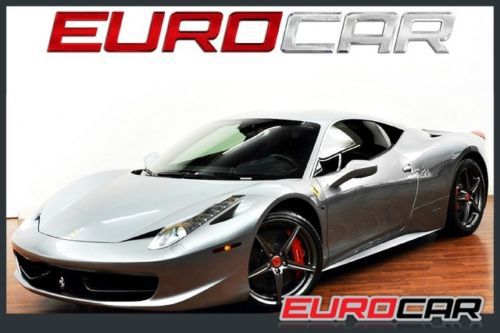

2012 Ferrari 458 Spider Low Miles Daytona Carbon Power Seats Shields on 2040-cars

San Antonio, Texas, United States

Ferrari 458 for Sale

2012 ferrari 458 spider rosso dino(US $317,900.00)

2012 ferrari 458 spider rosso dino(US $317,900.00) 2011 ferrari 458 italia like new showroom just service 4k miles best price @!!@.(US $224,850.00)

2011 ferrari 458 italia like new showroom just service 4k miles best price @!!@.(US $224,850.00) 2010 ferrari 458 italia coupe tdf blu tour de france blue / huge msrp / loaded(US $224,999.00)

2010 ferrari 458 italia coupe tdf blu tour de france blue / huge msrp / loaded(US $224,999.00) 2013 ferrari matte gray(US $349,950.00)

2013 ferrari matte gray(US $349,950.00) Ferrari 458 italia, full carbon package, 15k in added carbon fiber, front lift(US $229,888.00)

Ferrari 458 italia, full carbon package, 15k in added carbon fiber, front lift(US $229,888.00) 2013 ferrari 458 spider. 600 miles. yellow over black. loaded with options.(US $339,980.00)

2013 ferrari 458 spider. 600 miles. yellow over black. loaded with options.(US $339,980.00)

Auto Services in Texas

Yang`s Auto Repair ★★★★★

Wilson Mobile Mechanic Service ★★★★★

Wichita Falls Ford ★★★★★

WHO BUYS JUNK CARS IN TEXOMALAND ★★★★★

Wash Me Down Mobile Detailing ★★★★★

Vara Chevrolet ★★★★★

Auto blog

Ferrari vetoes F1 engine supply cost cap

Thu, Oct 29 2015The costs associated with competing in Formula One are enormous. In addressing the problem, the FIA has proposed a number of measures aimed at reducing those expenses. But while most of the teams are apparently on board, one key player has exercised its veto to defeat the initiative. The issue came up at a recent meeting of the Formula One Strategy Group, where the participating parties discussed implementing a global cost ceiling, amending the regulations in order to drive down costs, and increasing the standardization of common parts. However one of the most concrete steps would have seen the FIA institute a maximum price which engine suppliers could charge independent teams for their power units. The issue was put to a vote, which the FIA reports passed with a "large majority." But Ferrari vetoed the measure, exercising the right accorded to it under the governing regulations – a step which the FIA will not contest. With its cost-cap measure defeated, the governing body has confirmed its intent to move ahead with proposals to bring in an outside engine supplier that will provide motivation to independent teams at a lower cost. As we recently reported, the price associated with securing power units from suppliers like Mercedes, Renault, and Ferrari, typically costs teams as much as $30 million per season – a solid two or three times what they cost in the previous V8 era. One of the leading contenders at this early stage to supply those low-cost power units is Cosworth. The British firm has long participated in the championship as an engine supplier, stepping back from the sport only recently. However other companies could enter a bid for the contract as well. A French outfit called PURE run by former BAR-Honda team principal Craig Pollock began development of an engine package back in 2011. BMW and Toyota both supplied V8 engines until a few years ago, while independent outfits like Mecachrome, Mugen, and TAG have also prepared F1 power units based on engines developed by major manufacturers. 26.10.15 FIA FORMULA 1 WORLD CHAMPIONSHIP - COST REDUCTION The FIA has studied cost reduction measures for teams participating in the FIA Formula 1 World Championship which were not conclusive, including: - a global cost ceiling, - a reduction in costs via technical and sporting regulations, - an increased standardisation for parts.

Seven-figure cars highlight day one of RM's Monterey auction

Sat, 17 Aug 2013RM Auctions is one of several houses holding auctions during the Monterey weekend, and Friday night's festivities got quite pricey. Seven-figure vehicles were not at all uncommon during the first day of the two-day event, with the 1953 Ferrari 375 MM Spider, seen above, crossing the block for $9,075,000.

Other big earners included a pair of rare Ferraris, a 1950 166 MM Barchetta and a 1955 750 Monza Spider, which took $3,080,000 and $4,070,000, respectively. Outside of the red Italians, a 1939 Mercedes-Benz 540K Special captured $7,480,000 while a stunning, color-appropriate 1955 Jaguar D-Type took $3,850,000. We've got images of these vehicles, and a few other stunning examples of last night's auction, in the gallery above.

Thought it seems impossible, tonight's auction is expected to see even more high-dollar action. The winner of the 2012 Pebble Beach Concours, a 1928 Mercedes-Benz 680S Torpedo Roadster is expected to command over $10 million. Also crossing the block will be a car we reported on a few weeks back - a supremely rare 1967 Ferrari 275 GTB/4 NART Spyder. One of only 10 in the world, it's expected to take anywhere from $14 to $17 million when it hits the stage tonight.

Ferrari 488 GTB challenges that whole 'no replacement for displacement' thing [w/video]

Tue, Mar 3 2015You can't stand in the way of progress, even if you wanted to. And the current state of affairs in the automobile industry has everyone reaching for turbochargers. That includes even a company as famous for its wailing, high-revving supercars as Ferrari. The Prancing Horse marque has galloped in to the Geneva Motor Show this year on the back of the new 488 GTB. Replacing the 458 with its atmospheric 4.5-liter V8, the new 488 GTB packs a downsized turbo eight that may be smaller at 3.9 liters, but doesn't skimp on the power – now producing 661 horsepower and 560 pound-feet of torque to trump even the ultimate 458 Speciale. Compared to the new McLaren 675LT, the 488 packs almost as many horses but even more torque, and goes well beyond the Lamborghini Huracan by both measures. Even the new Audi R8 V10 Plus can't touch it. That's the kind of progress we can get behind, but there's more to the new 488 GTB than the turbocharged engine. It's also got revised electronics, updated bodywork, enhanced aerodynamics and a revised interior. Scope it out in our slideshow of live images from the floor of the Geneva Palexpo and in the video below. THE FERRARI 488 GTB – EXTREME POWER FOR UNIQUE DRIVING PLEASURE The innovative 8-cylinder berlinetta debuts at Geneva: new design, new engine and a plethora of patented solutions Geneva, 3 March 2015 – On its official debut at the Geneva Motor Show, the Ferrari 488 GTB sets a new benchmark for the sports car sector. Forty years on from the launch of Ferrari's iconic first-ever mid-rear-engined V8 berlinetta, the 308 GTB, the Ferrari 488 GTB opens a new chapter in the history of cars with this particular architecture. Credit for this achievement must go to the Ferrari 488 GTB's revolutionary proprietary solutions which deliver a car at the top of its class in terms of power output (670 cv) with engine and response times of just 0.8 and 0.06 seconds respectively. Sophisticated dynamic vehicle controls make this performance completely controllable even on the limit by drivers of all abilities, resulting in the unique driving pleasure that only a Ferrari can deliver. Ferrari drew extensively on its experience in both Formula One and endurance racing, bringing to the road the technology that delivered victory in two editions of the 24 Hours of Le Mans and the title in the WEC (World Endurance Championship).