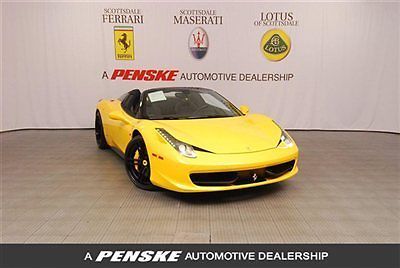

2013 Ferrari 458 Spider~factory Painted Roof~carbon Interior~park Sensors~in Az on 2040-cars

Scottsdale, Arizona, United States

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Automatic

Year: 2013

Make: Ferrari

Warranty: Vehicle has an existing warranty

Model: 458

Mileage: 1,587

Options: Leather

Sub Model: Convertible

Exterior Color: Giallo Modena DS

Interior Color: Nero

Doors: 2

Number of Cylinders: 8

Engine Description: 4.5L V8 DOHC 32V

Ferrari 458 for Sale

2011 ferrari 458 italia 2dr cpe(US $257,888.00)

2011 ferrari 458 italia 2dr cpe(US $257,888.00) 2011 ferrari 458 italia! red/beige! carbon! low miles!!

2011 ferrari 458 italia! red/beige! carbon! low miles!! Carbon fiber driver zone w/ led's- carbon fiber racing seats- carbon fiber front(US $379,880.00)

Carbon fiber driver zone w/ led's- carbon fiber racing seats- carbon fiber front(US $379,880.00) Ferrari 458 spider 4.5l v8 2014(US $379,000.00)

Ferrari 458 spider 4.5l v8 2014(US $379,000.00) 12 nero black 4.5l v8 f-1 *leather & alcantara electric seats *scuderia shields

12 nero black 4.5l v8 f-1 *leather & alcantara electric seats *scuderia shields 2011 ferrari 458 coupe. 1500 miles. red over tan. carbon ceramic brakes.(US $259,780.00)

2011 ferrari 458 coupe. 1500 miles. red over tan. carbon ceramic brakes.(US $259,780.00)

Auto Services in Arizona

Windshield Replacement & Auto Glass Repair Glendale ★★★★★

Williamson Automotive Mobile Repair ★★★★★

Toy Box Fine Motor Cars ★★★★★

TintAZ.com Mobile Window Tinting ★★★★★

Terrell Battery Corp. ★★★★★

Suntec Auto Glass & Tinting ★★★★★

Auto blog

Ferrari borrows $2.6 billion to finance FCA spinoff

Tue, Dec 1 2015Ferrari announced Monday that it is borrowing about $2.6 billion to finance its spinoff from Fiat Chrysler Automobiles. Here's how it breaks down: Ferrari NV, the automaker's parent company based in the Netherlands, is taking out loans totaling 2.5 billion euros. That's equivalent to $2.64 billion at current exchange rates, and is divided between a term loan of $2.12 billion and a revolving credit facility of $529 million. The larger term loan "will be used to refinance indebtedness owing to Fiat Chrysler Automobiles," among other purposes. That ought to constitute the lion's share of the $2.38 billion which the Prancing Horse marque was, according to reports last year, slated to pay its current parent company in order to help FCA fund its ambitious growth plans. The separate line of credit is earmarked "to be used from time to time for general corporate and working capital purposes of the Ferrari group." Though Ferrari is not expected to take any other Fiat Chrysler properties with it, the "group" in this case would include its various financial services and distribution arms around the world that may have been separately incorporated. As noted in the statement below, the financial arrangement "represents a further step towards the separation of Ferrari from the FCA Group," following the separate stock issues from both companies as independent from each other. FERRARI N.V. SIGNS ˆ2.5 BILLION SYNDICATED CREDIT FACILITY Ferrari N.V. (NYSE: RACE) ("Ferrari") announced today that it has entered into a ˆ2.5 billion syndicated loan facility with a group of ten bookrunner banks. The facility comprises a bridge loan (the "Bridge Loan") and a term loan (the "Term Loan") of ˆ2 billion in aggregate and a revolving credit facility of ˆ500 million (the "RCF"). Proceeds of the Bridge Loan and Term Loan will be used to refinance indebtedness owing to Fiat Chrysler AutomobilesN.V. (NYSE: FCAU) ("FCA") and other indebtedness and for other general corporate purposes. Proceeds of the RCF may be used from time to time for general corporate and working capital purposes of the Ferrari group. The Bridge Loan has a 12 month maturity with an option for Ferrari to extend once for a six-month period. Ferrari intends to refinance the Bridge Loan prior to its maturity with longer term debt, including through capital markets or other financing transactions. The Term Loan, which comprises a majority of the total facility, and the RCF each have a maturity of five years.

Stellantis reports $15B profit in first year of merger

Wed, Feb 23 2022FRANKFURT, Germany — Automaker Stellantis said Wednesday that it made 13.4 billion euros ($15.2 billion) in its first year after it was formed from the merger of Fiat Chrysler Automobiles and PSA Group. The earnings nearly tripled profits compared with its pre-merger existence as two separate companies, as the maker of Jeep, Opel and Peugeot vehicles exploited cost efficiencies from combining the businesses. The result compared to a combined 4.79 billion euros for the separate companies in 2020 before the merger, which took effect on Jan. 17, 2021. Revenue for the combined business rose 14%, to 152 billion euros. CEO Carlos Tavares said the results “prove that Stellantis is well positioned to deliver strong performance" and had overcome “intense headwinds” during the year. Automakers have struggled with shortages of key parts such as semiconductor electronic components and rising costs for raw materials as the global rebound from the worst of the coronavirus pandemic brings more demand. The company said the benefits of the merger were worth some 3.2 billion euros during the year. Mergers can lead to streamlined costs as companies combine functions and spread fixed costs over a larger revenue base. The company accelerated its rollout of battery-powered vehicles, with sales of low-emission vehicles reaching 388,000 — an increase of 160%. Stricter environmental regulations in Europe and China are pushing automakers to roll out more electric vehicles with longer range. Stellantis started production of a hydrogen fuel cell commercial van under its Opel brand in December. Stellantis' other brands include Chrysler, Citroen, DS, Fiat, Maserati, Ram and Vauxhall. Related video: Earnings/Financials Chrysler Dodge Ferrari Fiat Jeep RAM Citroen Opel Peugeot Vauxhall

Incredible $12 million Ferrari collection up for auction

Tue, Dec 8 2015Ferraris come up for auction all the time, but in Scottsdale next month Gooding & Company will be auctioning off an entire collection of Maranello's finest projected to fetch around $12 million. The collection belongs to one Tony Shooshani, described as "a widely published and renowned Ferrari collector." He's the proprietor of a 599XX Evo, a LaFerrari, and one of only six Pininfarina Sergio roadsters made. They'll remain in his collection, along with his prized 288 GTO and his thoroughbred Arabian stallion named Enzo. But he's liquidating some other notables from his garage, giving other collectors a chance to bring them home instead. This includes a trio of supercars. There's an Enzo tipped to fetch between $2.4 and 2.8 million, an F50 ($2.5-2.9m), and an F40 ($1.3-1.6m). The more classically inclined may be more enticed by the 1960s-era 250 GT Lusso ($2.2-2.5m), 250 GT Series II Cabriolet ($2-2.3m), and Dino 206 GT ($700-800k), and there's a pair of 80s models as well in a 512 BBi ($400-475k) and 328 GTS ($125-150k). The Berlinetta Boxer was Ferrari's first mid-engined twelve-cylinder supercar, and the 512 BBi was the ultimate incarnation thereof. It was never officially sold in the United States, but some still made it over here. This particular example was once owned by racing legend AJ Foyt. Those pre-sale estimates place the value of the collection altogether at $10.3 million on the low side, and as high as $13.5 million. That's a whole lot of cash, but there's a whole lot of machinery here – in both quantity and quality. So if you've had a good six or seven figures burning a hole in your proverbial pocket and have been looking for the right place to invest it, this could be your chance. Related Video: Gooding & Company is Thrilled to Announce The Tony Shooshani Collection to be Auctioned at the Scottsdale Auctions Headlining the historic collection, a trio of rare Ferrari supercars from an astute collector – the 1990 Ferrari F40, the 1995 Ferrari F50 and the 2003 Ferrari Enzo SANTA MONICA, Calif. (November 30, 2015) – Gooding & Company, the auction house acclaimed for selling the world's most significant and valuable collector cars, is pleased to announce an outstanding array of Ferraris at its annual two-day Scottsdale Auctions on January 29 and 30, 2016.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.035 s, 7841 u