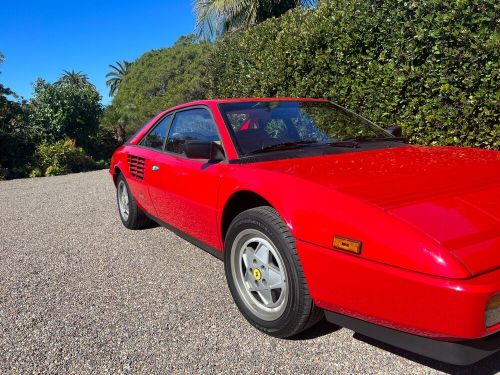

1991 Ferrari Mondial on 2040-cars

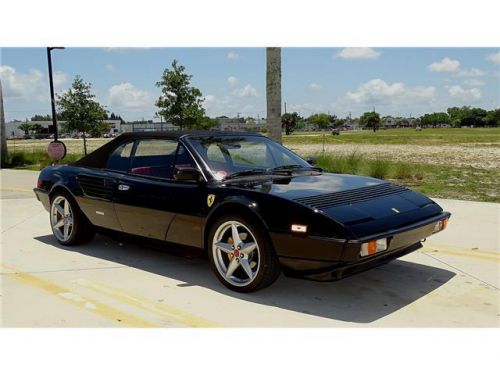

Stuart, Florida, United States

Body Type:Convertible

Vehicle Title:Clean

Fuel Type:Gasoline

VIN (Vehicle Identification Number): ZFFRK33AXM0088408

Mileage: 40713

Number of Seats: 4

Model: Mondial

Exterior Color: Red

Make: Ferrari

Ferrari Mondial for Sale

1987 ferrari mondial(US $82,500.00)

1987 ferrari mondial(US $82,500.00) 1985 ferrari mondial factroy(US $54,850.00)

1985 ferrari mondial factroy(US $54,850.00) Ferrari(US $490,000.00)

Ferrari(US $490,000.00) 1990 ferrari mondial(US $20,300.00)

1990 ferrari mondial(US $20,300.00) 1989 ferrari mondial 2 door coupe(US $20,900.00)

1989 ferrari mondial 2 door coupe(US $20,900.00) 1986 ferrari mondial(US $19,600.00)

1986 ferrari mondial(US $19,600.00)

Auto Services in Florida

Zip Automotive ★★★★★

X-Lent Auto Body, Inc. ★★★★★

Wilde Jaguar of Sarasota ★★★★★

Wheeler Power Products ★★★★★

Westland Motors R C P Inc ★★★★★

West Coast Collision Center ★★★★★

Auto blog

Race Recap: Belgian Grand Prix is new skirmishes, same war [spoilers]

Mon, 26 Aug 2013It's been four weeks since we last saw a Formula One race, when Lewis Hamilton improbably put his Mercedes-AMG Petronas in P1 in Hungary. Even more improbably, he held onto the first spot at the finish of the race, ahead of Kimi Räikkönen in the Lotus and Sebastian Vettel in the Infiniti Red Bull.

Resuming the season at Belgium's Spa-Francorchamps circuit this weekend, Hamilton picked up his recent - and just as improbable - pole-setting form by putting the Mercedes in P1 for the fourth time in a row. The effort came during a qualifying session visited by intermittent rains and dry spells, his 54th trip to the front of the pack, tying Niki Lauda.

But neither the fireworks and surprises, the mid-field full of backmarkers, nor the tire strategies and timing choices changed the mission for the drivers in with a chance at the title: finish in front of Vettel.

Alfa Romeo Giulia to get Ferrari-related engine

Fri, Jun 19 2015Alfa Romeo has a long, proud history of using V6 engines in its coupes, sedans, and sports cars over the years, but as the new Giulia sedan approaches, the Italian marque is allegedly turning to Ferrari for its next six-cylinder. This is obviously not the first time a Ferrari-sourced or derived engine has been found under an Alfa's long hood. While 8C Competizione famously used a version of Ferrari's F136 V8 during its short run, the Giulia's new V6 will be offered on a much larger scale, slotting in above an entry level, four-cylinder turbo (likely the next-gen version of the 4C sports car's 1.75-liter engine). According to Autocar, the new V6 will be "specially developed for Alfa Romeo," and will be built at the Termoli engine factory alongside the new turbo four-cylinder. As for the rest of the Giulia, Autocar has been able to shine a light on a number of other details about the new midsizer. It will, thankfully, be rear-wheel drive, and designed to counter the "mostly cold and clinical" and soulless cars of the German competition, Maserati chief Harald Wester told AC. Some of the new sedan's structural elements will even be shared with Maserati's entry level model, the Ghibli. Most notable of all, though, is what the Giulia means for American consumers. After the limited-run 8C and the niche 4C, the new sedan will lead Alfa Romeo's long-awaited, large-scale return, where it will combat the popular BMW 3 Series, Mercedes-Benz C-Class, Audi A4, not to mention rivals like the Cadillac ATS and Lexus IS. Look for more on the Giulia next week when it's officially revealed in Milan.

Ferrari planning six-cylinder Dino revival?

Wed, Apr 8 2015Ferrari swore up and down when it was developing the California that it wouldn't be an "entry-level" model. Whether that ultimately proved to be the case or not is up for debate, but it seems that the Prancing Horse marque is now preparing to launch a properly more accessible model in the near future. According to Motor Trend, Maranello is working on a new six-cylinder sports car to serve as the point of entry for new customers – especially in China. Tax implications there could mean the V6 would displace less than 3.0 liters, but likely pack a pair of turbochargers to ensure that output and performance live up to the Ferrari standard. Tipped to arrive in 2019, the six-cylinder model could materialize as a revival of sorts of the Dino line. Named after Enzo Ferrari's first-born son, the Dino sub-brand used mostly six-cylinder engines to take on the Porsche 911 on and off the track. The Dino 206 GT emerged in 1968, evolved into the larger-displacement 246 the following year and ultimately gave way to the very different, eight-cylinder, four-seat 308 GT4 in 1973, later to be rebadged as a proper Ferrari once the Dino brand was put to rest in '76. It's worth noting that Ferrari developed the 3.0-liter twin-turbo V6 for the Maserati Ghibli and Quattroporte, which would presumably serve as the basis for the new entry-level Ferrari. Though FCA typically endeavors to keep its brands from competing directly with one another, Maserati is due to release a production version of the Alfieri sports car concept within the next couple of years, powered by that same engine, and could share its underpinnings with the Ferrari model in question. The six-cylinder Prancing Horse could carry a price tag of around $180,000 to take on the likes of the Porsche 911 Turbo, Mercedes-AMG GT, Audi R8 and the Sports Series which McLaren just kicked off with its new entry-level 570S. Related Video: News Source: Motor TrendImage Credit: Newspress Ferrari Coupe Performance v6 ferrari dino