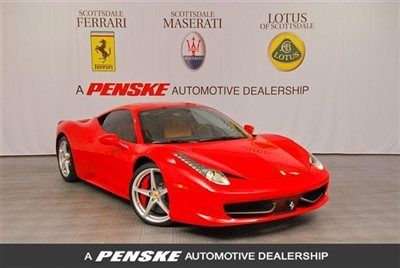

Ferrari 458 Italia Carbon Fiber. Loaded! V8 Call Today! on 2040-cars

Spring, Texas, United States

For Sale By:Dealer

Engine:4.5L 4499CC V8 GAS DOHC Naturally Aspirated

Body Type:Coupe

Transmission:Automatic

Fuel Type:GAS

Make: Ferrari

Model: 458 Italia

Disability Equipped: No

Trim: Base Coupe 2-Door

Doors: 2

Drive Train: Rear Wheel Drive

Drive Type: RWD

Inspection: Vehicle has been inspected

Mileage: 2,679

Number of Doors: 2

Exterior Color: White

Interior Color: Red

Number of Cylinders: 8

Warranty: Vehicle does NOT have an existing warranty

Ferrari 458 for Sale

2011 ferrari approved cpo 458, rosso corsa/nero(US $259,900.00)

2011 ferrari approved cpo 458, rosso corsa/nero(US $259,900.00) 2010 ferrari 458 italia cpe - very rare white!! upgraded sound!! fully serviced(US $249,995.00)

2010 ferrari 458 italia cpe - very rare white!! upgraded sound!! fully serviced(US $249,995.00) 2010 ferrari 458 italia with black/red interior(US $279,995.00)

2010 ferrari 458 italia with black/red interior(US $279,995.00) 2011 ferrari 458 coupe-park sensors-red calipers-daytona seats-like 2012 & 2010(US $268,850.00)

2011 ferrari 458 coupe-park sensors-red calipers-daytona seats-like 2012 & 2010(US $268,850.00) 2012 ferrari 458 italia(US $279,900.00)

2012 ferrari 458 italia(US $279,900.00) Shields+daytonas+parking sensors+ipod+20" ferrari sport rims(US $256,999.00)

Shields+daytonas+parking sensors+ipod+20" ferrari sport rims(US $256,999.00)

Auto Services in Texas

Your Mechanic ★★★★★

Yale Auto ★★★★★

Wyatt`s Discount Muffler & Brake ★★★★★

Wright Auto Glass ★★★★★

Wise Alignments ★★★★★

Wilkerson`s Automotive & Front End Service ★★★★★

Auto blog

Bonhams auction at Quail Lodge led by 1959 Ferrari 250 GT Competizione

Sat, Aug 15 2015It doesn't take too much knowledge of the classic car market to figure out that, when it comes to values, Ferrari leads the pack. Bonhams 2015 Quail Lodge Auction did absolutely nothing to buck that trend with four of the five top sellers bearing the Prancing Horse. While none came near the auction house's sale of a 1962 Ferrari 250 GTO for $38.115 million last year, there were still beauties in the bunch. The leader among these thoroughbreds was a 1959 Ferrari 250 GT Competizione Alloy Berlinetta (pictured above) that went for $8.525 million, including the buyer's premium. It was one of just seven vehicles made to this specification and raced extensively when new, scoring a win in competition at Watkins Glen. A classic 1971 Ferrari 365 GTS/4 Daytona Spider brought $2.64 million, and a somewhat more modern 1985 288 GTO had the hammer drop at $2.365 million. The final Prancing Horse in the top five was a 1951 212 Inter Cabriolet with a body by Vignale for $2.2 million. It scored second-in-class at the 2014 Pebble Beach Concours d'Elegance. Overturning the Ferrari trend, a 1955 Lancia Aurelia B24S Spider America rounded out the top five with a sale price of $1,952,500. While these are the most expensive vehicles to cross the block, you can check Bonhams' website for the results on all 111 lots. It's a wonderful array of largely European sports cars that are all in top shape.

Ferrari to stop supplying Maserati with its engines

Thu, May 9 2019The Ferrari Q1 earnings call was full of information, and perhaps the biggest revelation was that Ferrari is going to stop supplying engines to Maserati. CEO Louis Camilleri broke the news, and The Motley Fool posted a transcript of the whole call online. "Eventually, we will no longer supply engines to Maserati, which actually from our perspective is actually a good thing, both from a margin perspective, but also the fact that we can transfer a lot of the labor that's been focused on the engines to the car side of the business," Camilleri says. Maserati has used Ferrari engines (arguably, one of the most compelling reasons to buy a Maserati) in its vehicles since 2002, a little while after Fiat passed Maserati off to the prancing horse. The partnership continued as both Ferrari and Maserati were under the same house at FCA. Then when Ferrari was spun off from FCA in 2015, they kept the supply steady to Maserati. Those engines include a 3.8-liter twin-turbo V8, 3.0-liter twin-turbo V6 and a 4.7-liter naturally aspirated V8. Camilleri said Ferrari will officially stop in 2021 or 2022, with no intention of supplying anybody with engines beyond that. Of course, this leaves Maserati high and dry with no engines for its growing lineup. Maserati will have to reach into the FCA parts bin, find a new outside supplier or develop its own engines. Battery electric sounds out of the question. As of now, there doesn't appear to be a clear plan going forward. We've reached out to Maserati to see if they have any comment on the situation as it stands.

Watch this Koenigsegg CCX hit 211 mph on a runway, outpacing McLaren's P1

Tue, 03 Jun 2014Vmax200 in in England organizes events where those who care to show up with a supercar can run them down the two-mile runway at Bruntingthorpe Proving Ground. Evo attended the latest event, bringing an impressively green Lamborghini Aventador to test its girth and gaping vents against other precious metals like the McLaren P1 and F1, Ferrari F12 Berlinetta and Enzo, a Porsche Carrera GT and enough 911 Turbos to start a dealership. Speaking of those Porsches, nine of the top ten slots in the top speed competition are claimed by modified 911 Turbos.

A monochrome Swede ruled them all, though, a black-and-white Koenigsegg CCX setting fire to the speed trap run after run, hitting 211 miles per hour at its quickest. It was followed by, surprise, a 911 GT2 modified by 9E that did 210 mph. You can watch the EVO video below, GT Spirit has a bigger breakdown of the day, and we've included another vid showing the tandem launch of the CCX and McLaren F1.