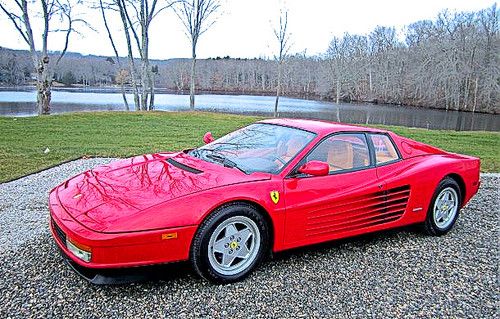

1991 Ferrari Testarossa.... Mint Condition..... on 2040-cars

Lake Worth, Florida, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:4.9L 4943CC H12 GAS DOHC Naturally Aspirated

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Ferrari

Model: Testarossa

Trim: Base Coupe 2-Door

Options: Cassette Player, Leather Seats, CD Player

Safety Features: Anti-Lock Brakes

Drive Type: RWD

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 40,712

Exterior Color: Red

Interior Color: Tan

Disability Equipped: No

Number of Cylinders: 12

Warranty: Vehicle does NOT have an existing warranty

Ferrari Testarossa for Sale

1985 ferrari testarossa base coupe 2-door 4.9l(US $55,000.00)

1985 ferrari testarossa base coupe 2-door 4.9l(US $55,000.00) 1989 ferrari testarossa base coupe 2-door 4.9l(US $74,900.00)

1989 ferrari testarossa base coupe 2-door 4.9l(US $74,900.00) 1987 ferrari testarossa grigio titanium red interior belts done collectible v-12

1987 ferrari testarossa grigio titanium red interior belts done collectible v-12 Only 8,842 miles pristine original condition dunlop tires pininfarina design v12

Only 8,842 miles pristine original condition dunlop tires pininfarina design v12 1989 ferrari testarossa base coupe 2-door 4.9l(US $74,900.00)

1989 ferrari testarossa base coupe 2-door 4.9l(US $74,900.00) 512 tr service up to date, all service records, clean carfax

512 tr service up to date, all service records, clean carfax

Auto Services in Florida

Z Tech ★★★★★

Vu Auto Body ★★★★★

Vertex Automotive ★★★★★

Velocity Factor ★★★★★

USA Automotive ★★★★★

Tropic Tint 3M Window Tinting ★★★★★

Auto blog

Stellantis reports $15B profit in first year of merger

Wed, Feb 23 2022FRANKFURT, Germany — Automaker Stellantis said Wednesday that it made 13.4 billion euros ($15.2 billion) in its first year after it was formed from the merger of Fiat Chrysler Automobiles and PSA Group. The earnings nearly tripled profits compared with its pre-merger existence as two separate companies, as the maker of Jeep, Opel and Peugeot vehicles exploited cost efficiencies from combining the businesses. The result compared to a combined 4.79 billion euros for the separate companies in 2020 before the merger, which took effect on Jan. 17, 2021. Revenue for the combined business rose 14%, to 152 billion euros. CEO Carlos Tavares said the results “prove that Stellantis is well positioned to deliver strong performance" and had overcome “intense headwinds” during the year. Automakers have struggled with shortages of key parts such as semiconductor electronic components and rising costs for raw materials as the global rebound from the worst of the coronavirus pandemic brings more demand. The company said the benefits of the merger were worth some 3.2 billion euros during the year. Mergers can lead to streamlined costs as companies combine functions and spread fixed costs over a larger revenue base. The company accelerated its rollout of battery-powered vehicles, with sales of low-emission vehicles reaching 388,000 — an increase of 160%. Stricter environmental regulations in Europe and China are pushing automakers to roll out more electric vehicles with longer range. Stellantis started production of a hydrogen fuel cell commercial van under its Opel brand in December. Stellantis' other brands include Chrysler, Citroen, DS, Fiat, Maserati, Ram and Vauxhall. Related video: Earnings/Financials Chrysler Dodge Ferrari Fiat Jeep RAM Citroen Opel Peugeot Vauxhall

Who are Mike Manley, Louis Camilleri, and Suzanne Heywood?

Sun, Jul 22 2018MILAN – Fiat Chrysler aid on Saturday that boss Sergio Marchionne, 66, would not be returning to work because he was gravely ill. In addition to being FCA chief executive, Marchionne was also CEO and chairman of luxury sports car brand Ferrari and chairman of truck and tractor maker CNH Industrial, which were spun off from FCA in recent years. Following is a brief summary on the executives who have been appointed to replace him in the various roles: MIKE MANLEY The 54-year-old Briton picked to become the FCA's new CEO has been leading the group's top brand Jeep since 2009, first as Jeep President and CEO at Chrysler and then as FCA's Jeep head. In 2015 he was also appointed head of the Ram brand. Under his tenure, Jeep turned into a global brand becoming, together with Ram, FCA's profit engine. Jeep sold nearly 1.4 million cars last year compared with less than 338,000 in 2009. Manley had worked as DaimlerChrysler's head of network development in Britain since 2000, having earlier worked for several years in car dealership. At Chrysler, he headed product planning and all sales activities outside of North America and then became the group's chief operating officer for Asia and the lead executive for the international activities outside of NAFTA. LOUIS CAMILLERI The new Ferrari CEO was already a board member at the luxury sportscar maker before his latest appointment. He is also the chairman of Philip Morris International, where he also held the job of CEO from 2008 to 2013. Born in 1955, Camilleri had joined Altria Group, which controls Philip Morris, in 1978 holding various positions until he became chief financial officer in 1996 and then CEO in 2002. Camilleri was also chairman of Kraft Foods from 2002 to 2007. Malta's Prime Minister Joseph Muscat wished Camilleri luck on Twitter saying he was proud to have "a bit of Malta in Ferrari" thanks to the new CEO, who was born in Egypt to Maltese parents. SUZANNE HEYWOOD The new, British-born chairwoman of CNH Industrial has been since 2016 the managing director of EXOR, the holding company through which the Agnelli family controls FCA. Heywood, 49, started her career at the British Treasury and then joined McKinsey in 1997, leading for many years the consultancy firm's global service line on organization design. She eventually became a senior partner there. Heywood sits on the board of The Economist, which is controlled by EXOR, and the board of the Royal Opera House, where she is also deputy chair.

Fiat Chrysler denies rumors that Ferrari SpA is moving to London

Sat, Dec 13 2014It seems that reports of Ferrari's relocation to London have been somewhat exaggerated. The past few days have seen more than a few stories on the legendary Italian brand's decision to move its tax base out of Italy, and now Fiat Chrysler is speaking out against the scuttlebutt. "These rumors have no grounds," FCA said in a statement obtained by Reuters. "There is no intention to move the tax residence of Ferrari SpA outside Italy, nor is there any project to delocalize its Italian operations, which will continue to be subject to Italian tax jurisdiction." Ferrari's move to London was based on two beliefs. First, that the company would benefit from being located nearer the investor community, should it be listed on a European exchange. FCA, though, said a European listing was only a "possibility," according to Reuters. Instead, the company will be listed on an American market. Aside from the move to benefit investors, it was believed Ferrari was looking to relocate to escape Italy's more oppressive corporate tax rate, which sits around at 31.4 percent, compared to the UK's 20 percent, Bloomberg reports. This denial by Fiat Chrysler, though, should be enough to close the book on Ferrari leaving Italy, no matter how much sense it might make. Related Video: