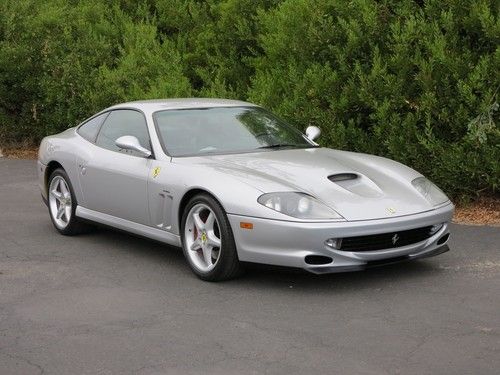

1998 Ferrari 550 Maranello Black/tan Fully Serviced Only 17,400 Miles on 2040-cars

Cleveland, Ohio, United States

Engine:12

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Manual

Make: FERRARI

Cab Type (For Trucks Only): Other

Model: 550

Warranty: Vehicle does NOT have an existing warranty

Mileage: 13,465

Exterior Color: Black

Interior Color: Tan

Disability Equipped: No

Doors: 2

Ferrari 550 for Sale

575m maranello clean title priced for a quick sale inspections welcomed 550m(US $79,999.00)

575m maranello clean title priced for a quick sale inspections welcomed 550m(US $79,999.00) 2001 ferrari 550 maranello, black/black, great service history, pristine car!!(US $85,888.00)

2001 ferrari 550 maranello, black/black, great service history, pristine car!!(US $85,888.00) 1999 ferrari 550 maranello - fresh belt service - two ca owners - no accidents(US $64,250.00)

1999 ferrari 550 maranello - fresh belt service - two ca owners - no accidents(US $64,250.00) 1999 ferrari 550 maranello 22,230 miles excellent shape. fully serviced(US $79,500.00)

1999 ferrari 550 maranello 22,230 miles excellent shape. fully serviced(US $79,500.00) Great collector limited edition car.(US $204,900.00)

Great collector limited edition car.(US $204,900.00) Rare 2001 ferrari 550 maranello barchetta, rosso corsa beige low miles(US $178,888.00)

Rare 2001 ferrari 550 maranello barchetta, rosso corsa beige low miles(US $178,888.00)

Auto Services in Ohio

Yonkers Auto Body ★★★★★

Western Reserve Battery Corp ★★★★★

Walt`s Auto Inc ★★★★★

Valvoline Instant Oil Change ★★★★★

Valvoline Instant Oil Change ★★★★★

Tritex Corporation ★★★★★

Auto blog

Ferrari 212 Barchetta highlights RM auction at Villa d'Este

Tue, May 26 2015While show-goers sip champagne and basque in the glow of some of the most beautiful classics and most notable concept cars at the Concorso d'Eleganza Villa d'Este, at the Villa Erba just down the shore, collectors bid on some of the most tempting automotive creations. And this year was no exception. Highlighting RM Sotheby's auction this year was a rare classic 1952 Ferrari 212 Export Barchetta. The Touring-bodied competition roadster from Ferrari's early days fetched an incredible ˆ6,720,000 – nearly $7.4 million at current exchange rates – to set a new record for that model. According to Sports Car Market, the previous record was held by a 212 Export coupe that sold for $3.2 million early last year. A Barchetta failed to sell for a high bid of $1.97 million in 2008, which just goes to show how far this auction raised the bar for the 212. Though it was by far the top lot of the day, it wasn't the only million-dollar sale of the day. Heck, it wasn't even the only million-dollar Ferrari sold. A quartet of Ferrari supercars – including a 288 GTO, F40, F50 and Enzo – each fetched seven figures, as did a 250 GT Berlinetta Lusso and a 250 GT Cabriolet. So did a Lamborghini Miura, a '73 Porsche 911 Carrera RS 2.7 and a '53 Fiat 8V Cabriolet, if you can believe it. Other notable lots included a 1949 Alfa Romeo 6C 2500 SS Villa d'Este Coupe, a '74 Lancia Stratos and a rare stick-shift Ferrari 599 HGTE. All told, RM Sotheby's racked up nearly $30 million in sales at its first European auction since merging and rebranding, selling 34 out of the 39 lots consigned, but that stunning 250 California Spider did not appear to be among them.

UK collector pays $800k for license plate '25 O'

Tue, Dec 2 2014You can't get a vanity license plate in the UK, but Brits have proven their willingness time and time again to part with huge amounts of cash in order to get a particularly desirable number to put on the front and back of their high-priced machinery. This time, a Ferrari collector paid over $800,000 for the license plate "25 O." The princely sum of GBP518,000 – equivalent to over $814k at today's rates – was paid by John Collins, owner of classic car broker Talacrest. Collins reportedly intends to put it on his Ferrari 250 GT SWB. What's more is that he had just paid another GBP130,320 ($205k) for the license plate "250 L" that he plans to put on his 1964 Ferrari 250 GT Lusso, the long-wheelbase touring version of the same vehicle. The winning bids were placed at an auction held by the UK's Driver and Vehicle Licensing Agency – the 150th such auction held by the government office, marking its 25th anniversary. The "25 O" plate broke the event's previous record of GBP357,000 ($560k), paid in March 2009 for plate number "1 D." In 2008 noted tuner Afzal Kahn bought the license plate "F1" for GBP440,000, which is less than what Collins paid for "25 O" but different exchange rates worked that out to $870k at the time. Kahn was said to have turned down a $9 million offer for that plate last year. DVLA PERSONALISED REGISTRATIONS SETS A NEW BRITISH RECORD AS 25 O SELLS FOR GBP500,000 DVLA Personalised Registrations has set a new British record for a personalised registration sold by the Agency after 25 O was bought for more than GBP500,000. Incredibly, John Collins, who, as owner of Talacrest, is regarded as one of the world's leading collectors and dealers of classic Ferraris, bought 25 O for GBP518,000 less than three hours after successfully buying 250 L for a staggering GBP130,320. Both sums include fees and take the total amount paid by the businessman to GBP648,320. Both are among the 1,600 registrations being auctioned by the Agency as part of its 25th Anniversary three-day auction – and also 150th live sale – currently being held at The Vale Resort near Cardiff. Both registrations will be placed on two of the world's most exclusive cars; 250 L will head onto a rare 1964 Ferrari Lusso, while 25 O will sit on the Ferrari 250 SWB once owned by the rock singer Eric Clapton.

2016 Canadian Grand Prix: A tale of 3 starts and 2 stops

Mon, Jun 13 2016The first curve in the Canadian Formula 1 Grand Prix happened before Turn 1. Lewis Hamilton sat on pole in the Mercedes-AMG Petronas, Sebastian Vettel in a Ferrari behind. That order changed as soon as the lights went out. Hamilton and teammate Nico Rosberg started well enough, but Vettel flew off the line, passing Hamilton in just a few meters. Vettel led through Turn 1 while Hamilton defended against Rosberg trying to pass on the outside by using the entire track. Hamilton bumped his teammate, sending Rosberg into the concrete runoff with an " infuriating but fair" maneuver Hamilton blamed on understeer. The Brit stayed second, his teammate fell to ninth by the time he rejoined the circuit and got back on the gas. The Ferrari finally looked an even match for the Mercedes, Vettel slowly building a gap out front. On Lap 11 the Honda in Jenson Button's McLaren self-ignited just after the hairpin, forcing Button to pull over on the Casino Straight. A Virtual Safety Car slowed the field, convincing Ferrari to pit its drivers. Vettel came in, handing the lead to Hamilton. The marshals cleared Button's car more quickly than expected, so the scuderia didn't get the full time advantage it expected, sending Vettel back on track seven seconds behind the Mercedes. Button's and Ferrari's unplanned stops decided the race. Ferrari had always planned to run a two-stopper, but the early pit didn't give the team a chance to gauge the ultra-soft Pirelli. The ultra-softs lasted longer than anyone expected. Hamilton only pitted once, Vettel had to pit again, and the Ferrari simply couldn't close the gap to the Mercedes even with newer tires. Post-race commentary accused Ferrari of two blunders: giving up track position, and not taking advantage of Mercedes' only known weakness of not being nearly as good in dirty air. If the ultra-softs had fallen off a performance cliff, however, Ferrari's play would have been considered daring and brilliant. Hamilton took his second win of the season, followed by a hard-driving Vettel five seconds later. Valtteri Bottas and Williams got everything right, the Finn taking advantage of a one-stop strategy, a perfectly-timed pit stop, and more unusual Red Bull issues to finish third. It's Williams' first podium of the year. Max Verstappen claimed fourth after two pit stops, holding off a frustrated Rosberg who had to make an unscheduled stop to remedy a slow puncture.