2021 Ferrari 812 Gts Convertible 2d on 2040-cars

Boca Raton, Florida, United States

Engine:V12, 6.5 Liter

Fuel Type:Gasoline

Body Type:Convertible

Transmission:Automatic

For Sale By:Dealer

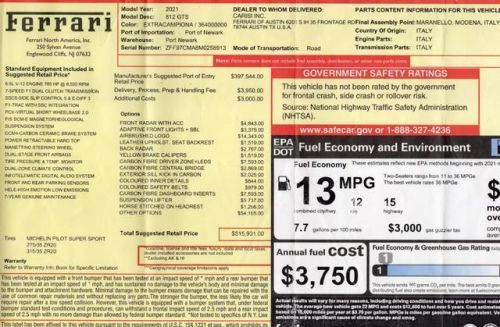

VIN (Vehicle Identification Number): ZFF97CMA8M0258913

Mileage: 3435

Make: Ferrari

Model: 812 GTS

Trim: Convertible 2D

Features: --

Power Options: --

Exterior Color: --

Interior Color: --

Warranty: Unspecified

Ferrari 812 GTS for Sale

2022 ferrari 812 gts certified cpo(US $619,900.00)

2022 ferrari 812 gts certified cpo(US $619,900.00) 2022 ferrari 812 gts certified cpo(US $569,900.00)

2022 ferrari 812 gts certified cpo(US $569,900.00) 2023 ferrari 812 gts(US $699,900.00)

2023 ferrari 812 gts(US $699,900.00) 2022 ferrari 812 gts tailor made(US $689,999.00)

2022 ferrari 812 gts tailor made(US $689,999.00)

Auto Services in Florida

Xtreme Auto Upholstery ★★★★★

Volvo Of Tampa ★★★★★

Value Tire Loxahatchee ★★★★★

Upholstery Solutions ★★★★★

Transmission Physician ★★★★★

Town & Country Golf Cars ★★★★★

Auto blog

Formula One speeds towards radical thousand-horsepower shakeup

Wed, Feb 11 2015The teams, the drivers, the fans, the circuits... few, if any, were satisfied with how Formula One has shaped up since the current regulations took hold last year. But that doesn't mean they aren't working on it. At a recent meeting of the F1 Strategy Group, the leading parties in the sport outlined a new framework that would radically shake up the cars themselves while keeping costs in check. And the biggest change could see the engines producing around 1,000 horsepower. Although a proposal put forth by Ferrari to ditch the current V6 hybrid engines in favor of new twin-turbocharged units was rejected by Honda and Mercedes, the members of the group approved in principal to increase the fuel flow in the existing engines to dramatically boost output. As it stands, the current 1.6-liter turbocharged V6 engines develop around 600 horsepower, with an additional 160 or so kicked in by the electric Energy Recovery System, for a combined output of about 760 hp. What's not clear at the moment is whether the increased fuel flow would necessitate either the return of mid-race refueling (currently banned) or the installation of larger fuel tanks. Red Bull and McLaren also submitted proposals to radically redesign the shape of the cars as well, however a more evolutionary approach was adopted instead. Though far from finalized, the new design would keep the same basic form of the current chassis, but with adjustments to make them more aesthetically pleasing while producing more downforce. Wider tires are also said to be part of the mix. With more power and more grip from the tires and aero, the resulting cars would most certainly end up going much faster than the current ones, which are already starting to nudge the lap records at some of the circuits, many of which were set during the V10 era. The F1 Strategy Group is made up of representatives of the FIA, Formula One Management and six leading teams. The next step will be for the teams' technical directors to iron out how to implement what their bosses have agreed to. If they settle the details fast enough, the revised regulations could be pushed through in time for next season. News Source: AutosportImage Credit: Mark Thompson/Getty Motorsports Ferrari Honda Infiniti McLaren Mercedes-Benz F1

Race recap: 2016 Hungarian Grand Prix was the pits

Mon, Jul 25 2016The Hungarian Grand Prix hasn't seen a race this calculated since 2012, when Lewis Hamilton – driving for McLaren – led from pole position to the checkered flag. We don't expect massive action from the Hungaroring, but Hamilton's first win for Mercedes in 2013, the thrilling wet mess in 2014, and Ferrari's surprising dominance in 2015 made us hope for more on-track commotion this year. Hungary denied us that. Hamilton parked his Mercedes-AMG Petronas in second on the grid but stole the lead through Turn 1 and never looked back. Teammate Nico Rosberg yo-yoed behind him in second place, getting into DRS range on a few occasions but never close enough to pass. Red Bull's Daniel Ricciardo kept the leading duo honest, but the Aussie couldn't put genuine fear into the German team and finished third. This is the third year in a row for Ricciardo on the Hungary podium. The pits provided our few scraps of excitement. During a stretch when Ricciardo managed to close on Rosberg, Mercedes told Hamilton to speed up. When Hamilton said he couldn't go faster, Mercedes said they'd pit second-place Rosberg first instead. Suddenly, Hamilton found the extra pace. Ricciardo pitted in early, hoping that fresh tires and fast laps could allow him to pass one or both Mercedes drivers when they pitted, but once Hamilton hit the throttle the Red Bull couldn't respond. Further down the lineup, Jenson Button came in on Lap 5 so McLaren could fix his brake pedal problem. The radio exchange before the stop included one forbidden instruction to Button, though, so the Englishman had to return to the pits for a drive-through penalty. Renault's Jolyon Palmer beat Force India's Nico Hulkenberg in a straight-up pit stop battle on Lap 40, but threw the good work away on Lap 49 with a spin on track that cost him three places. A pit wall miscommunication meant the Force India pit crew wasn't ready for Sergio Perez when the Mexican arrived for his second stop on Lap 43. And Daniel Kvyat's regrettable run at Toro Rosso continued, first with car issues, then a drive-through penalty for speeding in the pit lane. Sebastian Vettel brought his Ferrari home fourth, sniffing Ricciardo's gearbox at the flag but unable to get around the Red Bull. Max Verstappen enacted a replay of the final stages of the Spanish Grand Prix, finishing fifth by holding Ferrari's Kimi Raikkonen behind for 19 laps.

2015 Australian Grand Prix all about grooves and trenches [spoilers]

Sun, Mar 15 2015We can't remember the last time 90 percent of the action in Formula One had nothing to do with cars setting timed laps. Yet that's was the situation at the Australian Grand Prix, continuing the antics from a scarcely believable off-season with blow-ups, driver and team absences, a lawsuit, and a clear need for some teams to get down and give us 50 pit stops. Nothing much has changed from a regulation standpoint, and at the front of the field nothing has changed at all. Lewis Hamilton in the Mercedes-AMG Petronas claimed the first position on the grid like someone put a sign on it that read, "Reserved for Mr. Hamilton;" teammate Nico Rosberg was 0.6 behind in second, Felipe Massa in the Williams was 1.4 seconds back in third. Sebastian Vettel proved that Ferrari didn't do another Groundhog Day routine this off-season, slotting into fourth. His teammate Kimi Raikkonen was not even four-hundredths of a second behind, ahead of Valtteri Bottas in the second Williams, Daniel Ricciardo in the first Infiniti Red Bull Racing, and rookie Carlos Sainz, Jr. in the first Toro Rosso. Lotus, now powered by Mercedes, got both cars into the top ten with Romain Grosjean in ninth, Pastor Maldonado in the final spot. However, even though the regulations are almost all carryover, in actual fact, everything has changed this year. Mercedes is even faster. Renault is even worse. Ferrari and Lotus are a lot better. Toro Rosso is looking like anything but a junior team. And McLaren is – well, let's not even get into that yet. Furthermore, this weekend was shambles: 15 cars started the race, the smallest naturally-occurring grid since 1963. Manor couldn't get its cars ready before qualifying. Bottas had to pull out after qualifying when he tore a disc in his back and couldn't pass the medical clearance tests. The gearbox in Daniil Kvyat's Red Bull gave out on the lap from the pit to the grid, and to give misery some company, the Honda in Kevin Magnussen's McLaren blew up on the same lap. When the lights went out, Hamilton ran away and was more than a second ahead of his teammate at the end of Lap 1. The advantage disappeared, though, because behind him, at the first corner, we got our first pile-up. As Raikkonen drove around the outside of Vettel at the right-hand Turn 1 it looked like Vettel, going over the kerbing, hopped to his left and bounced into Raikkonen.