1965 Fiat 1500 on 2040-cars

Newport, New Hampshire, United States

Engine:--

Fuel Type:Gasoline

Body Type:CONVERTIBLE

Transmission:Manual

For Sale By:Dealer

VIN (Vehicle Identification Number): 00000000000000000

Mileage: 82000

Make: Fiat

Model: 1500

Features: --

Power Options: --

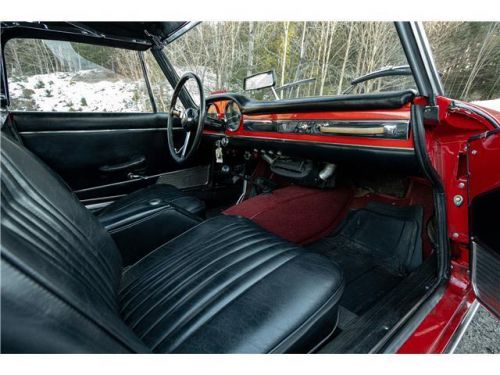

Exterior Color: Red

Interior Color: Black

Warranty: Unspecified

Auto Services in New Hampshire

Tom`s Automotive ★★★★★

Superior Window Tint ★★★★★

O`Reilly Auto Parts ★★★★★

Northeast Detailing ★★★★★

Leblanc Auto Body Repair & Sales Corp ★★★★★

Kelley Street Garage ★★★★★

Auto blog

Fiat diesels might also cheat emissions tests

Mon, Apr 25 2016Et tu, Fiat? Fiat is the latest automaker to come under suspicion for excessive emissions from its diesel vehicles. So far the trouble is only in Germany, as opposed to VW's trouble in multiple countries. And instead of using VW's method of installing software that identifies when the car is undergoing an emissions test and only then turning on emissions control devices, Fiat is running out the clock. Because the German emissions test lasts around 20 minutes, Fiat is accused of having its NOx emissions control systems operate only for the first 22 minutes when the car starts up. This potential new bombshell was first reported by Bild am Sonntag, a German newspaper. Bild says that the Italian automaker is under investigation by German authorities after a test of a 500X revealed this time-based method. Bild also says that Bosch tipped off the German authorities about Fiat's strategy. German transport minister Alexander Dobrindt released a report of new tests of 53 diesel cars and highlighted Fiat's numbers, saying, "We will need to carry out further tests on Fiat models." In February, the environmental lobby group DUH found that a 500X that had been running for a while emitted more NOx than one with a cold engine. Fiat said at the time that it had conducted an internal review and found that its diesel engines comply with the law. Of course, thanks to VW's diesel scandal implosion last fall, questions have been emerging from regulators around the world about diesel emissions from passenger vehicles. Mitsubishi was recently suspected of diesel emission irregularities in Japan. A recent lawsuit in the US accuses Mercedes-Benz of using a cheat device. Greenpeace has raised questions about the testing method that German authorities are using to test diesel vehicles. And on and on and on. Related Video: News Source: ReutersImage Credit: Sajjad Hussain/AFP/Getty Images Government/Legal Green Fiat Diesel Vehicles vw diesel scandal diesel emissions fiat 500x 500x

Fiat stock rockets up after word of Chrysler deal

Thu, 02 Jan 2014Now that Fiat has finalized a deal to purchase the outstanding shares of Chrysler owned by the United Auto Workers' VEBA retiree heathcare fund without having to file for an IPO, you can count the Italian automaker's stockholders among the happy. The Detroit News reports that Fiat stock closed Thursday with a 12-percent gain for the day on the Borsa Italiana, having been up by as much as 15.8 percent during the day's trading, at prices not seen since mid-2011. One trader reasoned the run was because Fiat "paid less than the market had expected and there will be no capital increase to fund this."

But there are some who worry, including bank analysts and unions. The final price of the stake will be $4.35 billion - $1.9 billion in cash from Chrysler, $1.75 billion from Fiat and extraordinary dividends in the amount of $700 million paid over three years. Adding that sum to its ledger will raise Fiat's debt level to roughly 10 billion euros ($13.8 billion), which Citibank says will make it the most indebted OEM in Europe.

Italian unions are also concerned about what the deal means for the future. Fiat CEO Sergio Marchionne has had an at-times contentious relationship with both unions and the Italian government over the future of Italian manufacturing, a fact that makes headlines because Fiat is Italy's largest private employer. At least two left-leaning unions have publicly called on Fiat to give guarantees and to explain what the deal means for its Italian operations, while a centrist union argues this is "good news for Fiat workers, for the auto industry and for our country."

Trump to meet with CEOs from Ford, GM, and FCA

Tue, Jan 24 2017In the wake of his inauguration, President Donald Trump is set to meet with the CEOs of Ford, General Motors, and Fiat Chrysler Automobiles Tuesday morning to discuss jobs, the North American Free Trade Agreement, and potential tax cuts. Trump has been highly critical of American automakers for shipping jobs to Mexico and has threatened to impose heavy import fees on foreign-made vehicles. Trump has threatened to dissolve NAFTA in order to encourage automakers to manufacture cars in the US. Automotive News and Crain's Detroit Business are reporting that the group is set to discuss how to bring more auto industry jobs back to the US. Under NAFTA, many automakers, both foreign and domestic, have moved vehicle production out of the States to Mexico in order to cut costs. White House spokesperson Sean Spicer said Trump is looking forward to the meeting and discussing how to bring jobs back to America. Dismantling NAFTA would be a major blow to automakers. Trump blasted Ford during his campaign for manufacturing in Mexico, but FCA and GM also have factories south of the border. Earlier this month, Ford nixed plans for a $1.6 billion plant in Mexico, instead investing $700 million into an existing facility. At this year's Detroit Auto Show, the unspoken theme was America and American manufacturing. Expect the automakers to fight to keep NAFTA alive. Related Video: News Source: Automotive News - sub. req., Twitter Government/Legal Plants/Manufacturing Fiat Ford GM FCA Mexico NAFTA