2012 Ferrari 458 Italia. on 2040-cars

Miami, Florida, United States

Ferrari 458 for Sale

2012 ferrari 458 italia 2dr cpe

2012 ferrari 458 italia 2dr cpe 2014 ferrari 458 spider(US $369,000.00)

2014 ferrari 458 spider(US $369,000.00) Ferrari 458 italia - carbon fibre - very rare -

Ferrari 458 italia - carbon fibre - very rare - 2011 ferrari 458 italia, $267k msrp, 1 owner, recaro seats!(US $248,888.00)

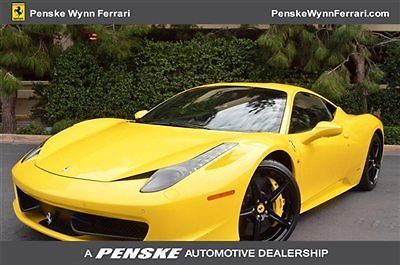

2011 ferrari 458 italia, $267k msrp, 1 owner, recaro seats!(US $248,888.00) 2010 ferrari 458 italia giallo yellow factory authorized dealer penske wynn(US $240,000.00)

2010 ferrari 458 italia giallo yellow factory authorized dealer penske wynn(US $240,000.00) 2010 ferrari 458 italia - 20" sport rims - front lift system - extended warranty(US $219,900.00)

2010 ferrari 458 italia - 20" sport rims - front lift system - extended warranty(US $219,900.00)

Auto Services in Florida

Workman Service Center ★★★★★

Wolf Towing Corp. ★★★★★

Wilcox & Son Automotive, LLC ★★★★★

Wheaton`s Service Center ★★★★★

Used Car Super Market ★★★★★

USA Auto Glass ★★★★★

Auto blog

How this Ferrari 250 GTE became Rome's most famous police car

Mon, 26 Aug 2013We're used to seeing fancy cars gifted to or bought by certain international police forces today, but the story of this 1962 Ferrari 250 GTE goes well beyond a gift. Because Rome's anti-organized-crime unit, Squadra Mobile, was doing a terrific job in the early '60s, the Italian president asked what they wanted as a token of appreciation. The answer, meant as a joke, was "A Ferrari." The president, in all seriousness, got them two.

One was almost immediately destroyed during testing, the other remains in the care of Alberto Capelli today, whose father began attending military and government auctions just after World War II. Petrolicious visited Capelli to hear the 51-year-old tale of the most precious cop car you're going to see for a while, and it involves outlaws, a French gangster in a Citroën, a policeman who was offered a spot on the Ferrari factory team by Enzo himself, and more. It's a fantastic yarn, and you can watch the whole story below.

Ferrari SF-15T will look to reclaim former F1 glories in 2015

Sat, Jan 31 2015The parade of cars for the 2015 Formula One World Championship continues apace, as Scuderia Ferrari has unveiled the vehicle that fans of the Italian team will doubtlessly be hoping drivers Sebastian Vettel and Kimi Raikkonen will pilot to victory. After the questionable styling of last year's vehicles, this new Ferrari continues the trend of more aesthetically pleasing designs. The vacuum-cleaner-like snout of last year's F-14T has been replaced with a longer, rounded bill that feeds more gracefully towards the cockpit. The new front end is arguably the most noticeable change for 2015, while changes elsewhere on the open-wheeler's body are mere evolutions of last year's design. In fact, that's kind of the theme around the SF-15T. The brake-by-wire system, clutch and gear ratios (which are locked after the first race) have all been optimized based on last season's experiences, while the weight of the car has increased by just 11 kilograms, as per sporting regulations. Take a look at Ferrari's batch of images showing its new challenger, and let us know whether you think this new design will fare better than last year's troubled F-14T. TECHNICAL FEATURE OF THE SF-15T The SF15-T the sixty first car built by Ferrari specifically to take part in the Formula 1 World Championship. It is the second car made by Ferrari since the reintroduction of turbo engines in 2014. The first year of these new regulations was extremely challenging for the Scuderia and the lessons learned have been applied vigorously to the SF15-T to create a car that is in every respect a large step forwards with respect to the F14-T. Chassis The most striking visual difference between the SF15-T and its predecessor is the lowering of the front end of the car in accordance with the change of regulations for the 2015 season. After a few seasons of rather unappealing aesthetics, the 2015 rules permit the SF15-T an attractive nose shape which also brings excellent aerodynamic performance. Aside from the nose area, the regulations for 2015 are largely unchanged. This has given the Team a stable base on which to engineer a much stronger chassis than the year before: A casual glance at the back of the car reveals a much more tightly packaged rear end which allows more downforce to be extracted from the critical surfaces around the rear of the car. The rear wing family has been extensively redesigned to deliver stable performance in corners while producing a larger DRS effect on the straights.

Drive inks 10-episode deal with NBC Sports Network

Tue, 20 May 2014Today is a good day for Chris Harris, Mike Spinelli and Matt Farah, the hosts of the entertaining YouTube series Drive. The show has officially moved from the world of online video and become an actual, honest-to-goodness television show.

In addition to its YouTube exploits, which will continue, ten episodes of the show will air on the NBC Sports Network. The debut will run this Saturday, and coincide with NBCSN's coverage of the 2014 Monaco Grand Prix. From the sounds of it, this first episode should be unlike anything the trio could do on the Internet.

The team is going on a Top Gear-like trans-European adventure in a Mercedes-Benz SLS AMG Black Series, a Ferrari F12 and a McLaren 650S. The three will converge on Monaco, and explore the legendary atmosphere that surrounds the principality when the Formula One World Championship rolls into town.