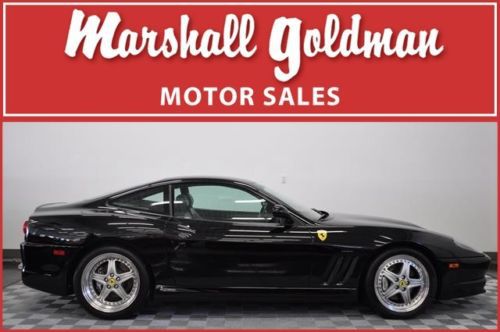

Beautiful Black On Black Ferrari 550 Maranello: Precision Driving Machine! on 2040-cars

Albuquerque, New Mexico, United States

Ferrari 550 for Sale

Number 366 of only 448 produced!(US $219,900.00)

Number 366 of only 448 produced!(US $219,900.00) Ferrari 550 barchetta loaded v12 leather 6 speed

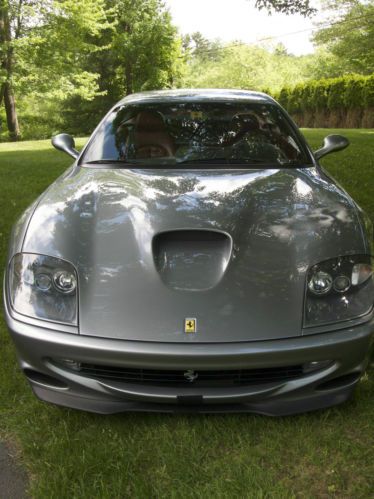

Ferrari 550 barchetta loaded v12 leather 6 speed 2000 ferrari maranello black charcoal modular wheels 16,200 miles 6-spd manual(US $98,900.00)

2000 ferrari maranello black charcoal modular wheels 16,200 miles 6-spd manual(US $98,900.00) '01 550 maranello, 14k miles, majors service, new tires just completed...(US $94,500.00)

'01 550 maranello, 14k miles, majors service, new tires just completed...(US $94,500.00) 1999 ferrari 550 maranello base coupe 2-door 5.5l(US $79,499.00)

1999 ferrari 550 maranello base coupe 2-door 5.5l(US $79,499.00) Le mans blue/crema, 24k miles, fully serviced(US $79,900.00)

Le mans blue/crema, 24k miles, fully serviced(US $79,900.00)

Auto Services in New Mexico

Solar Ray Auto Glass Repair ★★★★★

Silva`s Tire Center ★★★★★

Ray`s Truck Service ★★★★★

Pitre Buick GMC ★★★★★

Permian GMC ★★★★★

P D L Enterprises ★★★★★

Auto blog

LaFerrari trading at double its list price

Mon, 11 Aug 2014If you've been looking at the seven-figure price tags (plus or minus) on the latest batch of hypercars, and wondering how their manufacturers could possibly charge that much, consider that their predecessors typically traded at well above their list price as it is. The Ferrari Enzo, for example, listed for "only" $650k, but with production limited to 349 units, demand far outstripped supply, driving the mark-up into seven-figures. In fact Enzos are still selling for a million or more at auction. Surely Ferrari deserves a piece of that action itself, at least as much as the speculators... hence the $1.7 million sticker price on its successor LaFerrari.

Here's the thing, though: according to the latest reports, buyers are paying that much again just for the privilege of getting their hands on a LaFerrari. In other words, they're paying double the already sky-high asking price: as much as $3.4 million to put it in the same ballpark as the Lamborghini Veneno (whose production was even more limited) and the latest Legend edition of the Bugatti Veyron Vitesse roadster.

The story gets a bit more sane with its rivals, though: according to the analysis reported by Oracle Finance, the McLaren P1 is commanding "only" a $500k premium over list, and the Porsche 918 Spyder "just" $335k extra. However even less expensive new models from high-end automakers like the Lamborghini Huracán and Porsche Macan are reportedly commanding $50k and $10k premiums, respectively.

Ferrari, Mercedes selling cars with faulty Takata airbags

Thu, Jul 21 2016According to the US Senate, a small group of automakers are still selling new cars with faulty Takata airbags. Automotive News reports that Ferrari's entire lineup and various Mercedes-Benz vehicles come with faulty airbags and are subject to being recalled by the end of 2018. US Senator Bill Nelson, (D-FL), claims the affected Ferrari models include: the 2016 to 2017 FF, California T, F12 Berlinetta, F12 TdF, 488 GTB, 488 Spider, and GTC4 Lusso. Mercedes-Benz is also in the mix with the 2016 Sprinter and 2016 to 2017 E-Class Coupe and Convertible. Automotive News reports that both Ferrari and Mercedes-Benz will require its dealers to notify buyers of a recall in the vehicles' future. The National Highway traffic Safety Administration claims the vehicles are legal to be sold, as the airbags are safe until exposed to high humidity for a significant period of time. With the majority of Ferrari drivers storing their vehicles in temperature-controlled garages, this shouldn't be troubling news. What is troubling, however, is that seven out of 17 automakers that Senator Nelson contacted admitted to putting defective Takata airbags into its new cars. Volkswagen, Fiat Chrysler Automobiles, and Toyota are a few automakers that still use Takata's faulty airbags. All have agreed to notify buyers of future recalls. Related Video: News Source: Automotive News-sub.req.Image Credit: Copyright 2015 Lorenzo Marcinno / AOL Government/Legal Recalls Ferrari Mercedes-Benz ferrari ff ferrari f12 berlinetta ferrari 488 gtb ferrari california t ferrari f12 tdf ferrari 488 spider ferrari gtc4 lusso

Stellantis not looking for further mergers, including with Renault

Mon, Feb 5 2024MILAN — Stellantis Chairman John Elkann on Monday denied the carmaker was hatching merger plans, responding to press speculation about a possible French-led tie-up with rival Renault. Elkann said that the Peugeot owner, the world's third largest carmaker by sales, was focused on the execution of its long-term business plan. "There is no plan under consideration regarding merger operations with other manufacturers," said Elkann, who also heads Exor, the Agnelli family holding company that is the largest single shareholder in Stellantis. After abandoning the Russian market, at the time its second largest after France, and reducing the scope of its global cooperation with Nissan, Renault has been seen as a potential M&A target. Speculation intensified after an electric vehicle market slowdown forced it last week to cancel IPO plans for its EV and software unit Ampere. Its market cap remains stubbornly low at little over 10 billion euros ($10.8 billion) despite a financial recovery over the past few years. Stellantis, the product of a 2021 merger between France's PSA and Fiat Chrysler and one of the most profitable groups in the industry, has a market cap of more than 85 billion euros when unlisted shares are factored in. It has a 14 brand portfolio also including Citroen, Jeep, Opel and Alfa Romeo. NEWSPAPER REPORT Italian daily Il Messaggero had said on Sunday that the French government, which is Renault's largest shareholder and also has a stake in Stellantis, was studying plans for a merger between the two groups. A spokeswoman for Renault said on Monday the group did not comment on rumors. France's Finance Ministry had declined to comment on Sunday. Stellantis has crossed swords with the Italian government, which has accused it of acting against the national interest on occasions. Industry Minister Adolfo Urso last week raised the prospect of the Italian government taking a stake in Stellantis to help to balance the French influence. Renault shares pared gains after Elkann's comments to stand 1.2% higher by 1220 GMT, having initially risen more than 4%. Stellantis CEO Carlos Tavares, a Portuguese-national, last week said in an interview with Bloomberg that the group was "ready for any kind of consolidation" and that its job was to make sure that it would be "one of the winners". Analysts, however, question the rationale of a Stellantis-Renault merger, which would also expand the group's excess capacity in Europe.