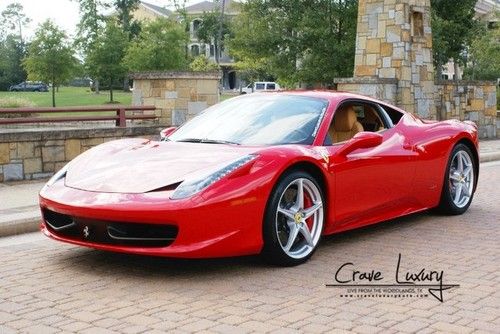

Ferrari 458 Italia Carbon Loaded Call Today on 2040-cars

The Woodlands , Texas, United States

For Sale By:Dealer

Engine:4.5L 4499CC V8 GAS DOHC Naturally Aspirated

Body Type:Coupe

Fuel Type:GAS

Transmission:Automatic

Make: Ferrari

Model: 458 Italia

Disability Equipped: No

Trim: Base Coupe 2-Door

Doors: 2

Drivetrain: Rear Wheel Drive

Drive Type: RWD

Number of Doors: 2

Mileage: 3,503

Exterior Color: Red

Number of Cylinders: 8

Interior Color: Tan

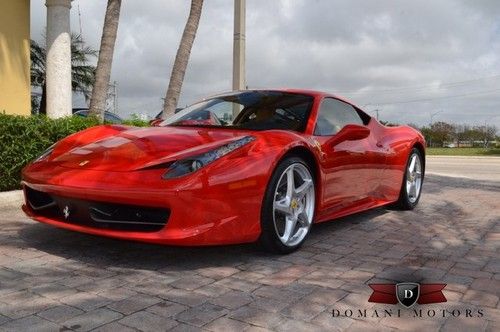

Ferrari 458 for Sale

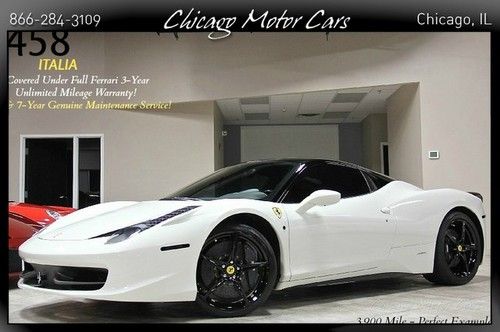

2012 ferrari 458 italia white loaded w/ carbon alcantara 2k mi

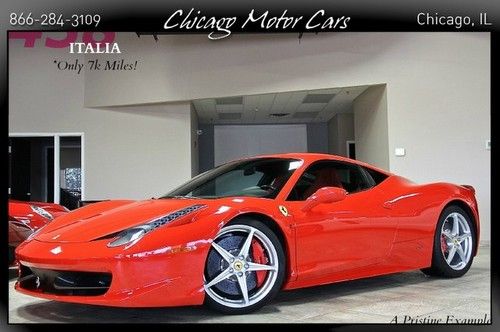

2012 ferrari 458 italia white loaded w/ carbon alcantara 2k mi 2011 ferrari 458 italia rare high msrp $$ carbon fiber ipod loaded only 7000 mi!(US $257,800.00)

2011 ferrari 458 italia rare high msrp $$ carbon fiber ipod loaded only 7000 mi!(US $257,800.00) 2012 ferrari 458 spider my12(US $349,000.00)

2012 ferrari 458 spider my12(US $349,000.00) 2012 ferrari(US $269,900.00)

2012 ferrari(US $269,900.00) 2013 ferrari 458 spider - silver black - 1,200 miles(US $365,000.00)

2013 ferrari 458 spider - silver black - 1,200 miles(US $365,000.00) 2012 ferrari 458 italia only 3900 miles full unlimited mileage & maintenance !!(US $299,800.00)

2012 ferrari 458 italia only 3900 miles full unlimited mileage & maintenance !!(US $299,800.00)

Auto Services in Texas

Zepco ★★★★★

Z Max Auto ★★★★★

Young`s Trailer Sales ★★★★★

Woodys Auto Repair ★★★★★

Window Magic ★★★★★

Wichita Alignment & Brake ★★★★★

Auto blog

Scuderia Ferrari displaces relatives of missing passengers at Malaysian hotel

Sun, 23 Mar 2014The action and glamor of a Formula One race coming to town is usually more than enough to shine an international spotlight on a host country, but Malaysia has made headlines recently for another reason entirely. That, of course, would be the disappearance of Malaysian Airlines flight 370. But with the two events coming together, something's going to have to give, and unfortunately in this case, it's the grieving families of the flight's passengers.

The clash came to a head when the Scuderia Ferrari came to town to set up for next weekend's race. Team members were booked to stay at the Cyberview Hotel in the capital of Kuala Lumpur, arrangements which F1 chief Bernie Ecclestone points out were likely to have been made long ago. The trouble is that over a dozen relatives of MH370 passengers who had come in from China were still staying at that hotel while awaiting word on their loved ones' fates, and with the hotel apparently filling up fast ahead of the grand prix weekend, those family members were forced to leave.

Just where they've gone, we don't know, but while the development may not look good for Ferrari or for F1, it strikes us as one of those unfortunate situations where no one is really to blame. The race has been booked for months, the team likely made their reservations long before the flight went missing, the hotel is obliged to honor the reservations and the grieving families need somewhere to stay. The tendency to point fingers often prevails, but in this situation we're afraid no one is to blame but the circumstances. That, and the still as-yet unknown cause of the flight's mysterious disappearance.

Ferrari return to Le Mans looking more likely?

Wed, 18 Dec 2013Statements made by Ferrari president Luca di Montezemolo may indicate that the Italian brand could return to a form of racing it's been absent from for 40 years - prototype racing. That's right, LMP1 could see a factory Ferrari team for the first time since 1973, if a report from ESPN F1 is to be believed.

"We have won with the 458 GTE, but I also quite like the idea of racing at Le Mans in the highest category: who knows, maybe one day we can return and win, say thanks and come home," Montezemolo said. "Maybe we should give it some consideration..."

These seemingly idle, off-hand comments might not hold much water, were rumors about Ferrari's return to prototype racing not swirling as recently as August. There's also the fact that the upcoming, 1.6-liter, turbocharged V6 being used for Formula One complies with the Automobile Club de l'Ouest's own LMP1 regulations, according to ESPN. Finally, Ferrari returning to Le Mans might also explain this video of a camouflaged Ferrari LaFerrari testing a new turbocharged engine, which we showed you a few weeks back. There's a fair chance that what we're actually seeing in that video are the early stages of a new Ferrari prototype testing.

Watch Edo Competition pit a Ferrari FXX against a Maserati MC12 Corsa on the 'Ring

Fri, 03 May 2013High-zoot supercar tour organizer Gran Turismo Events held its annual Nürburgring track day last month, and in addition to the amateur punters the gates were opened to two tuned supercars from Edo Competition: A Maserati MC12 Corsa and a Ferrari Enzo ZXX. The ZXX, in case you've forgotten, is the same love child of Edo Competition and Zahir Rana's ZR Exotics that belly flopped into the Atlantic during the 2011 Targa Newfoundland.

We get a trip around the Nordschleife with both cars during a no-doubt quick but not insane lap, on board with driver Patrick Simon in the 755-horsepower MC12 and 'Ring queen Sabine Schmitz following in the 840-hp ZXX.

That should be all the build-up you need when the action's in the video below.