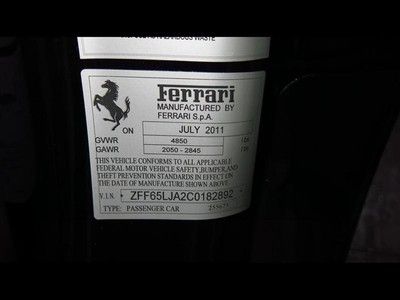

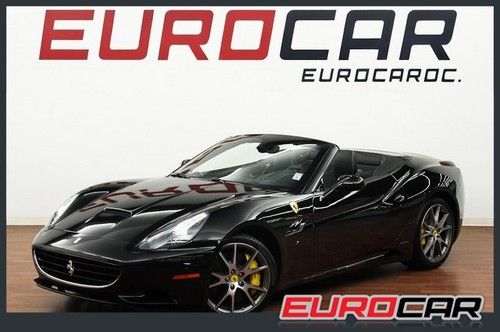

2012 Ferrari California 2dr Conv Low Mileage Convertible on 2040-cars

Plano, Texas, United States

Vehicle Title:Clear

Engine:4.3L 4308CC V8 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Convertible

Fuel Type:GAS

Make: Ferrari

Warranty: Vehicle has an existing warranty

Model: California

Trim: Base Convertible 2-Door

Options: Convertible

Power Options: Power Windows

Drive Type: RWD

Mileage: 1,003

Number of Doors: 2

Sub Model: 2dr Conv

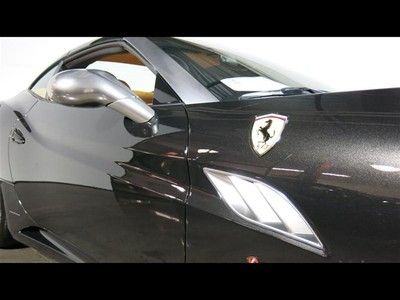

Exterior Color: Black

Number of Cylinders: 8

Interior Color: Tan

Ferrari California for Sale

2010 ferrari california 2dr conv low mileage convertible(US $195,000.00)

2010 ferrari california 2dr conv low mileage convertible(US $195,000.00) 2011 ferrari approved cpo california, blue pozzi/cuoio(US $169,700.00)

2011 ferrari approved cpo california, blue pozzi/cuoio(US $169,700.00) 2010 ferrari california(US $180,000.00)

2010 ferrari california(US $180,000.00) 2011 ferrari california best color combo!! like new!!

2011 ferrari california best color combo!! like new!! One owner california car low miles options navi ipod daytona scuderia shields(US $198,888.00)

One owner california car low miles options navi ipod daytona scuderia shields(US $198,888.00) 2010 ferrari california base convertible 2-door 4.3l(US $180,000.00)

2010 ferrari california base convertible 2-door 4.3l(US $180,000.00)

Auto Services in Texas

Woodway Car Center ★★★★★

Woods Paint & Body ★★★★★

Wilson Paint & Body Shop ★★★★★

WHITAKERS Auto Body & Paint ★★★★★

Westerly Tire & Automotive Inc ★★★★★

VIP Engine Installation ★★★★★

Auto blog

Petrolicious goes running up that Hill in a Ferrari 250 GTO

Mon, Dec 7 2015We might not ordinarily run a seven-minute clip of in-car footage. But this is no ordinary car, it's not being driven by any ordinary driver, and it wasn't put up by just any YouTube user. This is video of a Ferrari 250 GTO once raced by Phil Hill, being driven by his son, Derek Hill, in a hillclimb for Petrolicious. The footage was captured during the making of a previous clip, entitled The Ferrari 250 GTO Speaks for Itself and released over a year ago. Since it was left over after production, the Petrolicious uploaded it here for our enjoyment. Of course the GTO should require no introduction, being one of the most sought-after classics the world has ever known. And neither should Derek Hill. While the former's clout goes without saying, Hill's skills warrant repeating. The late legend Phil Hill was one of the few Americans to succeed in European racing in the 1960s, with a Formula One World Championship title and three Le Mans wins to his name. Derek may never have reached his father's level of success, but he's won races and titles in both formula and sports-car racing, and was among the last to professionally race a Bugatti when he campaigned an EB110 at Daytona back in 1996. The point is, the guy can drive, and you can see that much for yourself from the video above. Related Video:

In case you forgot, the Dubai Police supercar fleet is the coolest

Tue, Feb 10 2015Ever wonder why the Dubai Police have a fleet of vehicles worth millions and millions and millions of dollars? Why it has a Bugatti Veyron and a Bentley Continental and a Mercedes-Benz SLS AMG with sirens and light bars? Well, here's the reason. This video shows the fleet on display on the Emirate's roads and highways, while also reaching out to the people the police are meant to protect. It's an impressive display of machinery, to be sure. Alongside the Bentley, Bugatti and Mercedes, we spy a Ferrari FF, a Brabus G-Wagen, a BMW M6, a Nissan GT-R, an Audi R8 and a McLaren MP4-12C (although the latest Dubai Police car, the Lexus RC F, is absent). The video even has a very cinematic look and feel to it, which works well with the night scenes and the blues-and-twos of the exotics cruisers. News Source: Dubai Police via YouTube Audi Bentley BMW Bugatti Ferrari McLaren Mercedes-Benz Nissan Luxury Performance Videos dubai ferrari ff mclaren 12c

Marchionne: FCA, but not Ferrari, interested in Formula E

Sat, Aug 5 2017It seems like automakers have been clamoring to get on board with Formula E lately. In just the last few weeks a number of manufacturers have either become more directly involved, or otherwise announced entry into the series in coming years. That includes Audi, BMW, Mercedes-Benz and Porsche, with the latter two abandoning other series to join the electric one. Now, FCA CEO Sergio Marchionne says his company might join Formula E as well, according to Motorsport. Previously, Marchionne had toyed with the idea of bringing Ferrari into the Formula E field, but now says that would be unlikely. Instead, he thinks an FCA brand would be a better fit, perhaps Alfa Romeo or Maserati. At the moment, Maserati seems like the best fit, as Marchionne just announced that the brand would electrify its entire lineup after 2019, with each car it sells having either a hybrid or electric powertrain. Fans would probably be excited to see Maserati return to racing, and Formula E would be a good test laboratory for the development of electric propulsion technology. Still, another brand could represent FCA in Formula E, and apply the knowledge learned there to its vehicles, as Marchionne says half of the FCA fleet will be electrified by the end of the company's five-year plan ending in 2022. Marchionne said that while Ferrari won't be directly involved, he doesn't know which FCA brand – Alfa Romeo, Dodge, Chrysler, Fiat, or Maserati – would enter. As interesting as an electric Dodge race car would be, it seems unlikely, especially because of, well, Maserati. We're hoping it's Jeep, though. Related Video: News Source: MotorsportImage Credit: ALBERTO PIZZOLI/AFP/Getty Images Green Alfa Romeo Ferrari Maserati Green Culture Electric Racing Vehicles Sergio Marchionne FCA Formula E