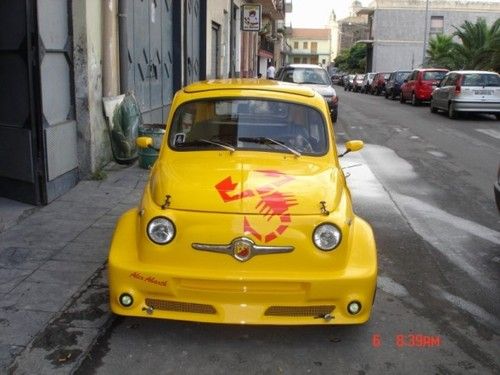

1964 Fiat Abarth 500 on 2040-cars

Royston, Georgia, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:650

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 4

Make: FIAT

Model: 500

Trim: Coupe 2 Door

Options: Leather Seats, CD Player, Convertible

Drive Type: RWD

Mileage: 1,000

Sub Model: D

Disability Equipped: No

Exterior Color: Yellow

Number of Doors: 2

Interior Color: Black with Yellow Trim

Warranty: Vehicle does NOT have an existing warranty

Fiat 500 for Sale

2012 fiat 500 abarth(US $20,500.00)

2012 fiat 500 abarth(US $20,500.00) 2012 pop 1.4l auto green a looker

2012 pop 1.4l auto green a looker 2012 fiat 500 convertible black manual stick shift like new bluetooth park sens

2012 fiat 500 convertible black manual stick shift like new bluetooth park sens Certified pre-owned, excellent condition, low miles, warranty

Certified pre-owned, excellent condition, low miles, warranty Hatchback 1.4l power windows power door locks power mirrors side air bag system

Hatchback 1.4l power windows power door locks power mirrors side air bag system 12 top safety pick 38 mpg 7 airbags euro styling great city car mocha color(US $12,499.00)

12 top safety pick 38 mpg 7 airbags euro styling great city car mocha color(US $12,499.00)

Auto Services in Georgia

Woodstock Quality Paint and Body ★★★★★

Volvo-Vol-Repairs ★★★★★

Village Garage And Custom ★★★★★

Tim`s Auto Upholstery ★★★★★

Tilden Car Care Abs ★★★★★

TDS Auto Service ★★★★★

Auto blog

As it did with Ferrari, Fiat Chrysler spinning off Magneti Marelli

Thu, Apr 5 2018MILAN — Fiat Chrysler said on Thursday its board had tasked management to proceed with spinning off Magneti Marelli and distributing shares in a new holding for the 99-year old parts business to FCA investors. The spinoff is part of a plan by FCA Chief Executive Sergio Marchionne to "purify" the Italian-American carmaker's portfolio and to unlock value at Magneti Marelli, which sits within FCA's components unit alongside robotics specialist Comau and castings firm Teksid, and which analysts say could be worth between 3.6 and 5 billion euros ($4.4-6.1 billion). "The separation will deliver value to FCA shareholders, while providing the operational flexibility necessary for Magneti Marelli's strategic growth in the coming years," Marchionne said in a statement. Magneti Marelli, which employs around 43,000 people and operates in 19 countries, is a diversified components supplier specialized in lighting, powertrain and electronics, and its spinoff is part of a five-year business plan FCA is due to present on June 1. "The spinoff will also allow FCA to further focus on its core portfolio while at the same time improving its capital position," Marchionne added. Marchionne has a long history of such moves. The 65-year-old was behind the spinoff and listing of trucks and tractor maker CNH Industrial and supercar brand Ferrari. The Magneti Marelli separation is expected to be completed by the end of this year or early 2019, with shares in the company expected to be listed on the Milan stock exchange. FCA's advisers initially looked at a possible initial public offering for the business to raise cash to cut FCA's debt, but the Agnelli family - FCA's main shareholder - were put off by low industry valuations and did not want their stake in Magneti Marelli to be diluted, three sources close to the matter told Reuters last month. Magneti Marelli has often been touted as a takeover target and FCA has fielded interest from various rivals and private equity firms over the years. South Korea's Samsung Electronics made a bid approach in 2016 but negotiations fell through as it was only interested in parts of the business, other sources have said. The spinoff is subject to regulatory approvals, tax and legal considerations and a final approval by the FCA board. The carmaker may modify or call off the transaction at any time and for any reason, it added.

EV cost burden pushing automakers to their limits, says Stellantis' CEO Tavares

Wed, Dec 1 2021DETROIT — Stellantis CEO Carlos Tavares said external pressure on automakers to quickly shift to electric vehicles potentially threatens jobs and vehicle quality as producers struggle with EVs' higher costs. Governments and investors want car manufacturers to speed up the transition to electric vehicles, but the costs are "beyond the limits" of what the auto industry can sustain, Tavares said in an interview at the Reuters Next conference released Wednesday. "What has been decided is to impose on the automotive industry electrification that brings 50% additional costs against a conventional vehicle," he said. "There is no way we can transfer 50% of additional costs to the final consumer because most parts of the middle class will not be able to pay." Automakers could charge higher prices and sell fewer cars, or accept lower profit margins, Tavares said. Those paths both lead to cutbacks. Union leaders in Europe and North America have warned tens of thousands of jobs could be lost. Automakers need time for testing and ensuring that new technology will work, Tavares said. Pushing to speed that process up "is just going to be counter productive. It will lead to quality problems. It will lead to all sorts of problems," he said. Tavares said Stellantis is aiming to avoid cuts by boosting productivity at a pace far faster than industry norm. "Over the next five years we have to digest 10% productivity a year ... in an industry which is used to delivering 2 to 3% productivity" improvement, he said. "The future will tell us who is going to be able to digest this, and who will fail," Tavares said. "We are putting the industry on the limits." Electric vehicle costs are expected to fall, and analysts project that battery electric vehicles and combustion vehicles could reach cost parity during the second half of this decade. Like other automakers that earn profits from combustion vehicles, Stellantis is under pressure from both establishment automakers such as GM, Ford, VW and Hyundai, as well as start-ups such as Tesla and Rivian. The latter electric vehicle companies are far smaller in terms of vehicle sales and employment. But investors have given Tesla and Rivian higher market valuations than the owner of the highly profitable Jeep and Ram brands. That investor pressure is compounded by government policies aimed at cutting greenhouse gas emissions. The European Union, California and other jurisdictions have set goals to end sales of combustion vehicles by 2035.

If Tesla Model 3 is successful, Sergio Marchionne will copy it

Fri, Apr 15 2016Fiat Chrysler CEO Sergio Marchionne hasn't hidden his disdain for electric vehicles, but he would copy the Tesla Model 3 if it is successful, according to Automotive News Europe. If Elon Musk "can show me that the car will be profitable at that price, I will copy the formula, add the Italian design flair and get it to the market within 12 months," Marchionne told Automotive News Europe during FCA's annual meeting in Amsterdam. In terms of pre-orders, the Model 3 is a success. Musk tweeted on April 7 that the company had over 325,000 reservations for the sedan, which he estimated were worth around $14 billion. The car will start at $35,000 before incentives. Marchionne, however, isn't optimistic Tesla can actually make the electric sedan work financially. "I'm am not surprised by the high number of reservations but you have then to build and deliver them and also be profitable," he told ANE. The FCA boss is a noted skeptic of EVs. In 2012, he said that the company only built the 500e because of California's zero-emissions vehicle mandate and to give engineers experience with the technology. He doubled-down in 2014 when he claimed FCA lost $14,000 on each 500e and said he would rather people didn't buy them. More recently, he infamously said "you'd have to shoot me first," before he'd allow a fully electric Ferrari. Related Video: