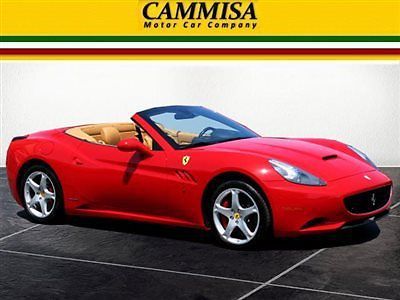

2012 Ferrari California - 1 Owner - Florida Vehicle - Extremely Low Miles on 2040-cars

Naples, Florida, United States

Ferrari California for Sale

1961 ferrari california 250 gt(US $88,888.88)

1961 ferrari california 250 gt(US $88,888.88) Financing available(US $148,000.00)

Financing available(US $148,000.00) 2014 ferrari california 30 low miles handling package magnaride convertible(US $224,900.00)

2014 ferrari california 30 low miles handling package magnaride convertible(US $224,900.00) 2010 ferrari california argento nurburgring(US $155,900.00)

2010 ferrari california argento nurburgring(US $155,900.00) 2014 california 30 ferrari approved certified msrp = $239,778 carbon drvng zone(US $209,888.00)

2014 california 30 ferrari approved certified msrp = $239,778 carbon drvng zone(US $209,888.00) 2010 ferrari california 6k clean carfax carbon fiber package rare

2010 ferrari california 6k clean carfax carbon fiber package rare

Auto Services in Florida

Wildwood Tire Co. ★★★★★

Wholesale Performance Transmission Inc ★★★★★

Wally`s Garage ★★★★★

Universal Body Co ★★★★★

Tony On Wheels Inc ★★★★★

Tom`s Upholstery ★★★★★

Auto blog

Tax The Rich goes slow-mo with a Ferrari F50

Thu, 05 Dec 2013What is it about slow-motion video that makes everything so much cooler? Whether it's as simple as slapshot during a hockey game or as complex as a hypercar, filming in slow motion adds a new sense of depth, technicality and beauty to the subject. That's especially true when the video in question includes a rare Ferrari F50 and the team from Tax The Rich.

One Autoblog staffer called it "mesmerizing" the first time he watched it, and we're certainly inclined to agree. The F50 has never been a very pretty car, but in this setting, it's somehow incredibly compelling, as it drifts around a corner and does donuts at an agonizingly slow pace. Scroll down for the entire video, and let us know what you think in Comments.

Forza Motorsport 6's new drivable Hot Wheels cars are the best

Tue, May 3 2016Each month, Turn 10 Studios releases a new car pack for the latest installment of its Forza Motorsport video game. Sometimes that means less-than-exciting stuff coming to our Xbox Ones – BMW X6M, bleh – but this time our inner seven-year-old is beyond ecstatic. Two of the seven cars are based on actual Hot Wheels models. And. They're. Awesome. First we have the 2011 Hot Wheels Bone Shaker. Yes, there are flames on the side. And yes, there's a giant skull where the grille should be. This one came from the imagination of "Mr. Hot Wheels" Larry Wood, whose design was so popular it inspired an actual real-world creation. Like all good things in this world, it's powered by a small-block Chevy V8. Oh, and it has no roof. This will be a popular one among gamers. The other digitized Hot Wheels creation is a 2005 Ford Mustang. A modest vehicle, sure, but the toy designers have festooned this pony car with a wild paint scheme and the body mods to emphasize it. Originally developed to celebrate the 'Stang's 50th birthday, this Hot Wheels car trades Americana for wild Japanese style. There's just one functioning life-size version of this car in existence as well, but if you look hard, you might be able to find one of the 1:64 scale models that inspired it. Other highlights from this month's car pack include the latest Ford Focus RS – finally time to replace that NASCAR-V8-powered, all-wheel-drive 2009 Focus RS – the 2015 McLaren P1 GTR, the 2016 Chevrolet Camaro SS, the aforementioned X6M, and Alain Prost's 1990 Ferrari 641 F1 car. The Hot Wheels Car Pack is available for download today. Related Video: Featured Gallery Forza Motorsport 6: Hot Wheels Car Pack News Source: Turn 10 Studios via YouTube Toys/Games BMW Chevrolet Ferrari Ford McLaren Racing Vehicles Performance video games Hot Wheels forza motorsport chevy camaro ss forza motorsport 6

Dubai police add Ferrari FF to keep Lambo company

Thu, 18 Apr 2013Supercars are a sulky lot by nature. Leave them to their own devices and they'll quickly grow despondent. That's why so many owners have more than one exotic in the stable. The Dubai Police seem to have caught on to that fact, having just added a Ferrari FF to help keep the force's new Lamborghini Aventador company. The duo will patrol the city's more affluent regions to promote the area's image as a mecca for money.

Mission: accomplished.

Of course, the Dubai PD certainly isn't the first law enforcement agency to adopt flashy cruisers, and car gods willing, it won't be the last. There was the Nissan GT-R gussied up for police duty, as well as the Lamborghini Gallardo LP560-4 and the Mitsubishi Evo X, but we have to say the DPD certainly has the most lust-worthy stable at the moment.