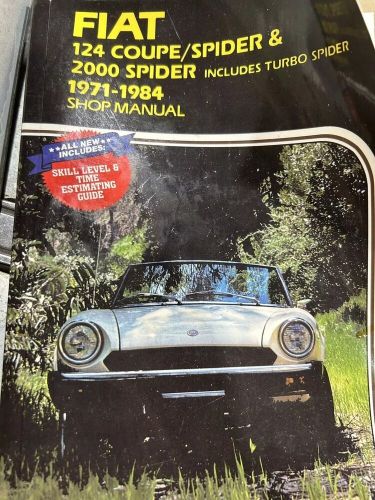

1983 Fiat 124 Spider on 2040-cars

Grants Pass, Oregon, United States

Body Type:Convertible

Transmission:Manual

Vehicle Title:Clean

Fuel Type:Gasoline

VIN (Vehicle Identification Number): ZFRAS00B8D5503157

Mileage: 30000

Number of Seats: 2

Model: 124 Spider

Exterior Color: Blue

Make: Fiat

Fiat 124 Spider for Sale

1981 fiat 124 spider(US $12,500.00)

1981 fiat 124 spider(US $12,500.00) 1976 fiat 124 spider spider(US $10,995.00)

1976 fiat 124 spider spider(US $10,995.00) 1979 fiat 124 spider(US $12,750.00)

1979 fiat 124 spider(US $12,750.00) 1978 fiat 124 spider(US $14,900.00)

1978 fiat 124 spider(US $14,900.00) 2017 fiat 124 spider abarth 2dr convertible(US $20,995.00)

2017 fiat 124 spider abarth 2dr convertible(US $20,995.00) 1978 fiat 124 spider(US $7,950.00)

1978 fiat 124 spider(US $7,950.00)

Auto Services in Oregon

Toy Doctor Inc ★★★★★

Thor`s Lake Auto Service ★★★★★

Speed Sports ★★★★★

River City Transmissions ★★★★★

Richie`s Mufflers & Customs ★★★★★

Prestine Motors Inc ★★★★★

Auto blog

Brand new cars are being sold with defective Takata airbags

Wed, Jun 1 2016If you just bought a 2016 Audi TT, 2017 Audi R8, 2016–17 Mitsubishi i-MiEV, or 2016 Volkswagen CC, we have some unsettling news for you. A report provided to a US Senate committee that oversees the US National Highway Traffic Safety Administration (NHTSA) and reported on by Automotive News claims these vehicles were sold with defective Takata airbags. And it gets worse. Toyota and FCA are called out in the report for continuing to build vehicles that will need to be recalled down the line for the same issue. That's not all. The report also states that of the airbags that have been replaced already in the Takata recall campaign, 2.1 million will need to eventually be replaced again. They don't have the drying agent that prevents the degradation of the ammonium nitrate, which can lead to explosions that can destroy the airbag housing and propel metal fragments at occupants. So these airbags are out there already. We're not done yet. There's also a stockpile of about 580,000 airbags waiting to be installed in cars coming in to have their defective airbags replaced. These 580k airbags also don't have the drying agent. They'll need to be replaced down the road, too. A new vehicle with a defective Takata airbag should be safe to drive, but that margin of safety decreases with time. If all this has you spinning around in a frustrated, agitated mess, there's a silver lining that is better than it sounds. So take a breath, run your fingers through your hair, and read on. Our best evidence right now demonstrates that defective Takata airbags – those without the drying agent that prevents humidity from degrading the ammonium nitrate propellant – aren't dangerous yet. It takes a long period of time combined with high humidity for them to reach the point where they can rupture their housing and cause serious injury. It's a matter of years, not days. So a new vehicle with a defective Takata airbag should be safe to drive, but that margin of safety decreases with time – and six years seems to be about as early as the degradation happens in the worst possible scenario. All this is small comfort for the millions of people who just realized their brand-new car has a time bomb installed in the wheel or dashboard, or the owners who waited patiently to have their airbags replaced only to discover that the new airbag is probably defective in the same way (although newer and safer!) as the old one.

Mopar maneuvers into SEMA with a multitude of modified models

Wed, 05 Nov 2014As the aftermarket and performance arm of Fiat Chrysler Automobiles, Mopar has a duty to extract everything from the company's models that it can, and there's no better place to show all of its work off than the annual SEMA Show.

Dodge really gets in on the act this year with several customs to show off different parts of the brand's performance heritage. Perhaps the most interesting among them is the track-prepped Viper ACR Concept (pictured above). It wears a custom body kit to produce even more downforce, thanks in no small part to a monstrous wing at the back. To shed weight, most of the interior is stripped out, as well. Next up, the Challenger T/A Concept takes inspiration from '70s Trans-Am racing in a livery of Sublime Green and matte black paint. The center scoop in the hood keeps the 6.4-liter V8 fed with cool air, and the special's 20-by-9.5-inch matte black wheels keep it planted in the corners.

Also getting the once-over from Mopar is the Charger R/T. It wears the division's body kit, and under the hood, a cold-air intake keeps the 5.7-liter V8 breathing. The suspension is retooled to hold the road better with a coil-over kit, upgraded sway bars and strut tower braces for the front and rear. The company is also showing off a snazzy blue Charger with a mean look. The final Dodge getting work from Mopar is the Dart R/T Concept with bright, O-So-Orange paint and a matte black hood with a scoop hooked directly to the air intake. The performance-oriented design is finished off with a coil-over suspension and big brake kit, as well.

CEO says Volkswagen's buying spree is over

Mon, 03 Sep 2012

After adding Italian motorcycle icon Ducati to its stable and spending $5.6 billion on the rest of Porsche, Volkswagen CEO Martin Winterkorn says he's done shopping for a while.

"We have enough to do at the moment in taking our twelve brands to where we want to be," Winterkorn tells German newspaper Handelsblatt.