brokerage Oddo-BHF said in a note, adding the results confirmed the company's "best-in-class status." However PSA forecast a 3% contraction in Europe's car market this year, by far its biggest market. The tie-up with Fiat Chrysler will help it gain exposure to that group's strong presence in North America with brands like Jeep. The two companies struck a deal in December to create the world's No.4 carmaker, to better cope with market turmoil and the cost of making less-polluting vehicles. Fiat also posted more upbeat results than most rivals this year. CORONAVIRUS WEIGHS PSA boss Carlos Tavares told a news conference that the two groups were both in good shape and well placed to face market challenges together. He said he did not expect any major regulatory hurdles to the merger, adding it had so far submitted 14 approval requests to competition authorities out of the 24 it needs. There are no immediate plans to change anything in the large portfolio of brands within the combined group, he added. However the companies still face problems this year, including the coronavirus outbreak which has paralyzed production in China and hits carmakers' supply chain. PSA said the coronavirus impact was still difficult to assess. It factories in Wuhan, at the epicenter of the outbreak, are due to reopen in the second week of March.

Strains between France and Italy risk Renault-FCA merger

Thu, May 30 2019PARIS/ROME — Fiat Chrysler's proposed $35 billion merger with Renault has cheered investors, won conditional support from Paris and Rome and even earned cautious backing from trade unions. Beneath this veneer, however, the bold attempt to create the world's third-largest carmaker risks becoming rapidly embroiled in the fraught relationship between France's europhile President Emmanuel Macron and Italy's euroskeptic leaders. For while Deputy Prime Minister Matteo Salvini hailed the proposal as a "brilliant operation," Italy's creaking, state-subsidized Fiat factories are likely to bear the brunt of any production-related cost savings. FCA and Renault said this week that more than 5 billion euros ($5.6 billion) of annual savings would come mainly from combining platforms, consolidating powertrain and electrification investments and the benefits of increased scale. Salvini and France's Finance Minister Bruno Le Maire, who called the deal a "good opportunity" to build a European industrial champion able to compete with China and the United States, have both said they want guarantees on local jobs. "It's not every day that I agree with Salvini," said Le Maire, whose government appears to hold the trump cards. When it comes to where any job cuts fall, France will be helped by its existing 15 percent holding in Renault, whose superior efficiency at its five French plants makes it better placed to handle a supply glut, the demise of the petrol engine and the investments needed for electric and autonomous vehicles. "It will take many, many years to find real savings, and ugly political and operational realities can often swamp the potential of such new entities," Bernstein analyst Max Warburton said of the FCA-Renault plan to rival Japan's Toyota and Germany's Volkswagen. Advantage France? As well as Italy's government having to cope with the aftermath of European elections, which coincided with news of the FCA-Renault plans, political leaders in Rome were only informed shortly before the deal was made public, an FCA source said. This contrasted with the way the French government was treated, with Fiat Chrysler Chairman John Elkann, a fluent French speaker, letting it know of his merger proposal to Renault weeks ago, a French government official said.

Recharge Wrap-up: Fiat 500X emissions, Japan EV sales down

Thu, Feb 11 2016The Fiat 500X exceeds EU emissions limits, according to environmental lobby group DUH. In dyno tests, DUH found NOx emissions in the diesel-powered 500X to be 11 to 20 times the limit with a warm engine, but closer to the limit with a cold engine. Testing of vehicles from Fiat and other automakers "point towards defeat devices," says DUH campaigner Axel Friedrich. Fiat Chrysler Automobiles (FCA) offered no comment in response to the accusations. Read more from Reuters. A UK study finds that about 20 percent of the benefits from fuel efficient vehicles are negated by a tendency for people to drive them more. The study, which covers the years 1970 to 2011, finds a significant "rebound effect," when consumers use more of a cheaper energy source. It suggests these drivers drive more not because of the fuel efficiency, but because of the lower operating costs. "Until now, we didn't know the size of this effect for British motoring," says Dr. Lee Stapleton, Research Fellow for the University of Sussex Centre on Innovation and Energy Demand. "We found evidence of a significant, long-term rebound and expect our results to be of interest for public policy." Read more at Green Car Congress. Japanese EV sales have declined for the first time ever. Sales of electric vehicles slid 22 percent in 2015, leaving them at the same levels as 2012. Low gasoline prices are to blame, as well as the late arrival of the updated Nissan Leaf, which caused potential customers to hold off on their purchase. This allowed the Mitsubishi Outlander PHEV to take the lead as Japan's best selling EV. The Toyota Prius Plug-In came in third place in EV sales, with the BMW i3 close on its heels. Read more from EV Sales. Featured Gallery 2016 Fiat 500X: First Drive View 34 Photos Related Gallery Mitsubishi Outlander PHEV Concept-S: Paris 2014 View 12 Photos News Source: Reuters, Green Car Congress, EV SalesImage Credit: Copyright 2016 Drew Phillips / AOL Green Fiat Mitsubishi Nissan Emissions Fuel Efficiency Electric recharge wrapup